USD/CHF resumes uptrend amid mixed US data, steady Swiss CPI figures

- Mixed US Nonfarm Payrolls data initially fails to boost USD, but ISM Manufacturing PMI lifts sentiment.

- Swiss inflation exceeds estimates, but weak Retail Sales could deter SNB from tightening.

- The upcoming Federal Reserve meeting on September 14 could be a key event for the pair.

The Swiss Franc (CHF) losses traction against the American Dollar (USD) in the mid-New York session on Friday after a tranche of economic data from the United States (US) bolstered the USD. The USD/CHF dived towards a daily low of 0.8795 before resuming its latest three-day uptrend and exchanging hands at around 0.8850s, above its opening price by 0.28%.

Swiss Franc losses ground as improvement in US business activity and bond yields support the USD

The financial markets remain calm after a busy week in the US economic docket. August’s Nonfarm Payrolls figures came mixed, with the US economy adding 187K jobs, above estimates of 177K, which surprisingly failed to boos the Greenback, as the Unemployment rate rose by 3.8% YoY, above forecasts of 3.5%. The US Dollar weakness was because investors speculated the Fed would not tighten monetary conditions on September, while reducing bets the US central bank would do it by November.

However, USD/CHF sellers were caught off guard, as the ISM Manufacturing PMI improved to 47.6 from 46.4 in July and topped expectations of 47. Most of the subcomponents of the report strengthened, painting a more positive outlook for business activity in the US.

Another reason that underpinned the buck was US bond yields recovering some lost ground, which underpinned the US Dollar Index (DXY) back above the 104.000 figure, a tailwind for the USD/CHF pair.

In Switzerland, inflation rose by 1.6%, exceeded estimates of 1.5%, and was unchanged compared to July’s figures. Although the data reinforces the chances for additional tightening by the Swiss National Bank (SNB), a worse than expected Retail Sales report in July could deter the central bank from tightening monetary policy. Traders should be aware the SNB’s current interest rate sits at 1.75%, and chances for keeping them unchanged loom 70%.

Given the backdrop, the USD/CHF could resume its uptrend and test the 0.9000 figure, but the upcoming US Federal Reserve meeting on September 14 can shift the perspective ahead of the Fed’s decision.

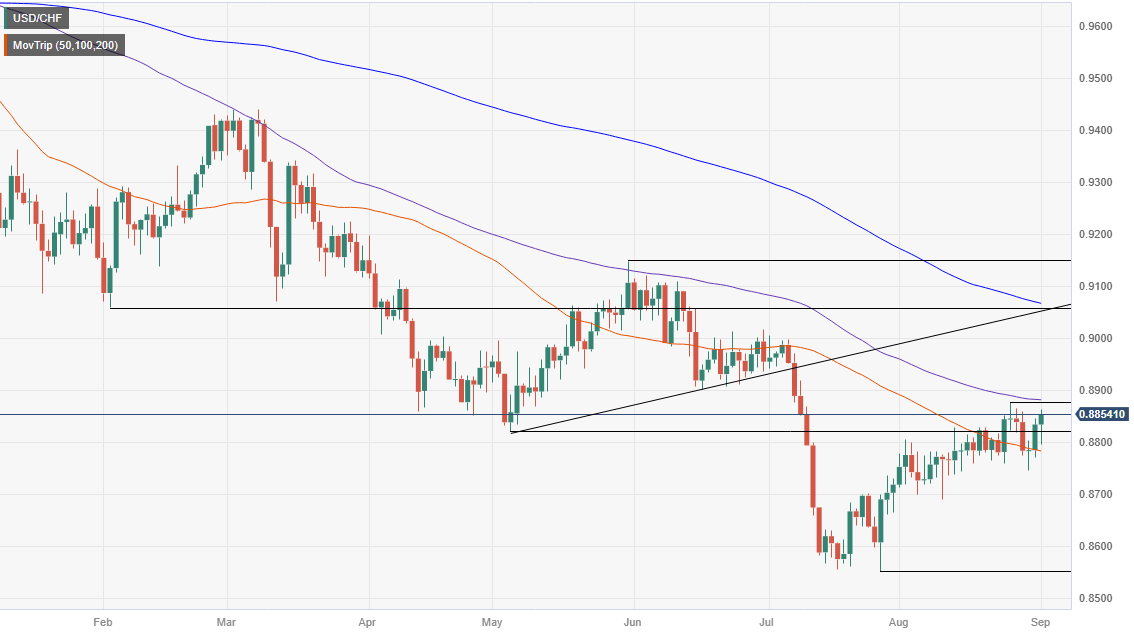

USD/CHF Price Analysis: Technical outlook

The USD/CHF daily chart portrays the pair as entering a consolidation phase, though tilted to the upside, once buyers reclaimed the 50-day Moving Average (DMA) at 0.8782. In addition, the major has crossed above a downslope resistance trendline drawn from March 2023 highs, a five-month-old relevant trendline, which, once broken, the pair would have a straightforward way to test 0.9000. A breach of the latter will expose the confluence of a previous support trendline turned resistance and the 200-DMA at around 0.9040/65 before buyers set their sights on the May 31 high of 0.9147. Contrarily, downside risks emerge below the current week’s low of 0.8744.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.