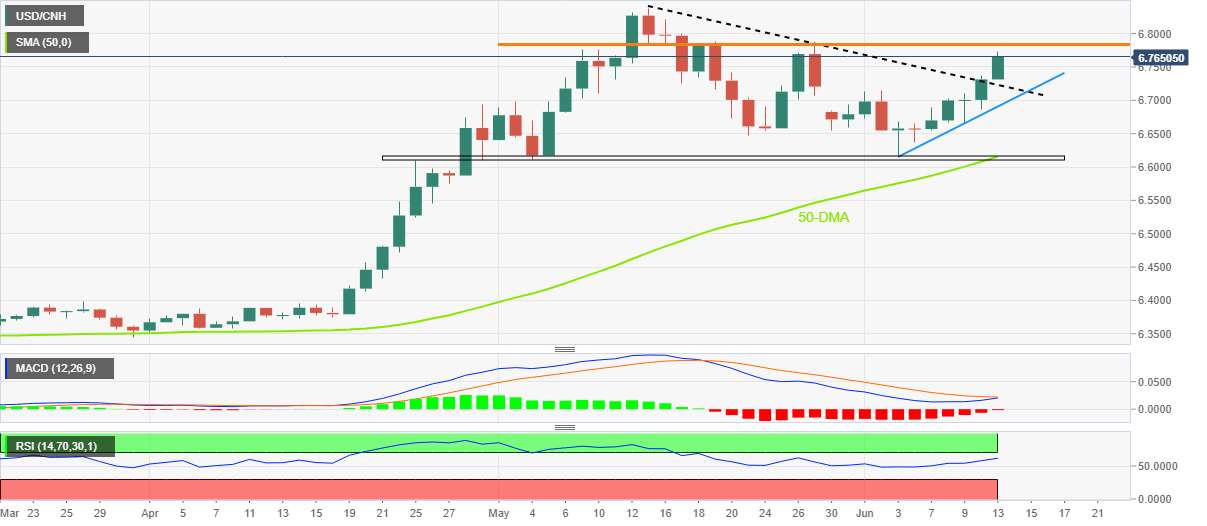

USD/CNH Price Analysis: Bulls cheer fresh monthly high with eyes on 6.7860

- USD/CNH extends one-week-old upward trajectory towards challenging late May’s swing high.

- Yearly top in focus as MACD teases bulls, RSI hints at further upside.

- Previous resistance line, weekly support trend line restrict short-term downside ahead of seven-week-old horizontal area.

USD/CNH remains on the front foot as it refreshes the monthly top around 6.7731, around 6.7635 by the press time of Monday’s Asian session.

In doing so, the offshore Chinese yuan (CNH) pair justifies Friday’s upside break of a one-month-old resistance line, now support around 6.7220.

Also keeping the USD/CNH bulls hopeful is the MACD lines suggesting a bull cross, as well as the firmer RSI (14).

That said, the quote stays on the way to the monthly horizontal resistance area surrounding 6.7840-60 before challenging the yearly top near 6.8384.

Should the USD/CNH prices refresh yearly top, the odds of witnessing a rally towards the 6.9000 psychological magnet can’t be ruled out.

Alternatively, pullback moves need to break the 6.7220 resistance-turned-support to recall the short-term sellers.

Following that, a weekly support line could probe the quote’s further downside around 6.6900.

It’s worth noting that a horizontal area comprising multiple lows marked since late April, surrounding 6.6100, appears a tough nut to crack for the USD/CNH bears afterward.

USD/CNH: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.