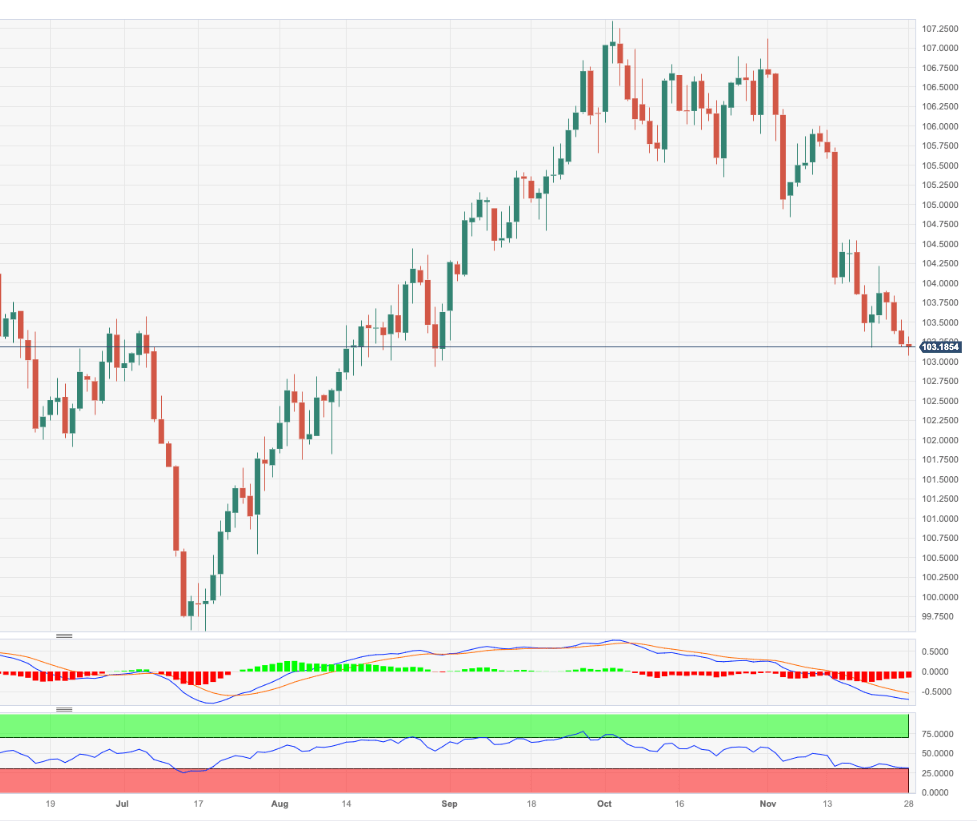

USD Index Price Analysis: Extra losses in the pipeline

- DXY keeps the negative performance in the low-103.00s.

- Next on the downside emerges the weekly low of 102.93.

DXY extends the leg lower for the fourth session in a row on turnaround Tuesday.

Further weakness in the index is expected to challenge the key support at 103.00 sooner rather than later. The loss of this region exposes the weekly low of 102.93 (August 30) ahead of another round level at 102.00.

In the meantime, while below the key 200-day SMA (103.60), the outlook for the index is expected to remain bearish.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.