USD/INR extends the rally as traders await US CPI release

- The Indian Rupee edges lower in Tuesday’s early European session.

- The weakness in Asian peers, firmer USD, and foreign outflows could drag the INR lower.

- Investors brace for the US November CP inflation report, which is due on Wednesday.

The Indian Rupee (INR) weakens to near a fresh record low on Tuesday. The local currency remains vulnerable due to a decline in its Asian peers, the outflow of foreign money, and persistent strength in the US Dollar (USD) from importers and foreign banks. However, the foreign exchange intervention by the Reserve Bank of India (RBI) might prevent the INR from further depreciation.

Looking ahead, the US Consumer Price Index (CPI) for November will be in the spotlight on Wednesday. This report could serve as the one remaining potential stumbling block to a third successive rate cut from the Federal Reserve (Fed). On the Indian docket, the CPI inflation data will be published on Thursday.

Indian Rupee remains weak amid multiple headwinds

- "We expect INR to trade at current levels with a depreciating bias. The Reserve Bank of India's recent measures to boost foreign inflows and a range-bound CAD (current account deficit) should lend support over the medium term," noted economists at Bank of Baroda.

- India's forex reserves rose by $1.51 billion to $658.09 billion for the week ended November 29, according to the RBI on Friday. For the previous week, the foreign exchange reserves were $656.58 billion.

- The Indian central bank revised its real Gross Domestic Product (GDP) growth forecast for the current fiscal year, lowering it from 7.2% to 6.6%, signaling a more cautious outlook for the Indian economy.

- San Francisco Fed President Mary Daly noted on Friday that the US jobs market still looked healthy after fresh employment data was released Friday. Daly further stated that the Fed is ready to raise rates if inflation breaks out again.

- Financial markets are now pricing in nearly an 85.8% possibility of a 25 basis points (bps) rate cut by the Fed on December 17-18, according to the CME FedWatch tool.

