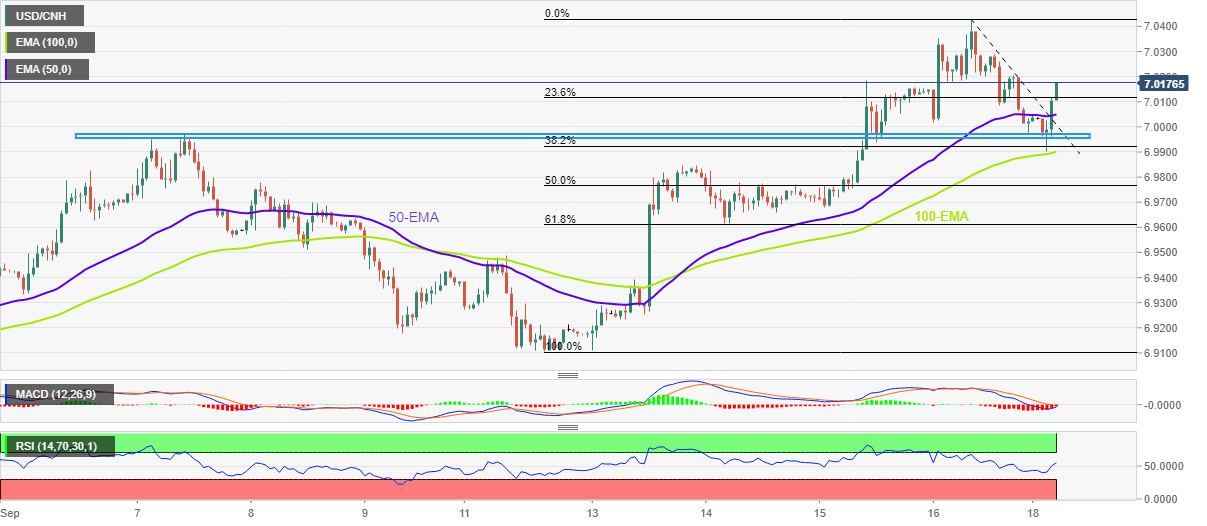

USD/CNH Price Analysis: Bulls cheer PBOC rate cut above 7.0000, bounces off 100-EMA

- USD/CNH picks up bids to refresh intraday high, crosses immediate resistance line, 50-EMA hurdle.

- PBOC cuts reverse repo rate by 10 bps to 2.15%.

- Sustained bounce off 100-EMA, one-week-old horizontal support keeps buyers hopeful.

- Sellers need validation from 61.8% Fibonacci retracement to retake control.

USD/CNH reverses the previous day’s pullback from the 26-month high while renewing the intraday top near 7.0120 during Monday’s Asian session. In doing so, the offshore Chinese yuan pair respects the People’s Bank of China’s (PBOC) rate cut to cross immediate hurdles amid a sluggish session.

That said, the Chinese central bank lowers the 14-day reverse repo rate by 10 basis points (bps) to 2.15%. “With no reverse repos maturing on Monday, China central bank injects 12 billion yuan on the day,” per Reuters.

Given the immediate break of the downward sloping resistance line from Friday, now support near the 7.0000 threshold, as well as the 50-EMA, the USD/CNH prices are likely to rush towards the recently flashed multi-day top near 7.0425.

It should, however, be noted that the tops marked during June 2020 near 7.0975 will precede the 7.1000 psychological magnet to restrict the pair’s further upside.

Meanwhile, a one-week-old horizontal area and the 100-EMA, respectively near 6.9960-50 and 6.9900, could restrict short-term declines of the USD/CNH pair.

Following that, the 61.8% Fibonacci retracement level of September 12-16 moves, near 6.9600, could challenge the bears before giving them control.

USD/CNH: Hourly chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.