USD Index Price Analysis: Further south comes 104.85

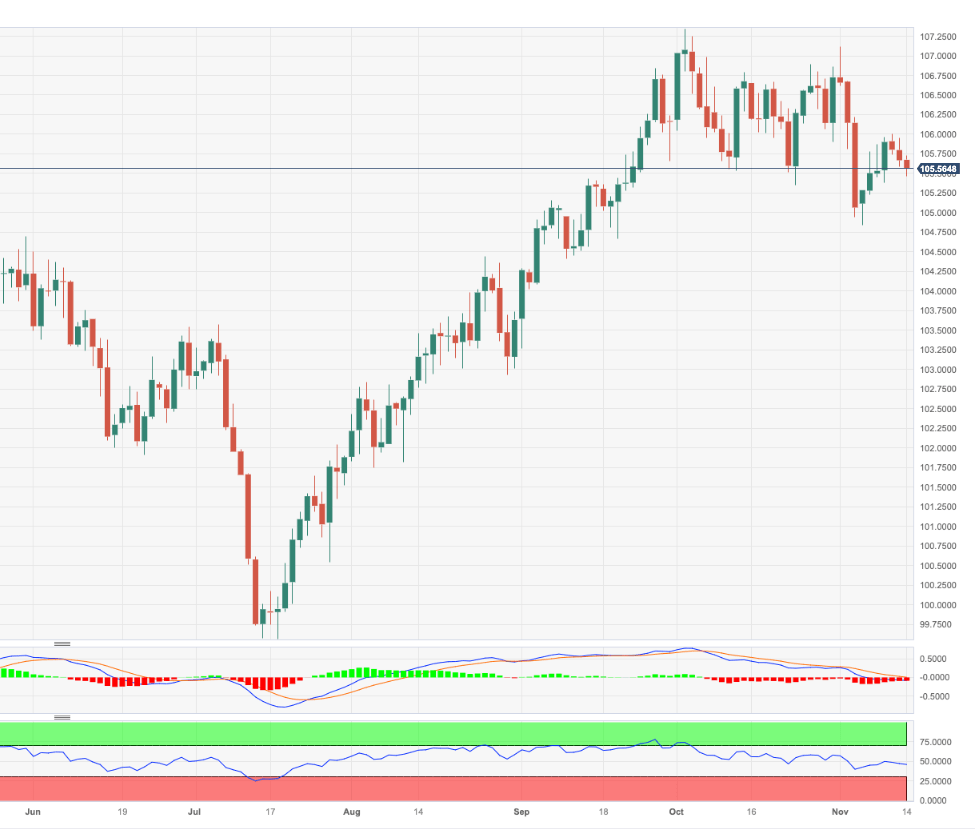

- DXY extends the corrective move to the 105.50 zone.

- The loss of 105.00 exposes a move to the 104.85 level.

DXY retreats for the third consecutive session and revisits the 105.50 zone on Tuesday.

Further decline appears on the cards in the very near term. Against that, the loss of the 105.00 support could put the so-far November low of 104.84 (November 6) to the test prior to the weekly low of 104.42 (September 11), which appears reinforced by the transitory 100-day SMA at 104.17.

In the meantime, while above the key 200-day SMA, today at 103.61, the outlook for the index is expected to remain constructive.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.