USD Index Price Analysis: Lack of direction points to some side-lined trade

- DXY fades Tuesday’s uptick and returns to the sub-104.00 region

- Further choppiness seems probable in the near term .

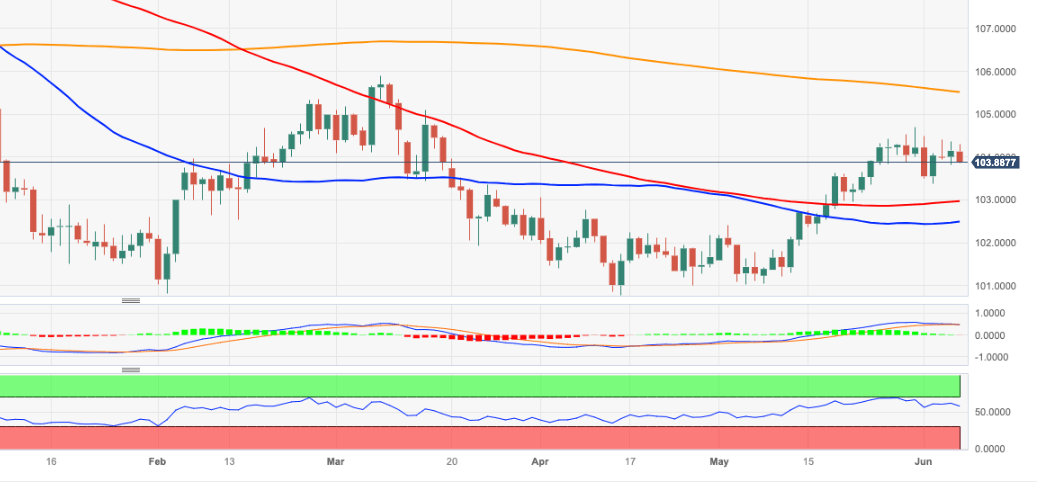

DXY leaves behind Tuesday’s decent gains and resumes the downside below the key 104.00 support on Wednesday.

Considering the ongoing price action, the index could now move into a consolidative phase in light of the current lack of strong catalysts. On the downside, the June low of 103.38 (June 2) emerges as the immediate contention, while the next up-barrier is seen at the May peak of 104.79 (May 31).

Looking at the broader picture, while below the 200-day SMA at 105.51 the outlook for the index is expected to remain negative.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.