USD/INR strengthens, Indian Services PMI accelerates to five-month high in August

- Indian Rupee loses traction in Wednesday’s early European session.

- The Indian HSBC Services PMI came in at 60.9 in August vs. 60.3 prior, stronger than expected.

- Possible RBI interventions and lower crude oil prices might support the INR, while firmer USD could limit its upside.

- Investors await JOLTS Job Openings and the Fed Beige Book on Wednesday for fresh impetus.

The Indian Rupee (INR) trades on a softer note on Wednesday. Traders remain vigilant for potential interventions from the Reserve Bank of India (RBI) to prevent the INR from breaching the 84 mark, though this has yet to be officially confirmed. Meanwhile, a fall in crude oil prices to the lowest since January might underpin the local currency as India is the world's third-largest oil-consuming and importing nation.

The latest data released on Wednesday showed that the HSBC India Services Purchasing Managers Index (PMI) improved to 60.9 in August from 60.3 in July, above the market consensus of 60.4. This figure registered the highest since March. However, the upbeat Indian Services PMI data fails to boost the local currency against the USD after the report.

Nonetheless, the renewed demand for the US Dollar (USD) from importers and risk aversion could weigh on the INR and boost the safe-haven currency like the Greenback. Looking ahead, the US JOLTS Job Openings and Fed Beige Book will be published later on Wednesday. The attention will shift to the US Nonfarm Payrolls (NFP) for August on Friday, which might offer some hints about the size and pace of rate cuts by the Federal Reserve (Fed) this year. Indian Rupee trades flat in Wednesday’s early European session.

Daily Digest Market Movers: Indian Rupee remains fragile amid multiple headwinds

- “The Composite PMI for India continued to show strong growth in August, driven by accelerated business activity in the service sector, which experienced its fastest expansion since March. This growth was largely fuelled by an increase in new orders, particularly domestic orders,” said Pranjul Bhandari, Chief India Economist at HSBC.

- The World Bank has raised India's growth forecast to 7% for the current financial year (FY25), up from an earlier projection of 6.6%.

- The RBI Deputy Governor Michael Patra said India will need rapid economic growth for a decade in order to achieve Prime Minister Narendra Modi’s goal of becoming a developed country by 2047.

- HSBC India Services PMI is expected to improve to 60.4 in August from 60.3 in July.

- The business activity in the US manufacturing sector continued to contract, albeit at a softer pace in August. The US ISM Manufacturing PMI rose to 47.2 in August versus 46.8 prior, weaker than expected.

- Financial markets have priced in around 61% odds of a 25 basis points (bps) rate cut by the Fed in September, while the possibility of a 50 bps reduction stands at 39%, according to the CME FedWatch tool.

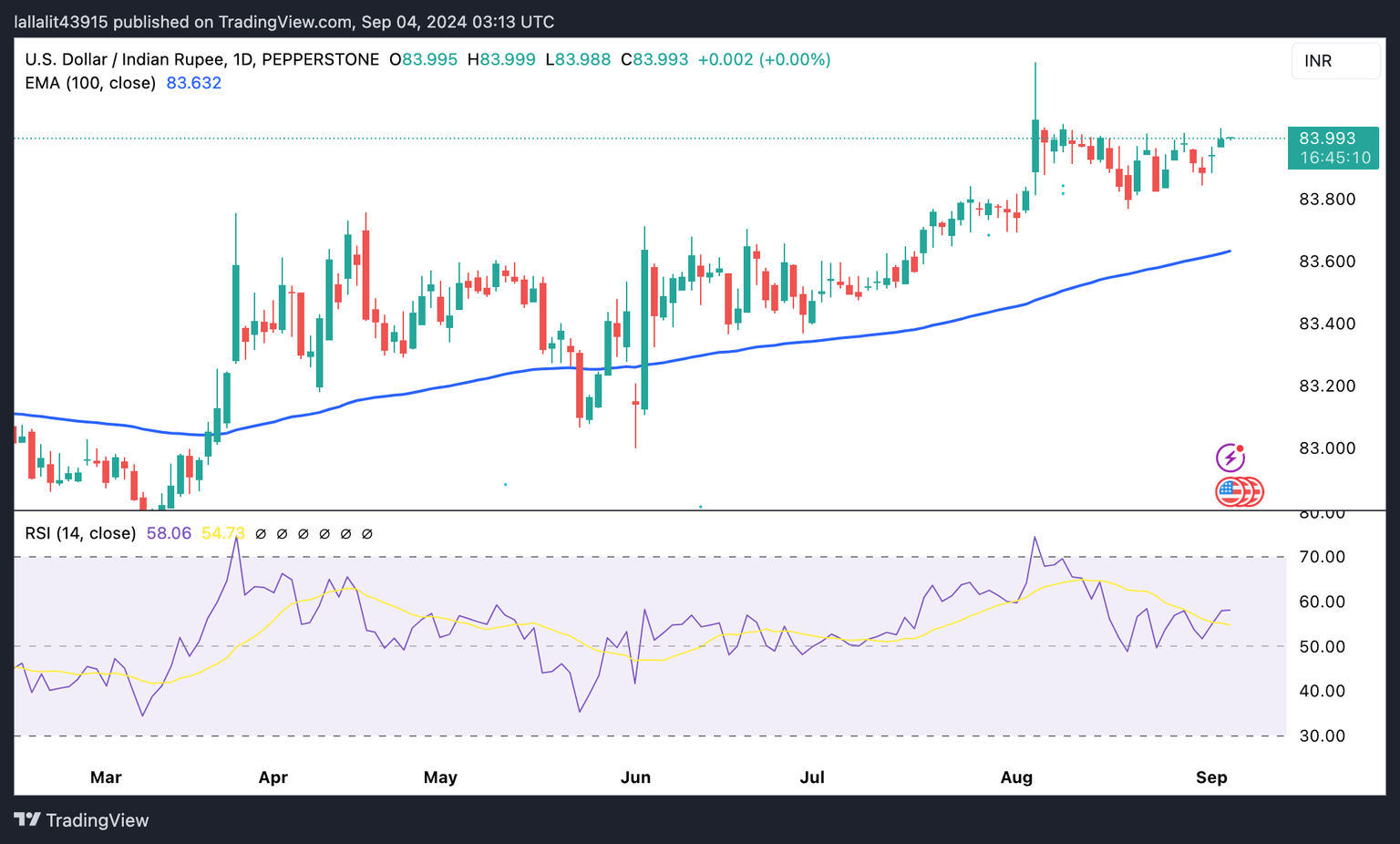

Technical Analysis: USD/INR is in consolidative mode, a longer-term bullish outlook remains in play

The Indian Rupee trades weaker on the day. The USD/INR pair remains traded in a consolidative mode in the near term. However, in the longer term, the positive view of the pair prevails as the price is well-supported above the key 100-day Exponential Moving Average (EMA) on the daily timeframe, with the 14-day Relative Strength Index (RSI) standing in bullish territory near 58.0.

The 84.00 psychological figure appears to be a tough nut to crack for USD/INR. A decisive break above this level could pave the way to 84.50.

In the bearish event, the initial support level emerges at 83.84, the low of August 30. A breach of the mentioned level could lead to some downside, possibly dragging the pair lower to the 100-day EMA at 83.62.

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.