USD/INR Price Analysis: Indian rupee drops the most since June as Russia roils sentiment

- USD/INR prints the biggest daily gains in a fortnight, renews weekly high.

- Ukraine pushes global leaders for action against Russian invasion.

- Bullish Doji, sustained bounce off 200-DMA keep buyers hopeful.

USD/INR takes the bids to refresh one-week high around 75.25, posting the biggest daily fall since June 2021 during early Thursday morning in Asia.

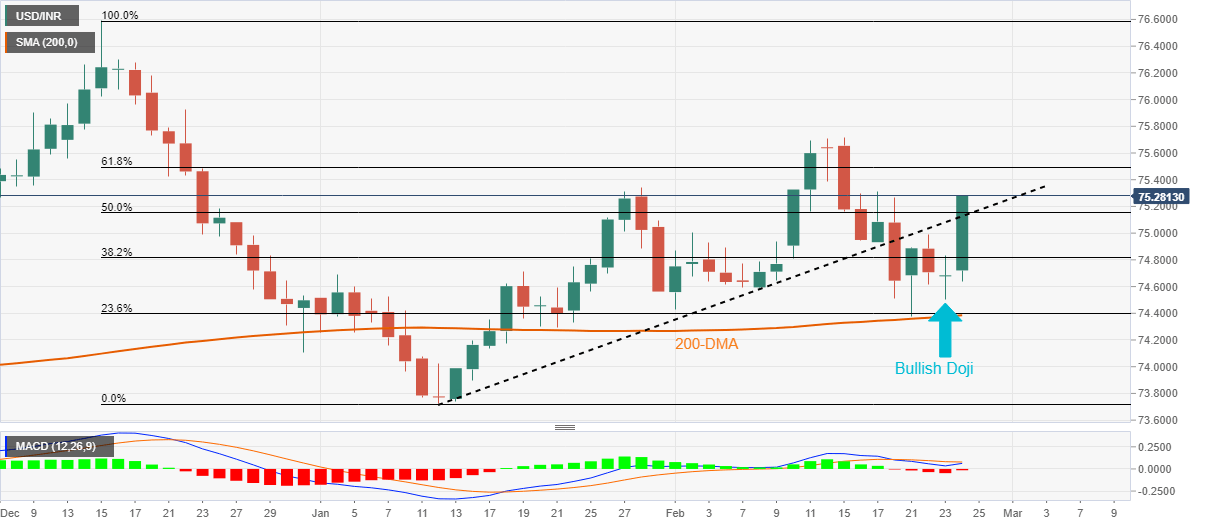

In doing so, the Indian rupee (INR) pair justifies the previous day’s Doji candlestick, as well as Monday’s bounce off 200-DMA and 23.6% Fibonacci retracement (Fibo.) of December-January fall.

Adding to the bullish bias is the pair’s latest upside break of the previous support line from January 12.

Above all, the US dollar’s rally on the back of the risk-aversion wave, triggered due to Russia’s military invasion of Ukraine, favors USD/INR buyers.

That said, the 61.8% Fibo. level of 75.50 becomes an imminent target for the USD/INR bulls ahead of the monthly peak surrounding 75.70.

On the contrary, a convergence of the 200-DMA and 23.6% Fibonacci retracement level near 74.40 becomes crucial support.

It’s worth noting that a daily closing below the previous support line near 75.12 may trigger consolidation of the recent gains.

USD/INR: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.