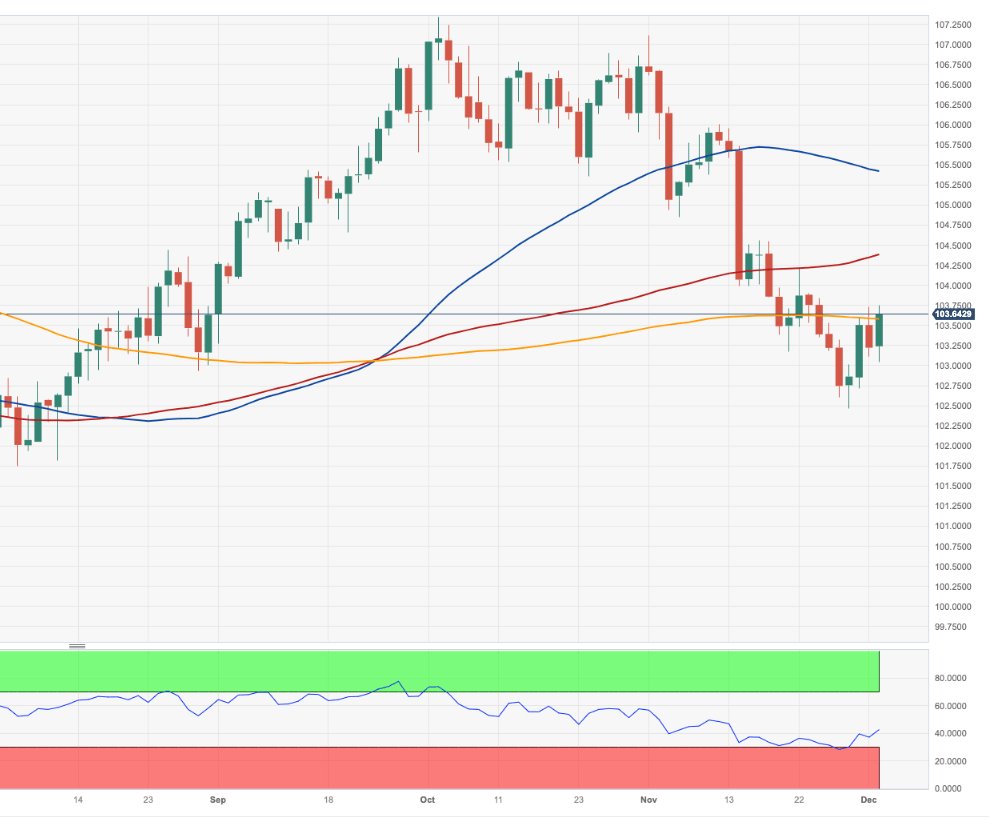

USD Index Price Analysis: Further gains likely above 103.57

- DXY resumes the upside and approaches 103.80.

- Extra upside looks likely once the 200-day SMA is cleared.

DXY regains the smile and advances to multi-day highs past 103.70 on Monday.

If the key 200-day SMA (103.57) is surpassed, the index is expected to face more sustained gains to, initially, the weekly top of 104.21 (November 22) ahead of the transitory 100-day SMA at 104.37.

In the meantime, above the key 200-day SMA, the outlook for the index is expected to shift to bullish.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.