USD/INR trades with mild gains as traders await US ISM Services PMI data

- Indian Rupee weakens in Thursday’s early European session, pressured by a sell-off in Indian equities.

- RBI’s intervention and lower crude oil prices might cap the INR’s downside.

- Investors await the US ISM Services PMI, which is due later on Thursday.

The Indian Rupee (INR) extends its downside on Thursday despite the weaker US Dollar (USD). A sell-off in domestic equities tracking global cues weighed on the INR, dragging the local currency to near all-time lows. However, the possible intervention by the Reserve Bank of India (RBI) through USD sales might prevent the Indian Rupee from breaching the 84 mark. Additionally, a fall in crude oil prices could help limit the INR’s losses as India is the world's third-largest oil-consuming and importing nation.

The US ISM Services Purchasing Managers Index (PMI) is due later on Thursday, which is estimated to ease to 51.1 in August from 51.4 in July. On Friday, the attention will shift to the US Nonfarm Payrolls (NFP) for August. This event might offer some cues about the size and pace of rate cuts by the Federal Reserve (Fed) this year.

Daily Digest Market Movers: Indian Rupee seems vulnerable ahead of US NFP report

- The Indian currency was expected to strengthen from Wednesday's rate of 83.96 to the dollar to 83.92 in one month and 83.75 in three months, according to a Reuters poll.

- The HSBC India Services Purchasing Managers Index (PMI) improved to 60.9 in August from 60.3 in July, above the market consensus of 60.4. This figure registered the highest since March.

- “The Indian rupee was again stopped near 83.9750, its lowest closing, possibly by RBI as it sold dollars to ensure it remains a touch away from the psychological level of 84.00. Risk-off sentiments ensured that markets kept buying dollars and RBI supplying them,” said Anil Kumar Bhansali, head of treasury and executive director at Finrex Treasury Advisors LLP.

- Job Openings and Labor Turnover Survey showed that available positions fell to 7.67 million in July, compared with 7.91 million openings (revised from 8.1 million) seen in June, the Labor Department reported on Wednesday. This figure came in below the market consensus of 8.1 million.

- Atlanta Fed President Raphael Bostic stated on Wednesday that he is ready to start cutting interest rates even though inflation is still running above the US central bank’s target.

- The markets are now pricing in nearly 57% chance of a 25 basis points (bps) rate cut by the Fed in September, while the odds of a 50 bps reduction stands at 43%, according to the CME FedWatch tool.

