USD/INR strengthens as traders await Fed rate decision

- Indian Rupee trades on a weaker note in Monday’s early European session.

- The combination of lower crude oil prices, strong foreign inflows and firmer Fed rate bets might cap the INR's downside.

- Investors await the Indian Trade Balance and US NY Empire State Manufacturing Index, which are due on Monday.

The Indian Rupee (INR) weakens on Monday despite a weaker US Dollar (USD). The decline in crude oil prices, strong foreign institutional inflows (FII) into the Indian stock market and the odds of an outsized Federal Reserve (Fed) rate cut at its upcoming monetary policy meeting on Wednesday might support the local currency.

However, the consistent USD buying by importers and risk aversion ahead of the key event could boost the Greenback. Looking ahead, the Indian Trade Balance and US NY Empire State Manufacturing Index are due on Monday. The Indian Wholesale Price Index (WPI) Inflation and US Retail Sales for August will be released on Tuesday. The US Federal Reserve (Fed) interest rate decision will be the highlight on Wednesday.

Daily Digest Market Movers: Indian Rupee remains weak amid multiple headwinds

- On Friday, the BSE Sensex closed lower by 72 points, down 0.1%, while the NSE Nifty stood lower by 32 points, down 0.1%. Bajaj Finserv, Axis Bank and Wipro were among the top gainers.

- “The US dollar index has fallen from a level of 106 to around 101 in the past three months. Simultaneously, Asian currencies have appreciated against the greenback. The likely interest rate cuts by the US Fed, a sharp drop in crude oil prices and consistent foreign institutional inflows into Indian stock markets are supportive factors for the rupee. However, the local currency has not appreciated; rather, it remains weak against the US dollar,” said Amit Pabari, MD, CR Forex Advisors.

- The Reserve Bank of India Governor Shaktikanta Das said the country’s expected growth rate over the next few years stood at 7.5%, with upside possibilities.

- University of Michigan Consumer Sentiment Index climbed to 69.0 in September from 67.9 in August, better than the estimation of 68.0.

- The markets are now pricing in a 48% possibility of a 25 basis points (bps) US rate cut on September 17-18, while the chance of a 50 bps cut stands at 52%, according to the CME FedWatch tool.

