USD/INR flat lines ahead of Indian CPI inflation data

- The Indian Rupee trades sideways in Monday’s Asian trading hours.

- Elevated Middle East geopolitical risks might boost the pair, while possible RBI intervention might cap the upside.

- Indian CPI and Industrial Production data will be the highlights on Monday.

The Indian Rupee (INR) trades on a flat note on Monday amid the consolidation of the Greenback. Traders turn cautious amid the geopolitical risks. The US is strengthening its capabilities in the Middle East by sending an additional guided missile submarine to the region "in light of rising regional tensions”, per ABC News. This might boost a safe-haven currency like the US Dollar (USD) in the near term. However, the likely intervention by the Reserve Bank of India (RBI) could support the local currency and cap the significant upside for the pair.

Looking ahead, traders will monitor the release of the Indian Consumer Price Index (CPI) and Industrial Production. On the US docket, the Producer Price Index (PPI), Consumer Price Index (CPI) and Retail Sales will be released later this week. The softer inflation data could reinforce expectations that the Federal Reserve (Fed) will start cutting interest rates soon, which might drag the Greenback lower.

Daily Digest Market Movers: Indian Rupee holds steady ahead of Indian CPI report

- Amit Somani, senior fixed income fund manager at Tata Asset Management, noted the balance of risks on the Indian Rupee remains on the downside, adding that he expects the currency to move in the 83.80-84.20 range for the week.

- "The Reserve Bank of India (RBI) has been very watchful of the Rupee's movement and has intervened in the spot market to ensure it stays near 84”, said Jigar Trivedi, senior analyst at Reliance Securities.

- The Indian CPI is expected to show an increase of 3.65% YoY in July, compared to 5.08% in the previous reading.

- The Israeli intelligence community believed Iran has decided to attack Israel directly and may do so within days, Axios reporter Barak Ravid said on Sunday, citing two sources.

- Fed Governor Michelle Bowman said on Sunday that she sees the progress in lowering inflation in the previous months, but inflation is still uncomfortably above the Fed's 2% target, highlighting the Fed may not be ready to cut rates at its upcoming meeting in September, per Reuters.

- The CME FedWatch Tool showed the possibility of a 50 basis points (bps) interest rate cut by the Fed at the September meeting at 52.5%, down from 57.5% a day ago.

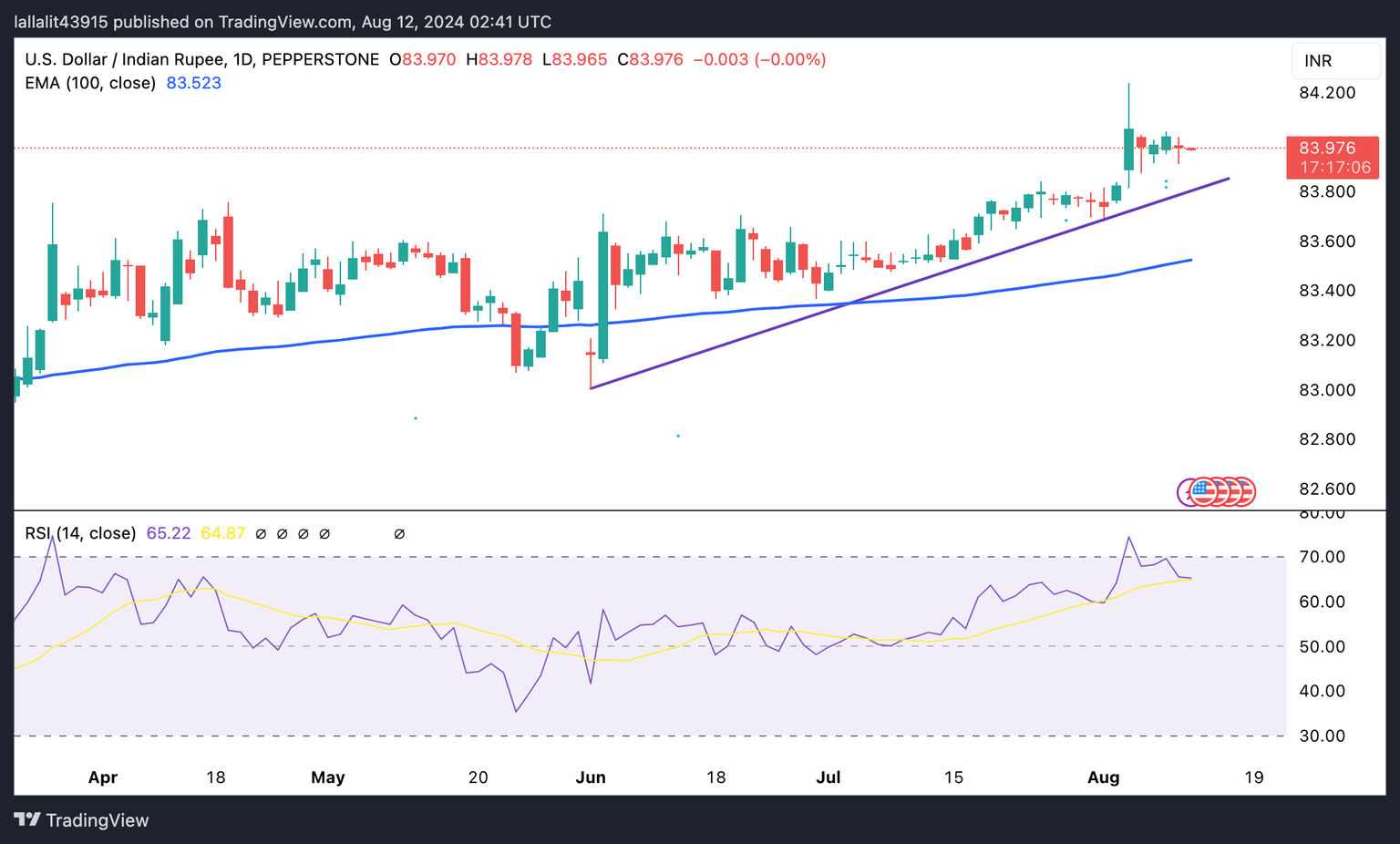

Technical analysis: USD/INR’s positive stance remains unchanged

A decisive bullish breakout above the 84.00 psychological barrier could pave the way to the all-time high of 84.24. If the upswing continues, it may take the pair to 84.50.

On the downside, a bearish turn could keep USD/INR back to the uptrend line near 82.82. Sustained trading below this level will see a drop to the 100-day EMA at 83.52.

US Dollar price this week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.05% | -0.09% | -0.02% | -0.23% | -0.09% | -0.23% | 0.02% | |

| EUR | 0.05% | -0.03% | 0.03% | -0.16% | -0.03% | -0.17% | 0.07% | |

| GBP | 0.08% | 0.03% | 0.06% | -0.14% | 0.00% | -0.14% | 0.10% | |

| CAD | 0.02% | -0.03% | -0.06% | -0.19% | -0.07% | -0.22% | 0.04% | |

| AUD | 0.23% | 0.16% | 0.13% | 0.20% | 0.13% | 0.00% | 0.25% | |

| JPY | 0.12% | 0.05% | 0.01% | 0.06% | -0.13% | -0.13% | 0.12% | |

| NZD | 0.22% | 0.17% | 0.14% | 0.20% | 0.01% | 0.12% | 0.24% | |

| CHF | -0.02% | -0.08% | -0.11% | -0.04% | -0.24% | -0.11% | -0.25% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.