USD/INR extends the rally, Indian Manufacturing PMI declines to eight-month low in September

- Indian Rupee softens in Tuesday’s early European session.

- The Indian August HSBC Manufacturing PMI came in at 56.5 vs. 57.5 prior, weaker than expected.

- The renewed USD demand, volatile crude oil prices, foreign outflows of funds undermine the INR.

- The US ISM Manufacturing PMI for September will be in the spotlight on Tuesday.

The Indian Rupee (INR) trades in negative territory for the third consecutive day on Tuesday. The latest data released on Tuesday showed that the HSBC India Manufacturing Purchasing Managers Index (PMI) eased to 56.5 in September. This figure was below the market consensus of 56.7 and the previous reading of 57.5. The local currency remains weak in an immediate reaction to the downbeat PMI data.

The downtick of the local currency is pressured by strong US Dollar (USD) demand from foreign banks. Additionally, the volatile crude oil prices amid rising tensions in the Middle East and the outflow of foreign funds contribute to the INR’s downside.

However, the anticipation of additional interest rate reduction by the Federal Reserve might cap the upside for the pair. Investors will keep an eye on the US ISM Manufacturing Purchasing Managers Index (PMI), which is due on Tuesday. Also, the Fed’s Raphael Bostic and Lisa Cook are scheduled to speak.

Daily Digest Market Movers: Indian Rupee remains weak amid global factors

- "The rupee, after experiencing a decent appreciation, has begun drifting back toward its typical range. This shift is driven by month-end dollar demand from importers, coupled with the RBI’s active management of the currency," said Amit Pabari, managing director at FX advisory firm CR Forex.

- India’s current account balance moved into a deficit of $9.7 billion in the April-June quarter (Q1) of 2024-25 (FY25), accounting for 1.1% of Gross Domestic Product (GDP), according to the Reserve Bank of India (RBI).

- Fed Chair Jerome Powell said on Monday that the recent half-percentage point interest rate cut shouldn’t be interpreted as a sign that future moves will be as aggressive. Powell added that further rate cuts are in the pipeline, though their size and pace would depend on the evolution of the economy.

- Powell further stated that the Fed's current goal is to support a largely healthy economy and job market, rather than rescue a struggling economy or prevent a recession.

- Interest rate futures contracts have priced in a nearly 35.4% chance of a half-point cut in November, versus a 64.6% possibility of a quarter-point cut, according to the CME FedWatch Tool.

