USD/INR extends the rally as Trump tariff threats boost US Dollar

- The Indian Rupee extends its downside in Tuesday's early European session.

- Trump's tariff threat, foreign fund outflows, and a stronger USD weigh on the INR.

- The US October JOLTs Job Openings will be released on Tuesday.

The Indian Rupee (INR) remains under pressure on Tuesday after depreciating to a fresh all-time low in the previous session. The disappointing Indian macroeconomic data, persistent foreign fund outflows and the renewed Greenback demand continue to undermine the local currency. The US President-elect Donald Trump on Saturday threatened a 100% tariff on the BRICS nations if they act to undermine the US Dollar (USD). This, in turn, could weigh on the INR against the Greenback.

However, the downside for the INR might be capped amid the routine intervention from the Reserve Bank of India (RBI). Traders will keep an eye on the US JOLTs Job Openings for October, which is due later on Tuesday. The Federal Reserve’s (Fed) Adriana Kugler and Austan Goolsbee are also set to speak. On Friday, the Reserve Bank of India (RBI) interest rate decision and the US Nonfarm Payrolls for November will be the highlights.

Indian Rupee trades softer amid multiple challenges

- The HSBC India Manufacturing Purchasing Managers Index (PMI) declined to 56.5 in November from 57.5 in October. This figure was below the market consensus of 57.3.

- "India recorded a 56.5 manufacturing PMI in November, down slightly from the prior month, but still firmly within expansionary territory. Strong broad-based international demand, evidenced by a four-month high in new export orders, fuelled the Indian manufacturing sector's continued growth,” said Pranjul Bhandari, Chief India Economist at HSBC.

- India’s foreign exchange reserves declined USD 1.31 billion to USD 656.582 billion for the week ended November 22, the RBI said on Friday.

- The US manufacturing improved more than expected in November but continued to indicate a contraction. The US ISM Manufacturing PMI climbed to 48.4 in November from 46.5 in October, better than the estimation of 47.5.

- Fed Governor Christopher Waller said on Monday that he’s inclined to vote to cut the interest rates when Fed officials meet on December 17-18, but added that data due before then could make the case for holding rates steady.

- Atlanta Fed President Raphael Bostic said on Monday that he’s undecided on whether a rate cut is needed in the December meeting, adding that he’ll wait for more data before making up his mind about the next meeting. “I’m keeping my options open,” he said.

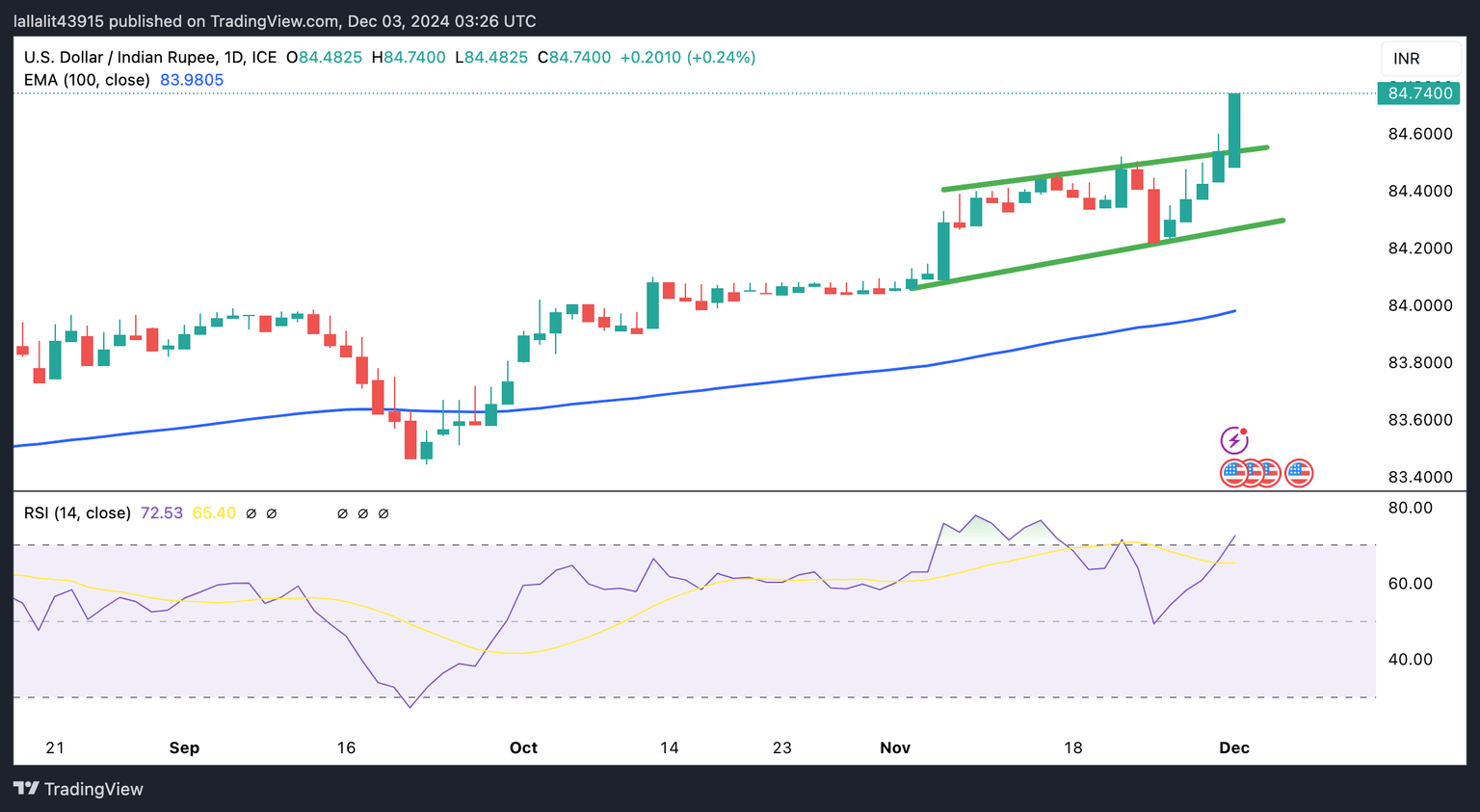

USD/INR accelerates above ascending channel, poised to seek new highs

The 85.00 psychological mark appears to be a tough nut to crack for bulls. Sustained trading above the mentioned level could attract enough bullish demand and expose 85.50.

On the flip side, a rejection from the resistance-turned-support at 84.55 could drag the pair lower to 84.22, the low of November 25. The next support level emerges at 83.98, the 100-day EMA.

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

India has run a trade deficit for most of its recent history, indicating its imports outweigh its exports. Since the majority of international trade takes place in US Dollars, there are times – due to seasonal demand or order glut – where the high volume of imports leads to significant US Dollar- demand. During these periods the Rupee can weaken as it is heavily sold to meet the demand for Dollars. When markets experience increased volatility, the demand for US Dollars can also shoot up with a similarly negative effect on the Rupee.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.