USD/INR slumps as Indian Rupee benefits from risk rebound

- The Indian Rupee edges higher in Tuesday’s Asian session.

- Risk recovery is likely to lift the INR, while India’s foreign outflows might undermine the local currency.

- All eyes will be on the RBI interest rate decision on Thursday.

The Indian Rupee (INR) recovers on Tuesday amid the decline of the US Dollar (USD). The improved risk sentiment helps emerging market currencies like the INR. However, the upside of the local currency might be limited as risk sentiment is likely to influence the markets. On Monday, the INR fell to an all-time low at the open as traders feared a looming US recession that could lead to further foreign outflows from India and other emerging markets. Additionally, the unwinding trade amid a rally in the Chinese Yuan and Japanese Yen could create a headwind for the Indian Rupee.

Nonetheless, the expectations of deeper rate cuts by the Federal Reserve (Fed) could exert some selling pressure on the Greenback and drag the pair lower. Market participants expect the US central bank to cut its interest rate by 50 basis points (bps) in both September and November and another quarter-point cut in December. Traders will closely monitor the Reserve Bank of India (RBI) interest rate decision on Thursday. The RBI is anticipated to keep the repo rate unchanged at 6.5% due to risks from higher food inflation.

Daily Digest Market Movers: Indian Rupee rebounds, potential upside seems limited

- The RBI is likely to intervene in non-deliverable forwards to support the Rupee, three traders told Reuters.

- Indian HSBC Services PMI declined to 60.3 in July from 60.5 in the previous reading, weaker than the 61.6 estimated.

- The US ISM Service Purchasing Managers Index (PMI) rose to 51.4 in July from 48.8 in June. This figure came in better than the estimation of 51.0.

- The US S&P Global Composite PMI was worse than expected, declining to 54.3 in July versus 55 prior.

- Chicago Fed President Austan Goolsbee said on Monday that the US central bank would respond if economic or financial conditions deteriorate.

- San Francisco Fed President Mary Daly stated that the central bank will monitor if the next job market report reflects the same dynamic or reverses, adding that the Fed is prepared to act as they get more information.

- Financial markets are now pricing in nearly 85% possibility that the Fed will cut the rate by 50 basis points (bps) in September, up from only 11.5% last week, according to the CME FedWatch Tool.