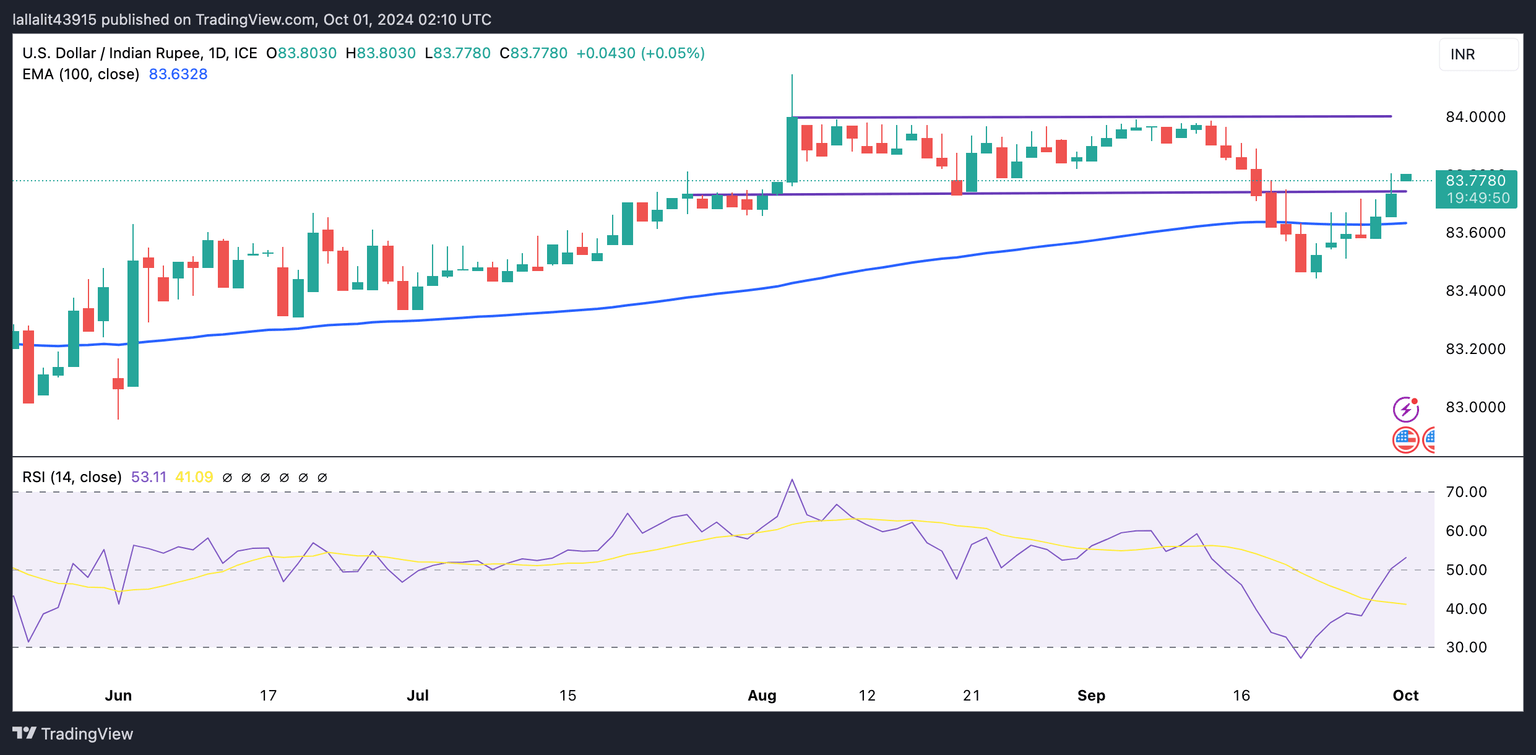

Technical Analysis: USD/INR’s positive outlook prevails

The Indian Rupee trades on a weaker note on the day. The USD/INR pair keeps the bullish vibe on the daily timeframe as the price holds above the key 100-day Exponential Moving Average (EMA). Nonetheless, further consolidation cannot be ruled out as the 14-day Relative Strength Index (RSI) hovers around the midline, indicating neutral momentum.

The 84.00 psychological mark appears to be a tough nut to crack for USD/INR bulls. A decisive break above this level could see a rally to 84.15, the high of August 5. The next upside barrier is seen at 84.50.

On the flip side, the 100-day EMA at 83.62 acts as an initial support level for USD/INR. Extended losses could pave the way to 83.00, representing the psychological level and the low of May 24.

Indian economy FAQs

The Indian economy has averaged a growth rate of 6.13% between 2006 and 2023, which makes it one of the fastest growing in the world. India’s high growth has attracted a lot of foreign investment. This includes Foreign Direct Investment (FDI) into physical projects and Foreign Indirect Investment (FII) by foreign funds into Indian financial markets. The greater the level of investment, the higher the demand for the Rupee (INR). Fluctuations in Dollar-demand from Indian importers also impact INR.

India has to import a great deal of its Oil and gasoline so the price of Oil can have a direct impact on the Rupee. Oil is mostly traded in US Dollars (USD) on international markets so if the price of Oil rises, aggregate demand for USD increases and Indian importers have to sell more Rupees to meet that demand, which is depreciative for the Rupee.

Inflation has a complex effect on the Rupee. Ultimately it indicates an increase in money supply which reduces the Rupee’s overall value. Yet if it rises above the Reserve Bank of India’s (RBI) 4% target, the RBI will raise interest rates to bring it down by reducing credit. Higher interest rates, especially real rates (the difference between interest rates and inflation) strengthen the Rupee. They make India a more profitable place for international investors to park their money. A fall in inflation can be supportive of the Rupee. At the same time lower interest rates can have a depreciatory effect on the Rupee.

India has run a trade deficit for most of its recent history, indicating its imports outweigh its exports. Since the majority of international trade takes place in US Dollars, there are times – due to seasonal demand or order glut – where the high volume of imports leads to significant US Dollar- demand. During these periods the Rupee can weaken as it is heavily sold to meet the demand for Dollars. When markets experience increased volatility, the demand for US Dollars can also shoot up with a similarly negative effect on the Rupee.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.