- Private hiring in February rose by 145K, lower than anticipated.

- ISM Non-Manufacturing PMI drops to 51.2, below expectations and the previous month’s reading.

- USD/CHF Price Analysis: Bullish continuation requires reclaiming 0.9100 resistance; otherwise, further losses lie below 0.9000.

USD/CHF hits a new YTD low at 0.9005 but rebounds as a risk-off impulse, seeing a flight to safety, as shown by US equities trading in the red. Growing concerns in the United States (USD) arose after the last tranche of US economic data increased the likelihood of a recession. At the time of writing, the USD/CHF is trading at 0.9070.

Wall Street fluctuates between gains and losses. US Treasury bond yields continued to drop as the bond market rallied, on investors seeking safe-haven assets. The USD/CHF fell to a multi-month low, though it recovered some ground after US data revealed elevated recession fears.

The ISM Non-Manufacturing PMI headed to 51.2, less than the expected 54.4, and fell short of the previous month’s reading of 55.1. Business activity deterioration, and a decline in new orders growth, were the reasons for the dip. Earlier, the ADP Employment Change report showed that private hiring in February rose by 145K, below the anticipated 200K, trailing January’s upwardly revised figure of 261K.

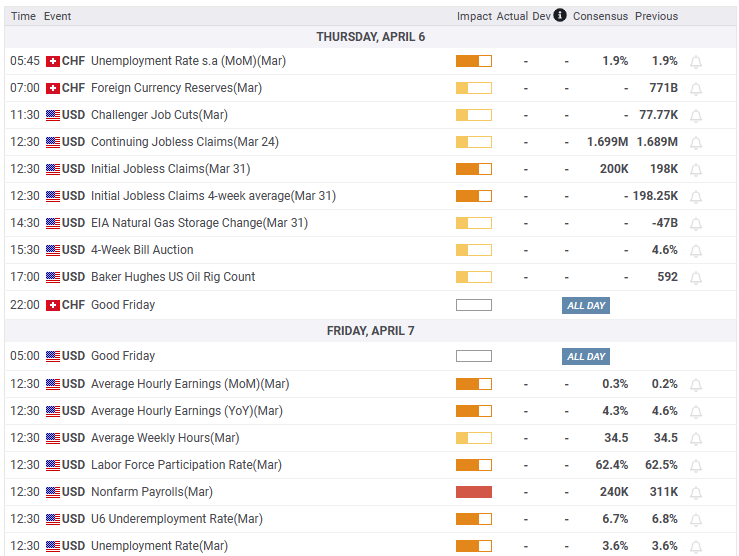

Given the backdrop that labor market indicators suggesting a downturn in unemployment claims could pave the way for a weak US Nonfarm Payrolls report. The consensus estimates that the US economy in March created 240K jobs, lower than February’s 311K.

USD/CHF Technical Analysis

The daily chart shows that the USD/CHF remains downward biased. Wednesday’s fall toward a multi-month low at around 0.9005 and a late recovery is forming a hammer, which, preceded by a downtrend, can exacerbate an upward correction. For a bullish continuation, the USD/CHF needs to reclaim 0.9100. Above that resistance, a previous support trendline turned resistance around 0.9170-0.9180, which would be the next supply zone, ahead of testing the 20-day EMA. Otherwise, the USD/CHF could extend its losses below 0.9000.

What to watch?

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

BoE keeps rates on hold as expected, Pound falls – LIVE

The Bank of England (BoE) maintained the bank rate at 4.75% following the December policy meeting, as expected. Three out of nine MPC voting members opted for a cut against expectations for just one. British Pound down on dovish hold.

EUR/USD retakes 1.0400 amid the post-Fed recovery

EUR/USD is recovering ground to near 1.0400 in the European session on Thursday. The pair corrects higher, reversing the hawkish Fed rate cut-led losses. Meanwhile, the US Dollar takes a breather ahead of US data releases.

Gold price recovers further from one-month low, climbs to $2,620 amid risk-off mood

Gold price attracts some haven flows in the wake of the post-FOMC sell-off in the equity markets. The Fed’s hawkish outlook lifts the US bond yields to a multi-month high and might the XAU/USD. Traders now look to the US Q3 GDP print for some impetus ahead of the US PCE data on Friday.

Aave Price Forecast: Poised for double-digit correction as holders book profit

Aave (AAVE) price hovers around $343 on Thursday after correcting more than 6% this week. The recent downturn has led to $5.13 million in total liquidations, 84% of which were from long positions.

Fed-ECB: 2025, the great decoupling?

The year 2024 was marked by further progress in disinflation in both the United States and the Eurozone, sufficient to pave the way for rate cuts. The Fed and the ECB did not quite follow the same timetable and tempo, but by the end of the year, the cumulative size of their rate cuts is the same: 100 basis points.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.