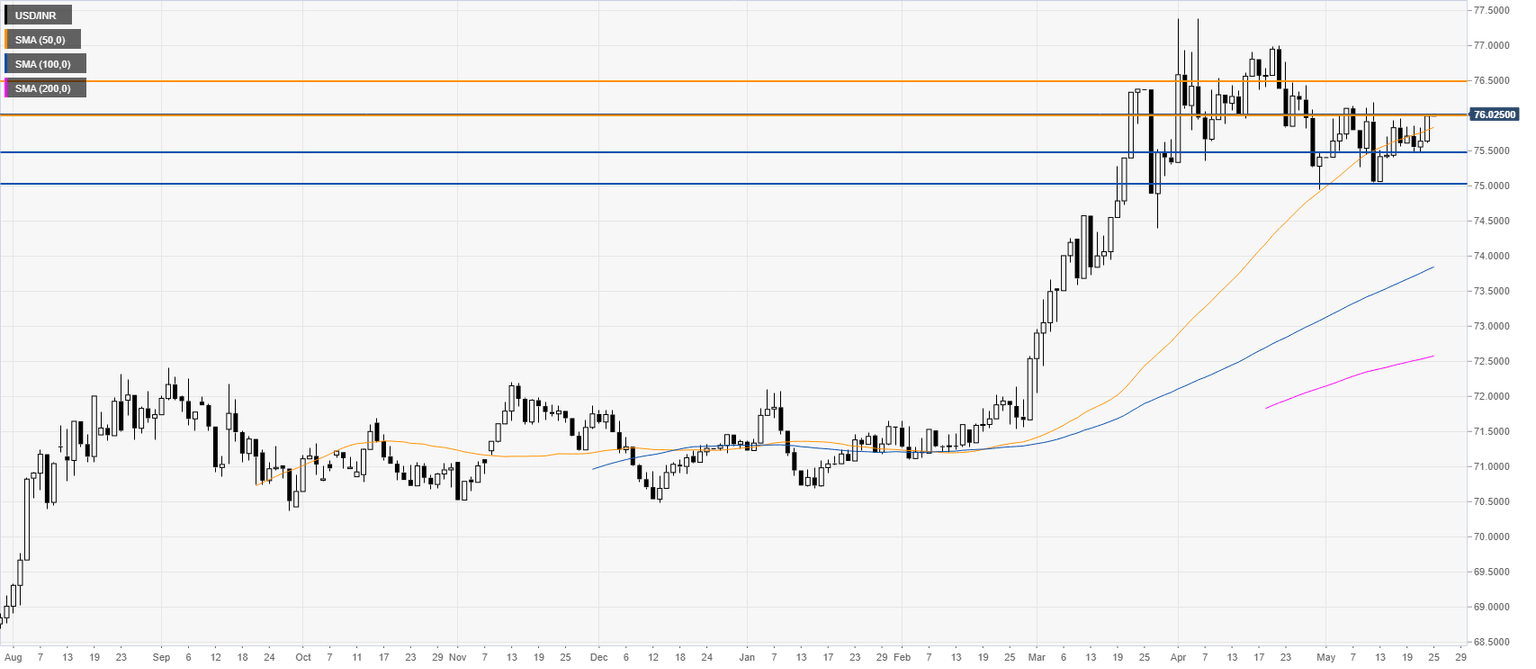

USD/INR New York Price Forecast: Greenback knocking at the 76.00 resistance vs. Indian rupee

- USD/INR is challenging the 76.00 resistance as the New York forex session is starting.

- A daily close above the 76.00 level can be seen as bullish.

USD/INR daily chart

Additional key levels

Author

Flavio Tosti

Independent Analyst