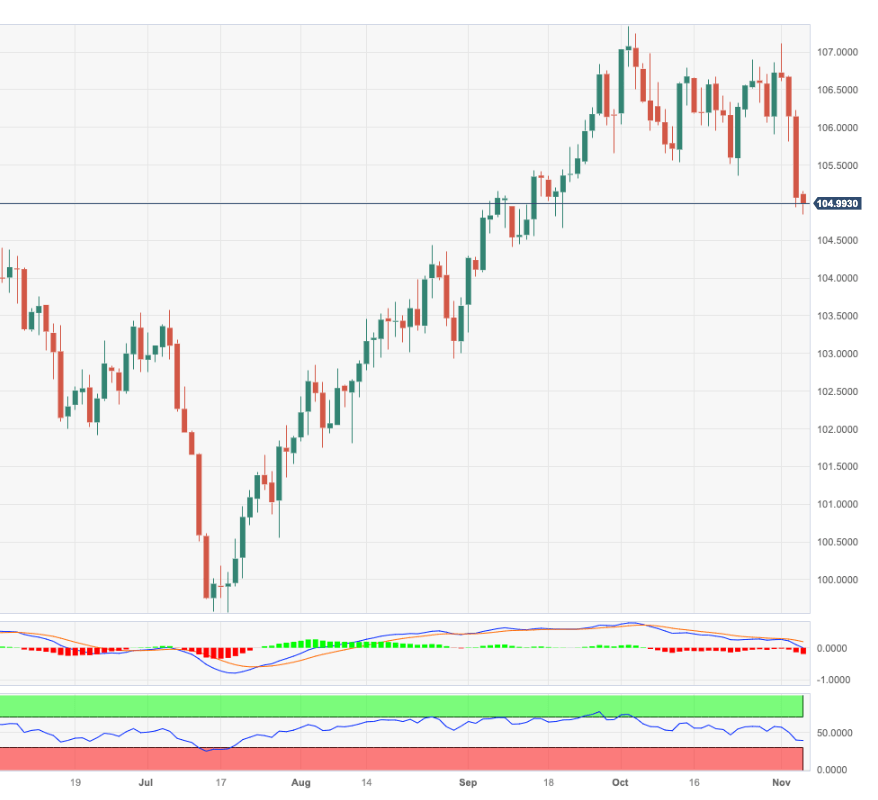

USD Index Price Analysis: Next support comes at 104.40

- DXY extends the leg lower to the area below 105.00.

- The immediate contention emerges near 104.40.

DXY accelerates its losses to new multi-week lows near 104.80 on Monday.

The continuation of the selling impulse appears likely in the very near term. That said, the next support is expected to turn up at the weekly low of 104.42 (September 11), ahead of the temporary 100-day SMA at 103.98.

So far, while above the key 200-day SMA, today at 103.51, the outlook for the index is expected to remain constructive.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.