USD/INR jumps on firmer US Dollar, higher crude oil prices

- The Indian Rupee trades softer to a record low in Wednesday’s early European session.

- The renewed USD demand and higher oil prices weigh on the INR.

- Investors await the FOMC Minutes due later today.

The Indian Rupee (INR) edges lower to near an all-time low on Wednesday, pressured by the stronger US Dollar (USD) and a rise in crude oil prices. Additionally, the persistent outflows, geopolitical tensions and downside risks to India’s growth projections might drag the INR lower against the USD. However, the likely foreign exchange intervention by the Reserve Bank of India (RBI) might help limit the INR’s losses.

Investors will closely monitor the development surrounding the incoming US administration under Donald Trump’s tariff plan. Looking ahead, the Federal Open Market Committee (FOMC) Minutes are due later on Wednesday. The US December labor market data will be the highlight on Friday. Economists expect 154,000 new jobs for December, while the unemployment rate is expected to remain at 4.2% during the same report period. These reports will give further cues on the interest rate trajectory of the US Federal Reserve (Fed).

Indian Rupee weakens amid ongoing uncertainty on US tariffs

- India's economy is estimated to slow significantly in FY25, with the first advance estimate revealing a real GDP growth rate of 6.4%, down from 8.2% in FY24.

- “As the dollar index fell, the Indian rupee gained up to 85.65 during the day before dollar buying from importers and oil companies pushed the rupee to 85.72/$1 levels,” said Anil Bhansali, head of treasury, Finrex Treasury Advisors.

- The RBI’s interventions in the foreign exchange market have drawn down reserves by $65 billion since their September 2024 peak to manage depreciation.

- The US Services PMI rose to 54.1 in December from 52.1 in November, according to the Institute for Supply Management (ISM) on Tuesday. This reading came in above the market consensus of 53.3.

- US JOLTS Job Openings increased to 8.09 million in November versus 7.83 million prior. The market expected 7.7 million Job Openings in November.

- Atlanta Fed President Raphael Bostic stated that the Fed officials should be cautious with policy decisions given uneven progress on lowering inflation and err on the side of keeping interest rates elevated to achieve their price stability goal, per Reuters.

- According to the CME FedWatch tool, the markets have priced in nearly a 93.5% possibility that the Fed will hold the rate steady this month.

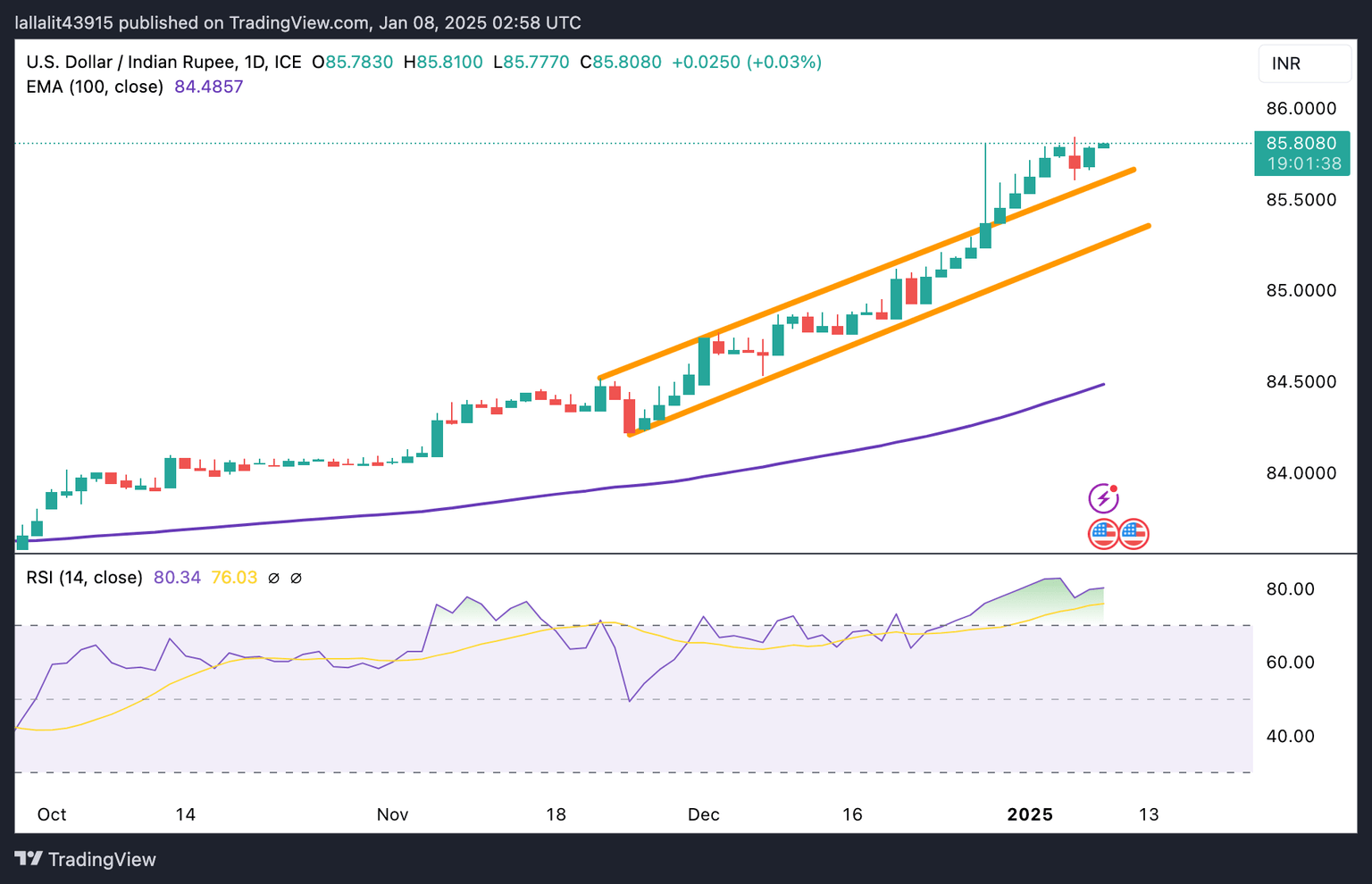

USD/INR maintains a positive picture, but an overbought RSI warrants caution for bulls

The Indian Rupee trades firmer on the day. The constructive view of the USD/INR pair prevails, with the price holding above the key 100-day Exponential Moving Average (EMA) on the daily chart. However, further consolidation cannot be ruled out before positioning for any near-term USD/INR appreciation as the 14-day Relative Strength Index (RSI) stands near 79.60, indicating an overbought condition.

The all-time high of 85.84 acts as an immediate resistance level for USD/INR. If the pair prints bullish candlesticks and sustainably breaks above the mentioned level, it could draw in technical buyers and pave the way to the 86.00 psychological mark.

On the other hand, the first downside target to watch is 85.60, the low of January 6. Sustained trading below this level could drag the pair back down to 85.00, followed by 84.48, the 100-day EMA.

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.