USD/INR clings to record highs, attention on 16th BRICS Summit

- The Indian Rupee struggles near all-time lows due to foreign selling in Indian equities.

- PM Modi is expected to meet with Chinese President Xi Jinping during the BRICS Summit.

- The Indian Rupee may hold ground if the RBI intervenes in the market by selling US Dollars.

The Indian Rupee (INR) holds steady against the US Dollar (USD) on Tuesday, bolstered by the potential for market interventions from the Reserve Bank of India (RBI) that have helped the INR weather equity outflows and the dollar's strength.

However, ongoing foreign selling continues to exert pressure on the INR, while concerns over the Middle East conflict have impacted risk-sensitive currencies. Foreign outflows from Indian equities are likely to persist as investors shift funds from India to China, attracted by the recent stimulus measures and relatively lower valuations.

Indian Prime Minister Narendra Modi landed in Russia's Kazan for the 16th BRICS Summit on Tuesday afternoon. During the visit, Modi is scheduled to engage in bilateral talks with Russian President Vladimir Putin. He is also expected to meet with Chinese President Xi Jinping and hold discussions with leaders from the other BRICS member countries.

Daily Digest Market Movers: Indian Rupee receives downward pressure from foreign outflows

- The US Dollar (USD) gained support following a surge in US Treasury yields, which climbed over 2% on Monday. This rise was fueled by signs of economic resilience and growing concerns about a potential resurgence of inflation in the United States, reinforcing expectations of tighter monetary policy.

- According to the CME FedWatch Tool, the likelihood of a 25-basis-point rate cut in November is 89.1%, with no expectation of a larger 50-basis-point cut.

- Federal Reserve Bank of Minneapolis President Neel Kashkari highlighted on Monday that the Fed is closely monitoring the US labor market for signs of rapid destabilization. Kashkari cautioned investors to anticipate a gradual pace of rate cuts over the coming quarters, suggesting that any monetary easing will likely be moderate rather than aggressive.

- Foreign institutional investors have sold approximately $10 billion worth of Indian stocks in October so far, surpassing the previous record monthly outflow of $8.35 billion set in March 2020, according to a Reuters report.

- The Reserve Bank of India stated in its October bulletin that aggregate demand in India is expected to rebound from the temporary slowdown observed in the second quarter, driven by a surge in festive demand and an increase in consumer confidence.

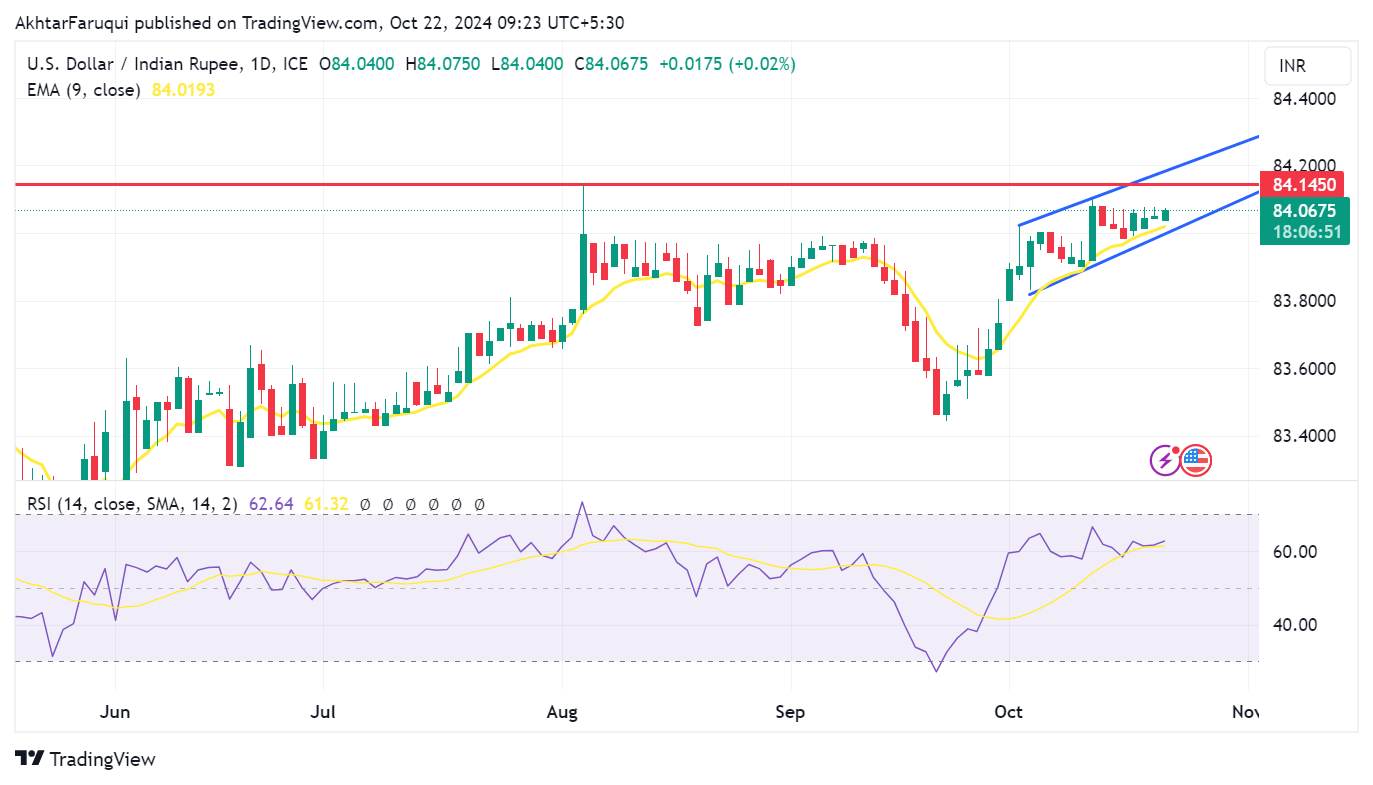

Technical Analysis: USD/INR remains above 84.00, close to all-time highs

The USD/INR pair trades around 84.10 on Tuesday. An analysis of the daily chart indicates that the pair is consolidating within an ascending channel pattern, suggesting a bullish bias. The 14-day Relative Strength Index (RSI) remains above the 50 level, further confirming the prevailing bullish momentum.

In terms of resistance, the USD/INR pair may face a hurdle at its all-time high of 84.14, reached on August 5, followed by the upper boundary of the ascending channel at the 84.20 level.

On the downside, immediate support appears at the nine-day Exponential Moving Average (EMA) around 84.01 level, which aligns with the lower boundary of the ascending channel near the psychological level of 84.00.

USD/INR: Daily Chart

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.14% | -0.08% | 0.03% | -0.02% | -0.38% | -0.44% | -0.13% | |

| EUR | 0.14% | 0.07% | 0.20% | 0.13% | -0.26% | -0.29% | 0.01% | |

| GBP | 0.08% | -0.07% | 0.12% | 0.06% | -0.33% | -0.36% | -0.06% | |

| JPY | -0.03% | -0.20% | -0.12% | -0.06% | -0.43% | -0.50% | -0.18% | |

| CAD | 0.02% | -0.13% | -0.06% | 0.06% | -0.37% | -0.43% | -0.12% | |

| AUD | 0.38% | 0.26% | 0.33% | 0.43% | 0.37% | -0.05% | 0.25% | |

| NZD | 0.44% | 0.29% | 0.36% | 0.50% | 0.43% | 0.05% | 0.30% | |

| CHF | 0.13% | -0.01% | 0.06% | 0.18% | 0.12% | -0.25% | -0.30% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.