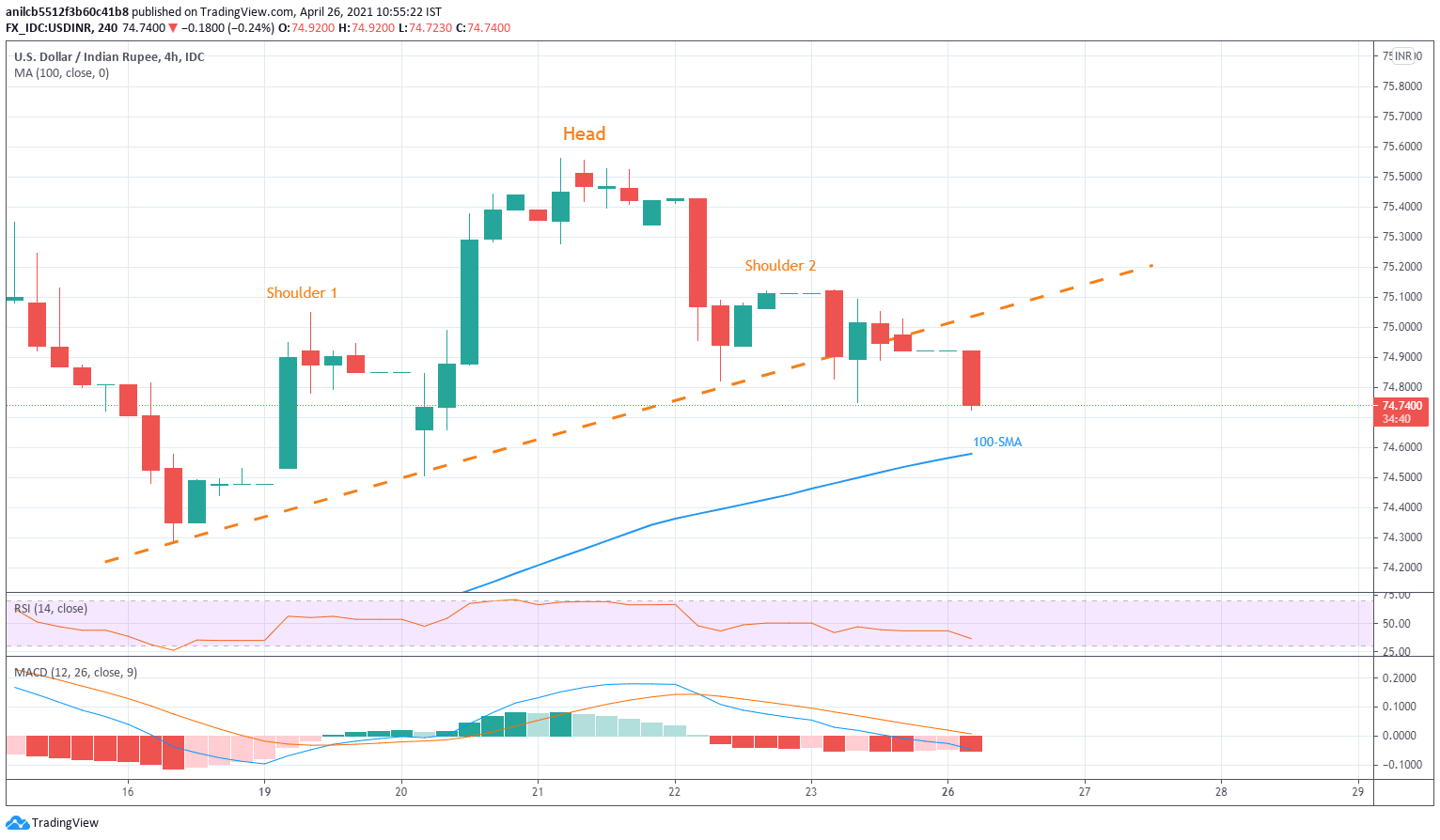

- USD/INR stays offered after confirming a bearish chart pattern.

- 100-SMA can offer intermediate halt during the drop towards 73.90.

- Bearish MACD, downward sloping RSI favor sellers, bulls need to cross 75.10 for fresh entries.

USD/INR holds lower ground near 74.80, down 0.05% intraday, amid an initial Indian session on Monday. The pair recently confirmed a bearish chart pattern, head-and-shoulders (H&S) on the four-hour play.

Not only the H&S confirmation but downbeat MACD and declining RSI line, not oversold, also back USD/INR sellers.

Although 72.30 comes out as the theoretical target of the H&S, 100-SMA near 74.57 and the mid-April low around 74.30 can test the USD/INR bears.

Meanwhile, a corrective pullback beyond the neckline figure of 75.05 should cross the shoulder 2, around 75.10, before recalling the USD/INR buyers.

Following that, 75.50 and the monthly top surrounding 75.56 will be the key levels to watch.

USD/INR four-hour chart

Trend: Further downside expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: Next on the downside comes 0.6500

Further gains in the US Dollar kept the price action in commodities and the risk complex depressed on Tuesday, motivating AUD/USD to come close to the rea of the November low near 0.6500.

EUR/USD: No respite to the sell-off ahead of US CPI

The rally in the Greenback remained well and sound for yet another session, weighing on the risk-linked assets and sending EUR/USD to new 2024 lows in the vicinity of 1.0590 prior to key US data releases.

Gold struggles to retain the $2,600 mark

Following the early breakdown of the key $2,600 mark, prices of Gold now manages to regain some composure and reclaim the $2,600 level and beyond amidst the persistent move higher in the US Dollar and the rebound in US yields.

SOL Price Forecast: Solana bulls maintain $250 target as Binance lists ACT and PNUT

Solana price retraced 7% from $225 to $205 on Tuesday, halting a seven-day winning streak that saw SOL become the third-largest cryptocurrency by market capitalization.

Five fundamentals: Fallout from the US election, inflation, and a timely speech from Powell stand out Premium

What a week – the US election lived up to their hype, at least when it comes to market volatility. There is no time to rest, with politics, geopolitics, and economic data promising more volatility ahead.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.