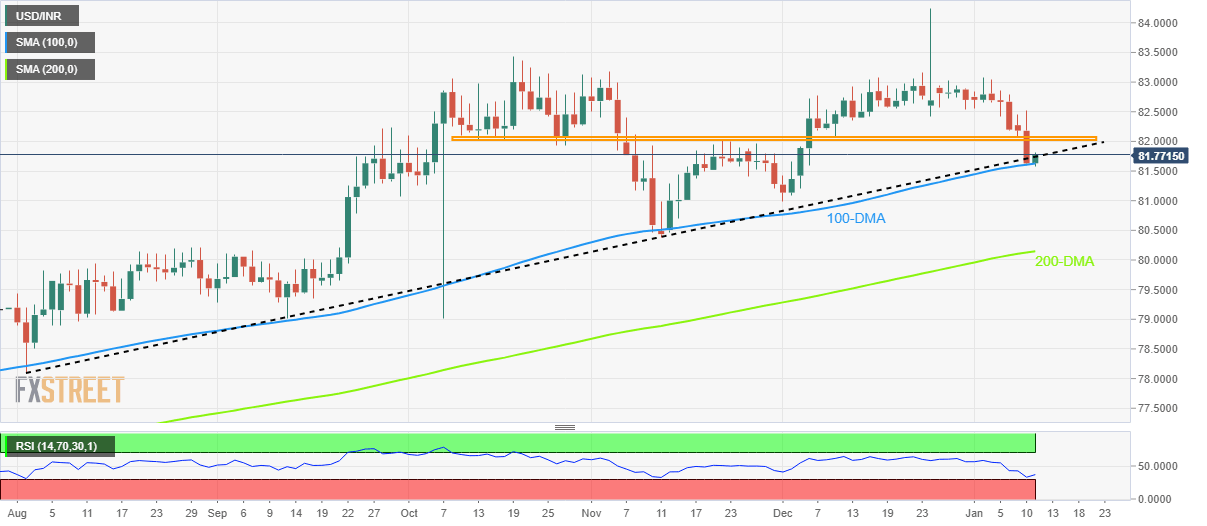

USD/INR Price Analysis: 100-DMA probes Indian Rupee buyers at five-week low

- USD/INR pares recent losses with mild gains around the key support, snaps five-day losing streak.

- Nearly oversold RSI conditions add strength to recovery expectations.

- Previous support line from early August, two-month-old horizontal resistance challenge bulls.

- Lows marked during December, November can entertain bears ahead of 200-DMA.

USD/INR rebounds from the lowest levels since December, marked the previous day, as prints the first daily gains around 81.75 on early Wednesday.

In doing so, the Indian Rupee (INR) pair bounces off the 100-DMA as the RSI (14) conditions favor short-covering moves.

However, the USD/INR pair buyers need to stay in the driver’s seat beyond crossing the previous support line from August, close to 81.75 at the latest, for conviction.

Even so, a horizontal resistance area comprising multiple levels marked since October 2022, around 82.10-05, could challenge the USD/INR upside.

It’s worth noting that 82.40 appears the last defense of the USD/INR bears, a break of which could quickly propel the quote towards the 83.00 round figure before highlighting the monthly high surrounding 83.10 for the buyers to trace.

Meanwhile, a daily closing below the 100-DMA level of 81.70 could help the USD/INR sellers to keep the reins.

In that case, the lows marked during December and November of 2022, around 81.00 and 80.37 in that order, could gain the bear’s attention.

Following that, the 200-DMA level surrounding 80.15 and the 80.00 psychological magnet could challenge the USD/INR bears afterward.

USD/INR: Daily chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.