USD/INR paints a positive picture in the longer term

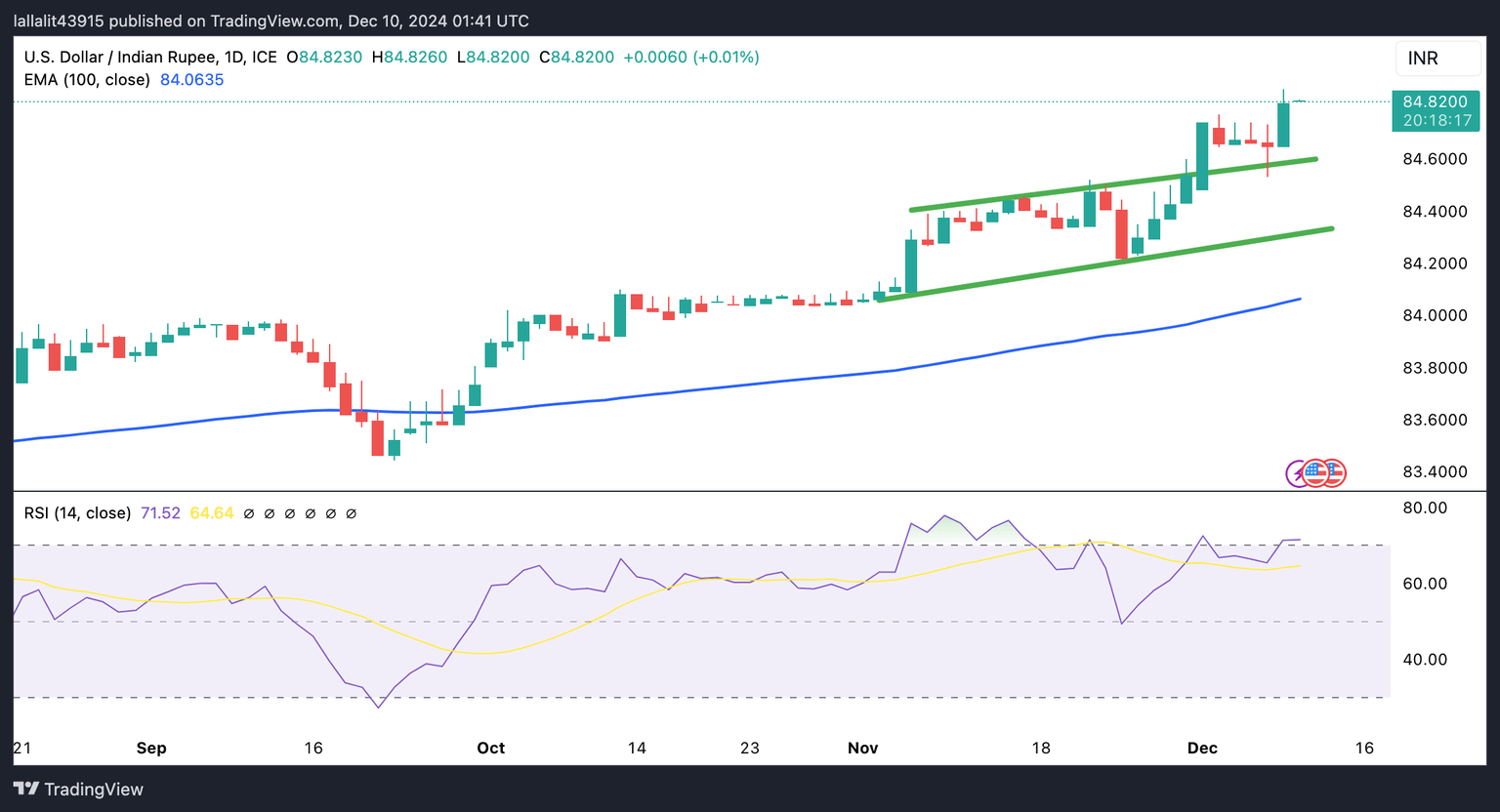

The Indian Rupee trades on a softer note on the day. The constructive outlook of the USD/INR pair remains in play, with the price holding above the key 100-day Exponential Moving Average (EMA) on the daily timeframe. Nonetheless, the 14-day Relative Strength Index (RSI) stands above the midline near 71.60, indicating the overbought RSI condition. This suggests that further consolidation cannot be ruled out before positioning for any near-term USD/INR appreciation.

The all-time high of 84.86 acts as an immediate resistance level for USD/INR. Consistent trading above this level could pave the way to the 85.00 psychological level, en route to 85.50.

On the other hand, bearish candlesticks below the resistance-turned-support of 84.61 may draw in enough selling pressure to drag the pair to 84.22, the low of November 25. The next contention level to watch is 84.06, the 100-day EMA.

RBI FAQs

The role of the Reserve Bank of India (RBI), in its own words, is "..to maintain price stability while keeping in mind the objective of growth.” This involves maintaining the inflation rate at a stable 4% level primarily using the tool of interest rates. The RBI also maintains the exchange rate at a level that will not cause excess volatility and problems for exporters and importers, since India’s economy is heavily reliant on foreign trade, especially Oil.

The RBI formally meets at six bi-monthly meetings a year to discuss its monetary policy and, if necessary, adjust interest rates. When inflation is too high (above its 4% target), the RBI will normally raise interest rates to deter borrowing and spending, which can support the Rupee (INR). If inflation falls too far below target, the RBI might cut rates to encourage more lending, which can be negative for INR.

Due to the importance of trade to the economy, the Reserve Bank of India (RBI) actively intervenes in FX markets to maintain the exchange rate within a limited range. It does this to ensure Indian importers and exporters are not exposed to unnecessary currency risk during periods of FX volatility. The RBI buys and sells Rupees in the spot market at key levels, and uses derivatives to hedge its positions.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.