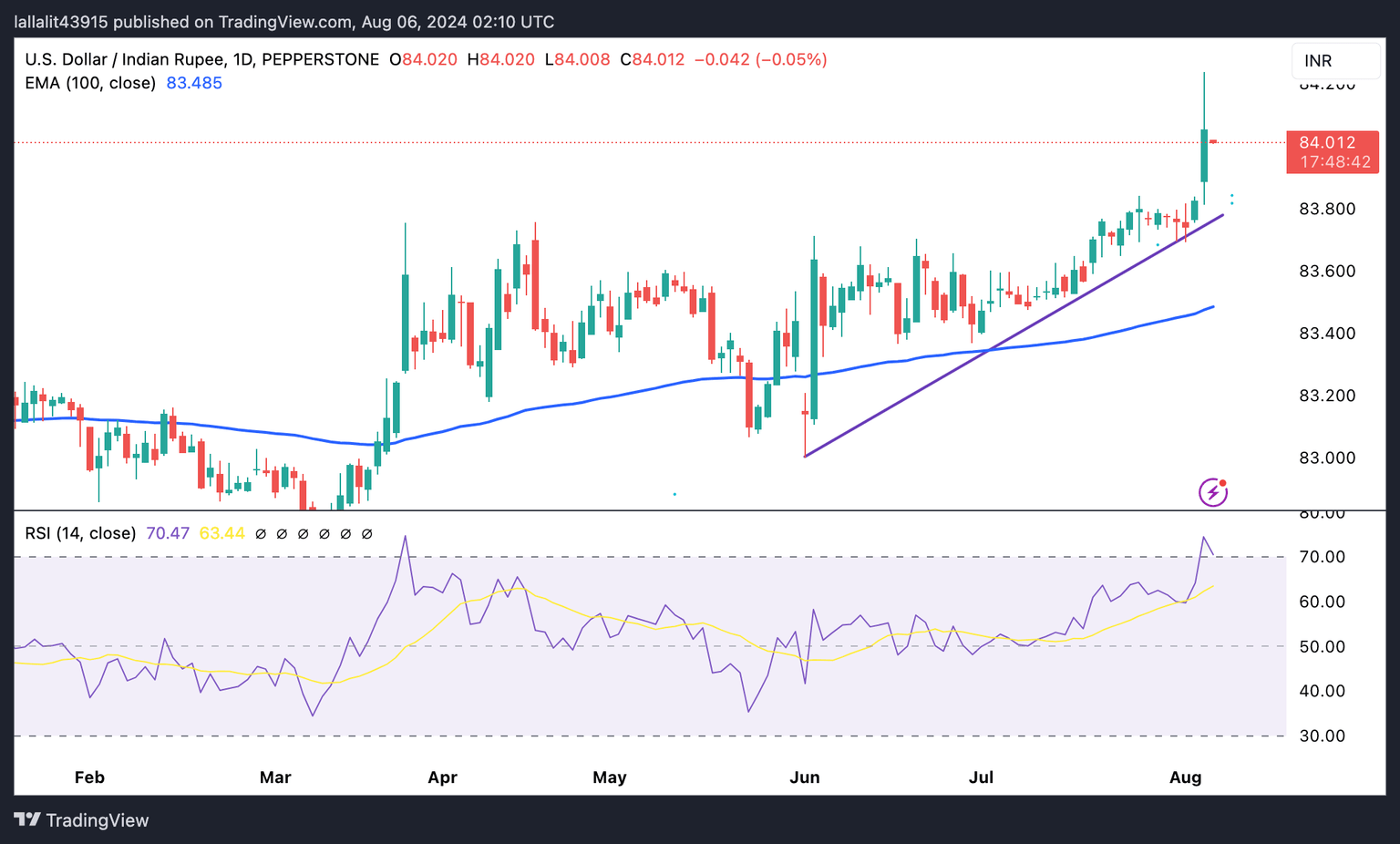

Technical analysis: USD/INR’s constructive picture remains in place

Indian Rupee trades on a stronger note on the day. The bullish outlook of the USD/INR pair remains strong on the daily chart, with the pair holding above the key 100-day Exponential Moving Average (EMA) and being underpinned by the uptrend line since June 3. However, the 14-day Relative Strength Index (RSI) showed the overbought condition above the 70.0 zone, indicating that further consolidation cannot be ruled out before positioning for any near-term USD/INR appreciation.

The immediate resistance level for the pair emerges at the 84.00 psychological level. Any follow-through buying above the mentioned level will see a rally to 84.50.

US Dollar price this week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the Canadian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.34% | 0.11% | -0.47% | -0.28% | 0.10% | 0.28% | 0.05% | |

| EUR | 0.34% | 0.46% | -0.13% | 0.07% | 0.45% | 0.64% | 0.42% | |

| GBP | -0.11% | -0.46% | -0.60% | -0.41% | -0.03% | 0.19% | -0.04% | |

| CAD | 0.47% | 0.13% | 0.59% | 0.20% | 0.56% | 0.76% | 0.55% | |

| AUD | 0.28% | -0.08% | 0.37% | -0.22% | 0.37% | 0.54% | 0.35% | |

| JPY | -0.12% | -0.18% | 0.24% | -0.57% | -0.38% | 0.40% | -0.04% | |

| NZD | -0.27% | -0.65% | -0.19% | -0.79% | -0.54% | -0.19% | -0.23% | |

| CHF | -0.06% | -0.42% | 0.04% | -0.55% | -0.35% | 0.02% | 0.22% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.