USD/INR jumps on broad-based US Dollar demand ahead of New Year holiday

- The Indian Rupee trades in negative territory in Tuesday’s early European session.

- The weakening of Chinese Yuan, spike in USD bids, and slower pace of Fed rate cuts drag the INR lower.

- India’s November Federal Fiscal Deficit and Q3 Trade Deficit will be the highlights on Tuesday ahead of New Year holiday.

The Indian Rupee (INR) extends its downside on Tuesday after falling to its weakest closing level in the previous session. The local currency remains under selling pressure amid a decline in the offshore Chinese Yuan and broad-based US Dollar demand. Furthermore, the rising expectation of higher-for-longer US Federal Reserve (Fed) policy rates, tepid capital inflows, and tariff threats under incoming US President Donald Trump contribute to the INR’s downside.

However, the Reserve Bank of India's (RBI) intervention in NDF (non-deliverable forward) markets could prevent the INR from sharp depreciation. It’s likely to be a quiet trading session in a holiday-shortened and thin-trading-volume week. Traders brace for India’s Federal Fiscal Deficit for November and the Indian Trade Deficit for the third quarter (Q3), which are due later on Tuesday.

Indian Rupee remains vulnerable amid multiple challenges

- Analyst believe the RBI is unlikely to change its strategy of stepping into the currency market to ensure stability of the INR.

- “We believe the central bank's action would be driven by a situation and may intervene to curtail volatility. Since the last two years, the strategy of intervening has rewarded in making the rupee stable,” said Dilip Parmar, a foreign exchange research analyst at HDFC Securities.

- India's Current Account Deficit (CAD) is expected to remain at 1.1% of the Gross Domestic Product (GDP) in the financial year 2024-25 (FY25), according to a report by ICICI Bank.

- “The dollar-rupee pair is expected to remain in a range of 85.30-85.60 with dips to be bought," said Anil Bhansali, head of treasury at Finrex Treasury Advisors.

- Foreign portfolio investors have sold over $10 billion of local stocks and bonds over this quarter on a net basis, according to stock depository data.

- The US Pending Home Sales increased by 2.2% MoM in November versus 1.8% (revised from 2.0%) prior, according to the National Association of Realtors (NAR) on Monday. This reading came in better than the estimation of 0.7%.

- The Chicago Purchasing Managers' Index declined to 36.9 in December from 40.2 in the previous reading, weaker than the 42.5 expected.

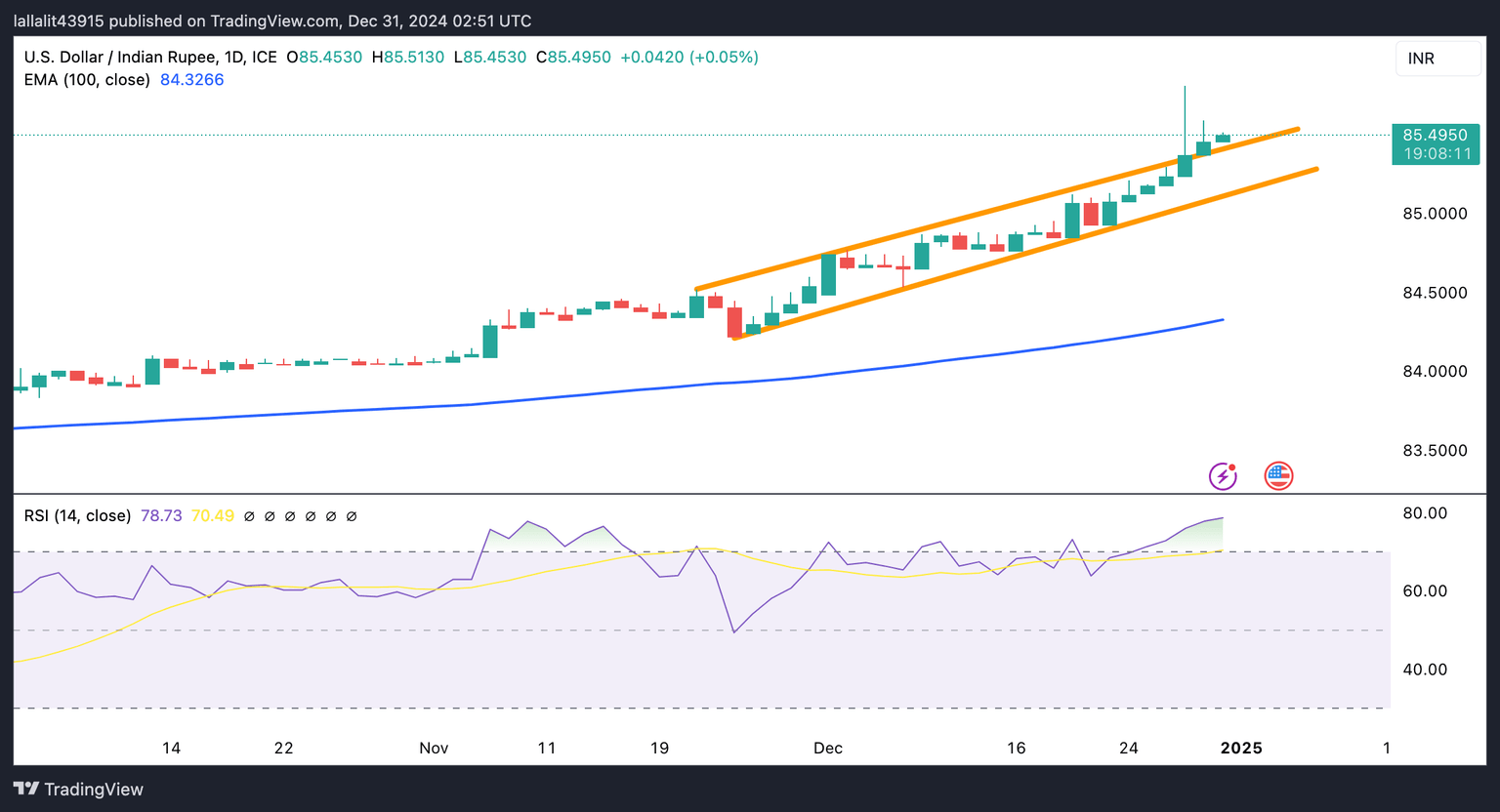

USD/INR maintains bullish bias in the longer term

However, the 14-day Relative Strength Index (RSI) is located near 76.10, indicating an overbought condition. This suggests that further consolidation cannot be ruled out before positioning for any near-term USD/INR appreciation.

The first upside barrier for the pair emerges at the all-time high of 85.81. If bulls manage to break decisively above the mentioned level, this could draw in potential buyers to the 86.00 psychological level.

On the bearish side, the resistance-turned-support level of 85.45 acts as a first downside target for USD/INR. Sustained trading below this level could expose 85.00, the round mark. The key contention level is seen at 84.32, the 100-day EMA.

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.