USD/CNH Price Analysis: Yuan renews six-month low above 7.1100 on unimpressive China PMIs

- USD/CNH takes the bids to refresh multi-day high marked the previous day on mixed China data.

- China’s official PMIs came in softer-than-previous readings, Non-Manufacturing PMI appears less negative.

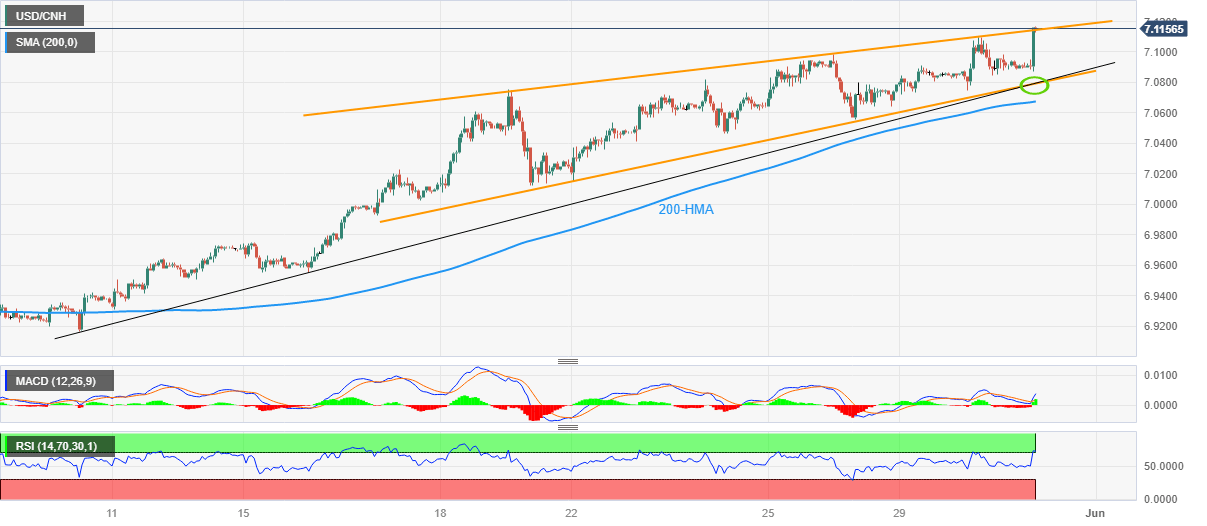

- One-week-old rising wedge, overbought RSI (14) prod offshore Chinese Yuan sellers.

USD/CNH prints 0.25% intraday gains as it prods the 7.1140 level while rising to the highest levels since November 2022 after almost downbeat China activity data for May published during early Wednesday. In doing so, the offshore Chinese Yuan (CNH) pair also justifies the US Dollar’s hesitance in declining further after witnessing a pullback from the previous day.

That said, China NBS Manufacturing PMI eases to 48.8 from 49.4 expected and 49.2 prior whereas Non-Manufacturing PMI rose past 50.7 market forecasts to 54.5 and 56.4 previous readings.

Also read: China's NBS Manufacturing PMI contracts further to 48.8 in May vs. 49.4 expected

Although the data allowed USD/CNH to refresh a multi-day top, a seven-day-old rising wedge bearish chart formation and the overbought RSI (14) line, challenges the Yuan sellers.

Hence, the stated wedge’s top line near 7.1140 appears the immediate key hurdle to cross for the USD/CNH bulls to keep the reins. Following that, October 2022 low surrounding 7.1660 may gain the market’s attention.

Alternatively, an upward-sloping trend line from May 10 increases the strength of the 7.0790 support, a break of which confirms the rising wedge bearish formation suggesting a theoretical target of around 6.9600.

However, the 200-HMA (Hourly Moving Average (HMA) level of around 7.0675 may act as intermediate halt whereas the monthly low of 6.8962 can lure the USD/CNH bears afterward.

USD/CNH: Hourly chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.