Technical Analysis: USD/INR’s constructive outlook remains in place

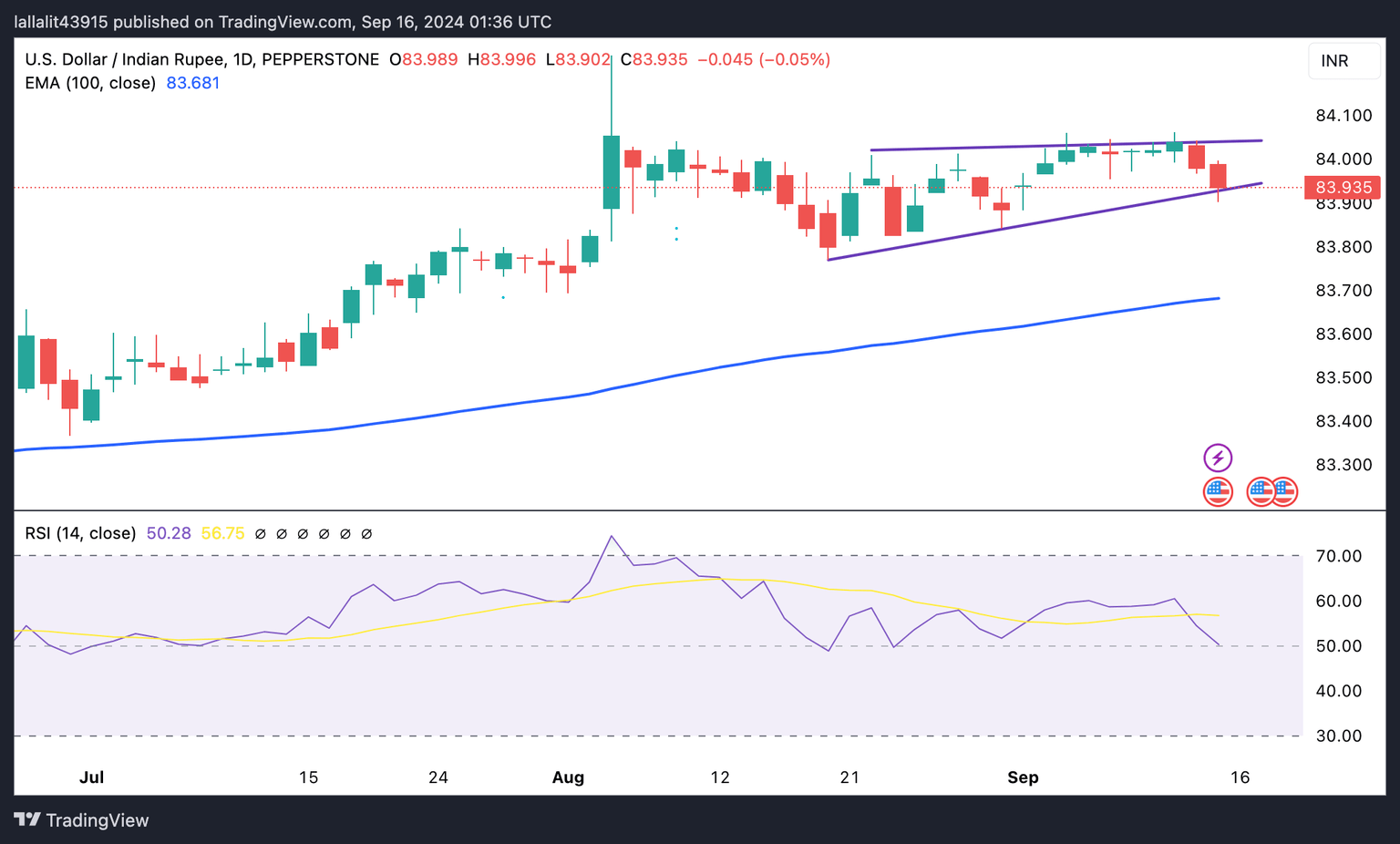

The Indian Rupee edges lower on the day. The USD/INR pair has broken below an ascending triangle on the daily chart. Nonetheless, in the long term, the pair keeps the bullish vibe as it remains above the key 100-day Exponential Moving Average (EMA). Further consolidation cannot be ruled out as the 14-day Relative Strength Index (RSI) hovers around the midline, indicating the neutral momentum of the pair.

Sustained upside pressure past the 84.00-84.05 region, the confluence of the psychological figure, the upper boundary of the triangle and the high of September 11 could take USD/INR up to the next upside barriers at 84.50.

On the flip side, the initial support level emerges at 83.84, the low of August 30. A break below this level could pave the way to the 100-day EMA at 83.68.

RBI FAQs

The role of the Reserve Bank of India (RBI), in its own words, is '..to maintain price stability while keeping in mind the objective of growth.” This involves maintaining the inflation rate at a stable 4% level primarily using the tool of interest rates. The RBI also maintains the exchange rate at a level that will not cause excess volatility and problems for exporters and importers, since India’s economy is heavily reliant on foreign trade, especially Oil.

The RBI formally meets at six bi-monthly meetings a year to discuss its monetary policy and, if necessary, adjust interest rates. When inflation is too high (above its 4% target), the RBI will normally raise interest rates to deter borrowing and spending, which can support the Rupee (INR). If inflation falls too far below target, the RBI might cut rates to encourage more lending, which can be negative for INR.

Due to the importance of trade to the economy, the Reserve Bank of India (RBI) actively intervenes in FX markets to maintain the exchange rate within a limited range. It does this to ensure Indian importers and exporters are not exposed to unnecessary currency risk during periods of FX volatility. The RBI buys and sells Rupees in the spot market at key levels, and uses derivatives to hedge its positions.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.