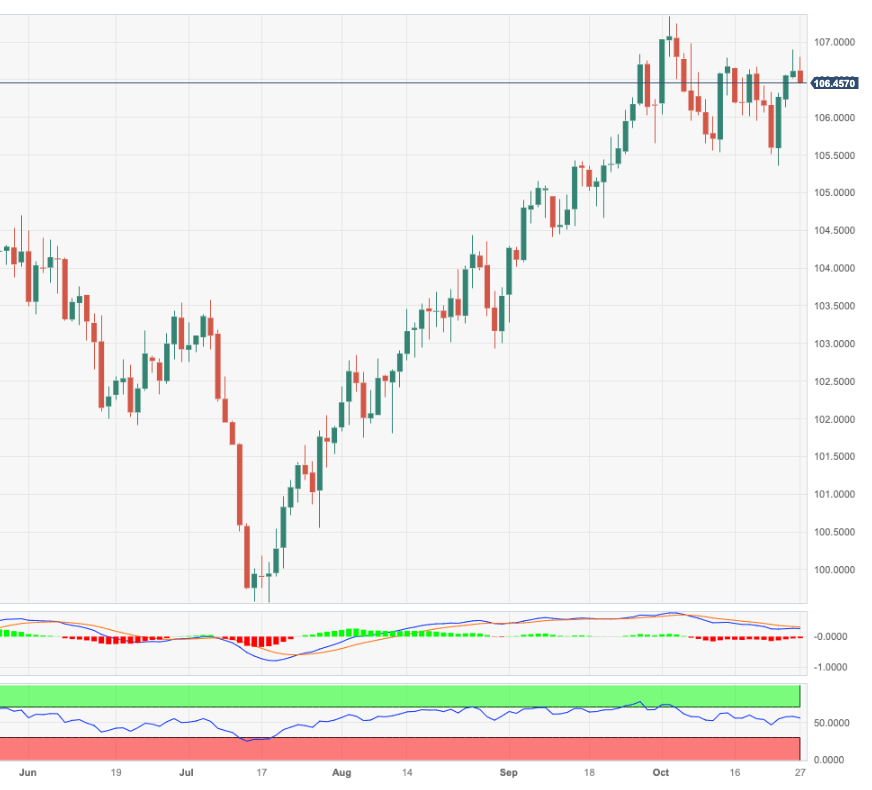

USD Index Price Analysis: There is an initial resistance around 107.00

- DXY now comes under some downside pressure near 106.50.

- Occasional bullish attempts should meet the next hurdle near 107.00.

DXY sees its recent upside momentum somewhat trimmed and revisits the mid-106.00s at the end of the week.

If the index breaks above the weekly top at 106.89 (October 26), it could then target the round level of 107.00 prior to the 2023 high of 107.34 (October 3).

So far, while above the key 200-day SMA, today at 103.39, the outlook for the index is expected to remain constructive.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.