- USD/CNH pulls back after China’s Caixin Manufacturing PMI surged to a five-month high.

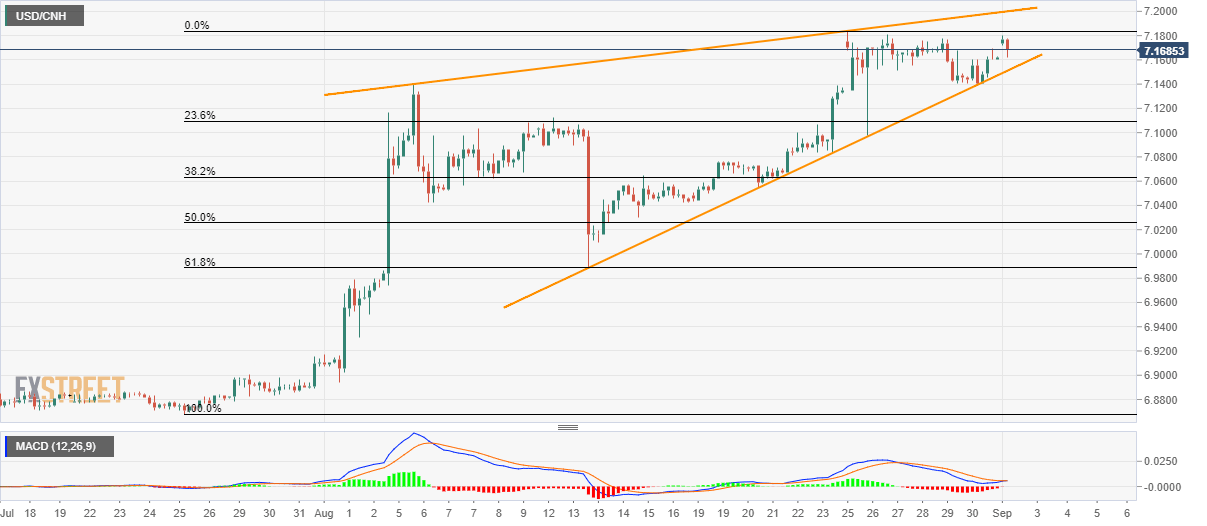

- A downside break of 7.1510 will confirm short-term bearish formation.

With China’s August month Caixin Manufacturing purchasing managers’ index (PMI) surging to a five-month high of 50.4, also beating 49.8 forecast, USD/CNH declines to 7.1685 amid initial Asian trading on Monday.

Sellers await entry on the break of three-week-old rising support-line, at 7.1510, in order to confirm the bearish formation indicating further downside to 7.0000 round-figure. However, 38.2% Fibonacci retracement level of late-July to August upswing, at 7.0632 may offer an intermediate halt during the downpour.

In a case where prices keep trailing 7.0632, 61.8% Fibonacci retracement of 6.9887 and 6.9150 can please bears.

On the upside, the latest high of 7.1838 and formation resistance close to 7.2000 will keep exerting downside pressure on prices.

USD/CNH 4-hour chart

Trend: pullback expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD challenges 1.0500 on Dollar's bounce

The US Dollar now picks up further pace and weighs on the risk-associated assets, sending EUR/USD to the boundaries of the key 1.0500 region and at shouting distance from its 2024 lows.

GBP/USD remains weak and puts 1.2600 to the test

GBP/USD remains on the back foot and now approaches the key support at 1.2600 the figure in response to the resurgence of the bid bias in the Greenback.

Gold extends gains beyond $2,660 amid rising geopolitical risks

Gold extends its bullish momentum further above $2,660 on Thursday. XAU/USD rises for the fourth straight day, sponsored by geopolitical risks stemming from the worsening Russia-Ukraine war. Markets await comments from Fed policymakers.

BTC hits an all-time high above $97,850, inches away from the $100K mark

Bitcoin hit a new all-time high of $97,852 on Thursday, and the technical outlook suggests a possible continuation of the rally to $100,000. BTC futures have surged past the $100,000 price mark on Deribit, and Lookonchain data shows whales are accumulating.

A new horizon: The economic outlook in a new leadership and policy era

The economic aftershocks of the COVID pandemic, which have dominated the economic landscape over the past few years, are steadily dissipating. These pandemic-induced economic effects are set to be largely supplanted by economic policy changes that are on the horizon in the United States.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.