- The index adds to Thursday’s gains north of 102.00.

- US markets will be closed on the Monday.

- Investors started to assess the potential Fed’s move in July.

The USD Index (DXY) tracks the greenback, which starts the week on the positive foot and revisits the 102.40 region, marking an increase for the second session in a row so far.

USD Index looks at risk trends, Fed

The index rises for the second session in a row and attempts to put further distance from last week’s multi-week lows around the 102.00 neighbourhood (June 16), as the recent upbeat mood in the risk complex appears to take a breather at the beginning of the week.

In the meantime, investors continue to expect a 25 bps rate hike by the Federal Reserve at the July 26 gathering following June’s hawkish skip, according to CME Group’s FedWatch Tool.

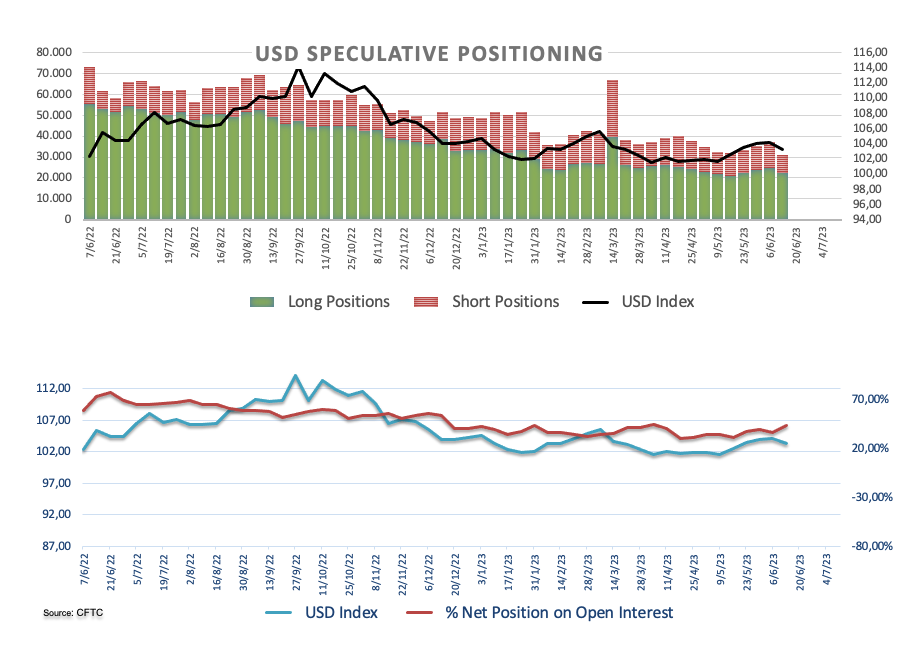

On another front, net longs in the greenback rose to the highest level since early April in the week ended on June 13, just ahead of the crucial FOMC event considering the latest CFTC report.

The only release of note in the US data space will be the NAHB Housing Market Index for the month of June amidst the inactivity in the domestic markets due to the Juneteenth holiday.

What to look for around USD

Despite a three-week negative streak, the index appears to have encountered significant contention around the 102.00 neighbourhood.

Meanwhile, the likelihood of another 25 bps hike at the Fed's upcoming meeting in July remains high, supported by the continued strength of key US fundamentals such as employment and prices.

This view was further bolstered by comments from Fed Chief Powell at the June FOMC event, who referred to the July meeting as "live" and indicated that most of the Committee is prepared to resume the tightening campaign as early as next month.

Key events in the US this week: NAHB Housing Market Index (Monday) – Building Permits, Housing Starts (Tuesday) – MBA Mortgage Applications. Fed’s Powell Testimony (Wednesday) – Chicago Fed National Activity Index, Initial Jobless Claims, Fed’s Powell Testimony, Existing Home Sales (Thursday) – Advanced Manufacturing/Services PMIs (Friday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in late 2023/early 2024. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is gaining 0.05% at 102.35 and the breakout of 103.04 (100-day SMA) would open the door to 104.69 (monthly high May 31) and then 105.25 (200-day SMA). On the downside, the next support emerges at 102.00 (monthly low June 16) followed by 100.78 (2023 low April 14) and finally 100.00 (round level).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold nears $3,400; fresh record highs and counting amid USD sell-off

Gold price closes in on $3,400 as the record rally regains strength on Easter Monday. Concerns over US-China trade war escalation and the Fed’s independence smash the US Dollar to three-year troughs. RSI stays overbought on the daily chart, with thin volumes likely to exaggerate moves in Gold price.

EUR/USD trades with sizeable gains above 1.1500, at over three-year highs

EUR/USD trades over 1% higher so far this Monday as the relentless selling interest in the US Dollar keeps it well above the 1.1500 threshold - the highest level since November 2021. Growing concerns over a US economic recession and the Federal Reserve’s autonomy continue to exert downward pressure on the USD.

GBP/USD stays strongly bid near 1.3400 on intense US Dollar weakness

GBP/USD continues its winning streak that began on April 8, trading close to 1.3400 in early Europe on Monday. The extended US Dollar weakness, amid US-Sino trade war-led recession fears and heightened threat to the Fed's independence, continue to underpin the pair. Thin trading is set to extend.

How to make sense of crypto recovery – Is it a buy or fakeout

Bitcoin (BTC), Ethereum (ETH) and XRP, the top three cryptocurrencies by market capitalization, extend their last week’s recovery on Monday, even as trader sentiment is hurt by the US President Donald Trump’s tariff policy and announcements.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.