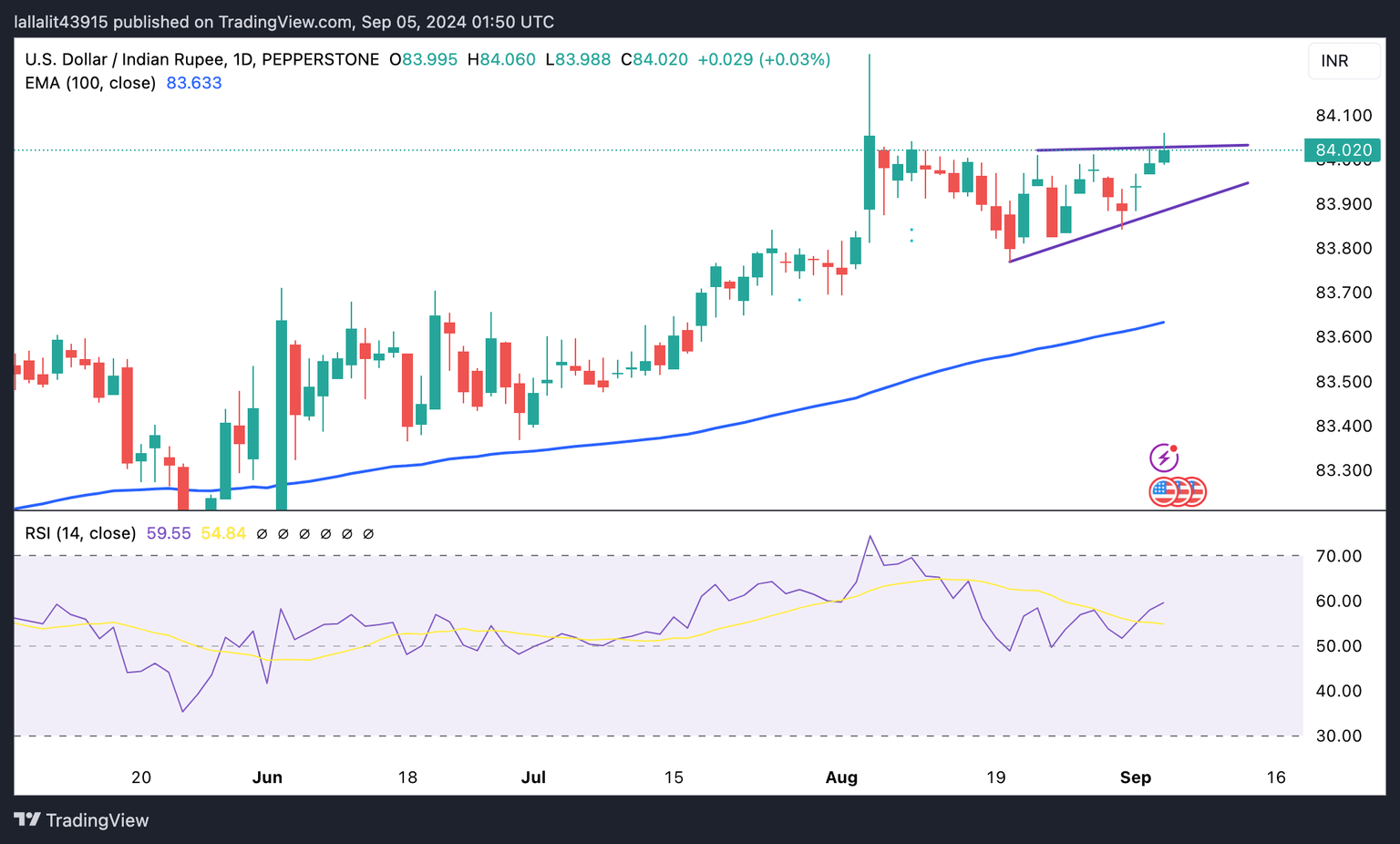

Technical Analysis: USD/INR’s outlook remains positive

A major resistance level emerges at the 84.00-84.05 region, portraying the 84.00 psychological figure, the upper boundary of the triangle and the high of September 4. Sustained trading above this level might set USD/INR up to 84.50.

On the downside, the ascending triangle support near 83.90 acts as an initial support level for the pair. A breach of the mentioned level could revisit the 100-day EMA at 83.63.

Indian economy FAQs

The Indian economy has averaged a growth rate of 6.13% between 2006 and 2023, which makes it one of the fastest growing in the world. India’s high growth has attracted a lot of foreign investment. This includes Foreign Direct Investment (FDI) into physical projects and Foreign Indirect Investment (FII) by foreign funds into Indian financial markets. The greater the level of investment, the higher the demand for the Rupee (INR). Fluctuations in Dollar-demand from Indian importers also impact INR.

India has to import a great deal of its Oil and gasoline so the price of Oil can have a direct impact on the Rupee. Oil is mostly traded in US Dollars (USD) on international markets so if the price of Oil rises, aggregate demand for USD increases and Indian importers have to sell more Rupees to meet that demand, which is depreciative for the Rupee.

Inflation has a complex effect on the Rupee. Ultimately it indicates an increase in money supply which reduces the Rupee’s overall value. Yet if it rises above the Reserve Bank of India’s (RBI) 4% target, the RBI will raise interest rates to bring it down by reducing credit. Higher interest rates, especially real rates (the difference between interest rates and inflation) strengthen the Rupee. They make India a more profitable place for international investors to park their money. A fall in inflation can be supportive of the Rupee. At the same time lower interest rates can have a depreciatory effect on the Rupee.

India has run a trade deficit for most of its recent history, indicating its imports outweigh its exports. Since the majority of international trade takes place in US Dollars, there are times – due to seasonal demand or order glut – where the high volume of imports leads to significant US Dollar- demand. During these periods the Rupee can weaken as it is heavily sold to meet the demand for Dollars. When markets experience increased volatility, the demand for US Dollars can also shoot up with a similarly negative effect on the Rupee.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.