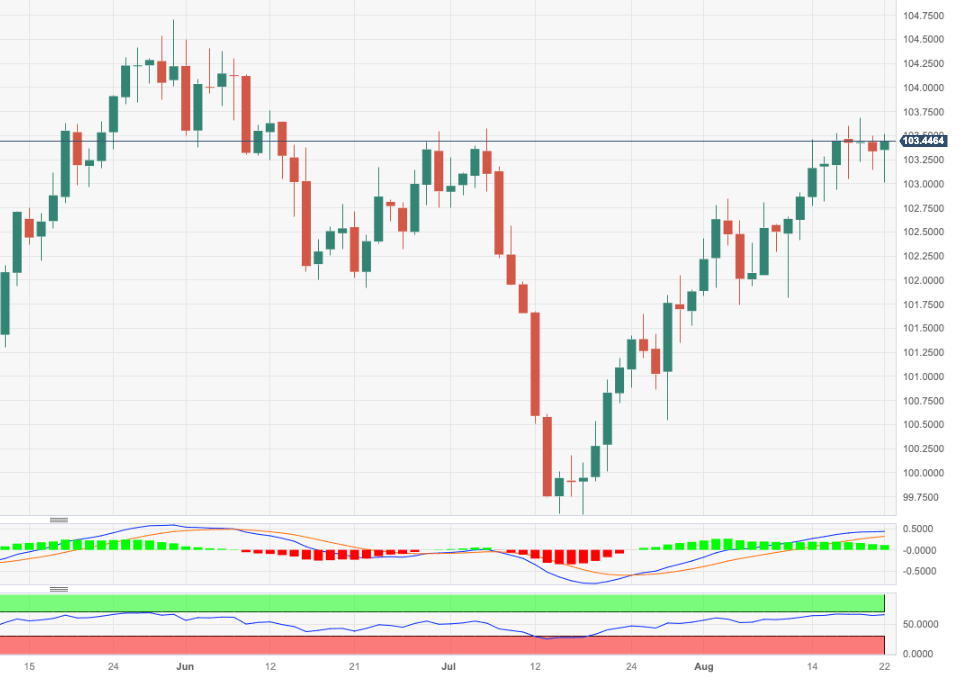

USD Index Price Analysis: Immediately to the upside comes 103.70

- DXY makes a U-turn and regains the 103.50 region.

- The next up barrier comes at the August high at 103.68.

DXY manages to regain composure and reverse three consecutive sessions of losses on Tuesday.

The index seems to be attempting a consolidative range following the recent multi-week rally. Against that, the resumption of the uptrend should retarget the August peak of 103.68 (August 18) ahead of the May top of 104.69 (May 31) and the 2023 peak of 105.88 (March 8).

It is worth noting that this area of monthly highs appears reinforced by the proximity of the key 200-day SMA, today at 103.16.

Looking at the broader picture, a convincing breakout of the 200-day SMA should shift the outlook for the index to a more constructive one.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.