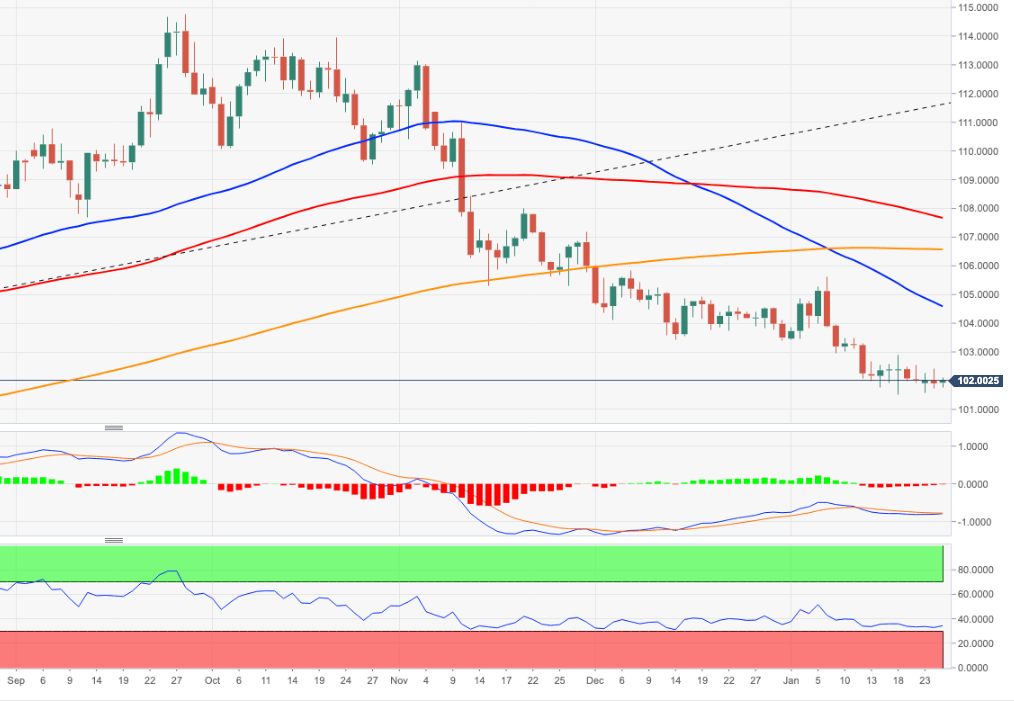

USD Index Price Analysis: Upside capped by 103.00 so far

- The index remains within a range bound theme around 102.00.

- Bullish attempts face immediate hurdle near the 103.00 mark.

DXY extends the side-lined mood for yet another day near the 102.00 zone on Wednesday.

Further range bound should not be ruled out for the time being. In case bears regain the upper hand, the index could then slip further back and revisit the so far 2023 low at 101.52 (January 18) ahead of the May 2022 low around 101.30 (May 30), all before the psychological 100.00 yardstick.

On the upside, the so far weekly high at 102.89 (January 18) is expected to offer initial resistance.

In the meantime, while below the 200-day SMA at 106.46 the outlook for the index should remain tilted to the negative side.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.