USD/INR edges lower as Indian Rupee receives support ahead of index inclusion

- The Indian Rupee appreciates as Indian bonds are scheduled to be included in J.P. Morgan’s Emerging Market Bond Index on June 28.

- Foreign investors have invested around $10 billion into the securities eligible to join J.P. Morgan’s index.

- US GDP Annualized (Q1) is expected to show a slight increase of 1.4% from the previous growth of 1.3%.

The Indian Rupee (INR) recovers its recent losses on Thursday due to receiving support from the expectations of foreign inflows. Indian bonds are set to enter the JP Morgan Emerging Market (EM) Bond Index on June 28. Foreign investors have already invested approximately $10 billion into the securities eligible to join JPMorgan’s index, according to Business Standard. Meanwhile, Goldman Sachs anticipates at least $30 billion more in inflows in the coming months as India’s weighting on the index steadily rises to 10%.

The US Dollar (USD) loses ground possibly due to traders’ anticipation of Friday’s Core PCE Price Index inflation, projected to decrease year-over-year to 2.6% from the previous 2.8%. This data is seen as the Federal Reserve's (Fed) preferred inflation gauge. Market participants are hoping that signs of easing inflation will encourage the Federal Reserve (Fed) to consider rate cuts sooner rather than later.

Daily Digest Market Movers: Indian Rupee gains ground on expected foreign inflows

- Lower crude Oil prices could support the Indian Rupee, the currency of the world's third-largest oil consumer after the United States and China. West Texas Intermediate (WTI) crude Oil price edges lower to near $80.30, at the time of writing. Crude oil prices received pressure after a surprise build in US crude stockpiles, which raised concerns about weakening demand from the world’s top oil consumers.

- Reuters cited Fed Governor Michelle Bowman repeating her view on Tuesday that holding the policy rate steady for some time will likely be enough to bring inflation under control. Meanwhile, Fed Governor Lisa Cook said it would be appropriate to cut interest rates "at some point," given significant progress on inflation and a gradual cooling of the labor market, though she remained vague about the timing of the easing.

- The S&P Global Ratings retained its growth forecast for India at 6.8% for FY25, citing high interest rates and government spending boosting demand in the non-agricultural sectors.

- On Tuesday, RBI Governor Shaktikanta Das said that India is on the verge of a major structural shift in its growth trajectory, moving towards sustained 8% GDP growth. Das attributes this growth to several key drivers, including structural reforms such as the Goods and Services Tax (GST), reported by The Economic Times.

- India is expected to become a $4 trillion economy in 2025, surpassing Japan by early next fiscal year to become the world's fourth largest economy, according to Indian Economic Advisory Council to the Prime Minister (EAC-PM) member Sanjeev Sanyal.

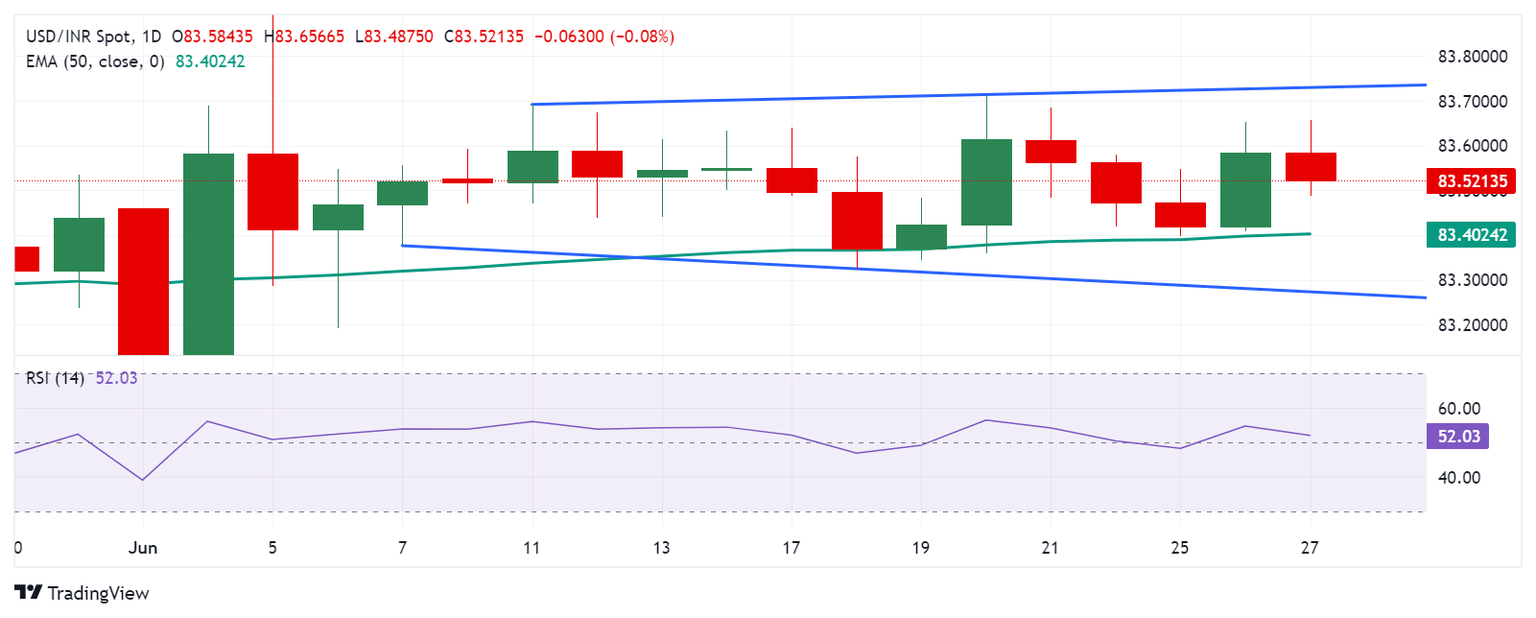

Technical analysis: USD/INR holds position around 83.50

The USD/INR trades around 83.50 on Thursday. The analysis of the daily chart shows a broadening pattern, indicating increasing volatility. This pattern suggests a potential correction before moving lower. The 14-day Relative Strength Index (RSI) is slightly above the 50 level, and a break below this level could signal a bearish bias.

Immediate support is at the 50-day Exponential Moving Average (EMA) at 83.40. A break below this level could push the USD/INR pair toward the lower boundary of the broadening bottom at around 83.30.

On the upside, resistance is expected at the upper boundary of the broadening formation at around 83.70, followed by the psychological level of 84.00.

USD/INR: Daily Chart

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | INR | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.08% | -0.07% | -0.14% | -0.12% | -0.24% | -0.15% | -0.12% | |

| EUR | 0.08% | 0.00% | -0.07% | -0.06% | -0.16% | -0.10% | -0.02% | |

| GBP | 0.07% | -0.00% | -0.06% | -0.06% | -0.15% | -0.07% | -0.06% | |

| JPY | 0.14% | 0.07% | 0.06% | 0.03% | -0.09% | -0.04% | 0.06% | |

| CAD | 0.12% | 0.06% | 0.06% | -0.03% | -0.13% | -0.04% | 0.01% | |

| AUD | 0.24% | 0.16% | 0.15% | 0.09% | 0.13% | 0.09% | 0.14% | |

| NZD | 0.15% | 0.10% | 0.07% | 0.04% | 0.04% | -0.09% | 0.02% | |

| INR | 0.12% | 0.02% | 0.06% | -0.06% | -0.01% | -0.14% | -0.02% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.