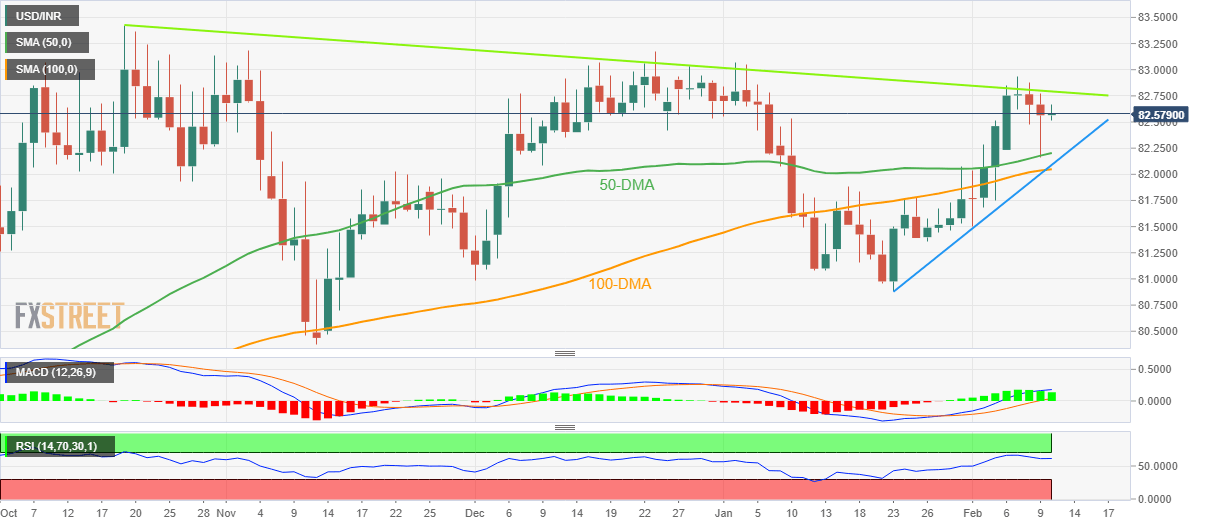

USD/INR Price Analysis: Indian Rupee struggles around 82.50 as 50-DMA probes buyers

- USD/INR remains sidelined between four-month-old resistance line and 50-DMA.

- A convergence of 100-DMA, ascending trend line from late January appears a tough nut to crack for the pair sellers.

- Indian Rupee sellers need successful break of 82.80 to retake control.

USD/INR remains indecisive around 82.60, challenging the two-day losing streak, as Indian Rupee traders seek fresh clues during early Friday. In doing so, the pair also takes clues from the cautious mood in the market ahead of the early signals for the US inflation, namely preliminary readings of February’s US Michigan Consumer Sentiment Index and 5-year Consumer Inflation Expectations.

That said, the quote’s trading within the key technical hurdles also challenges the momentum traders of late.

It’s worth observing that the bullish MACD signals and firmer RSI (14), however, keep the USD/INR buyers hopeful. On the same line could be the pair’s bounce off the 50-DMA.

As a result, the pair’s another attempt to cross the downward-sloping resistance line from October 2022, close to 82.80 by the press time, appears on the table.

Following that, a run-up towards the all-time high marked in late 2022 around 83.42 can’t be ruled out.

Meanwhile, the 50-DMA restricts the immediate downside of the USD/INR pair to around 82.20 before highlighting the 82.00 support confluence, which includes the 100-DMA and three-week-old ascending trend line.

If at all the USD/INR bears keep the reins past 82.00, the odds of witnessing a gradual south run towards the previous monthly low near 80.90 can’t be ruled out.

Overall, USD/INR is likely to remain depressed but the downside room appears limited, which in teases buyers to build positions for future gains.

USD/INR: Daily chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.