USD/CHF rallying as Greenback heads for 0.9050 on the Franc

- The USD/CHF is catching some bids to reclaim the 0.9000 handle.

- Hawkish statements from Powell are helping to bid the US Dollar late Thursday.

- Friday set to close out the trading week with US consumer sentiment reading.

The USD/CHF is marching itself back over the 0.9000 handle in Thursday's trading as the US Dollar (USD) grinds higher on a relatively quiet trading day. Market sentiment is drawing taught as investors react to headlines as they roll out.

US Federal Reserve (Fed) Chairman Jerome Powell made some surprisingly hawkish comments while participating in a panel discussion at the Jacques Polak Annual Research Conference, in Washington DC.

Fed Chair Powell focused on the risk of factors that could spark inflation again, with labor markets remaining tight and GDP growth moderating, albeit slowly.

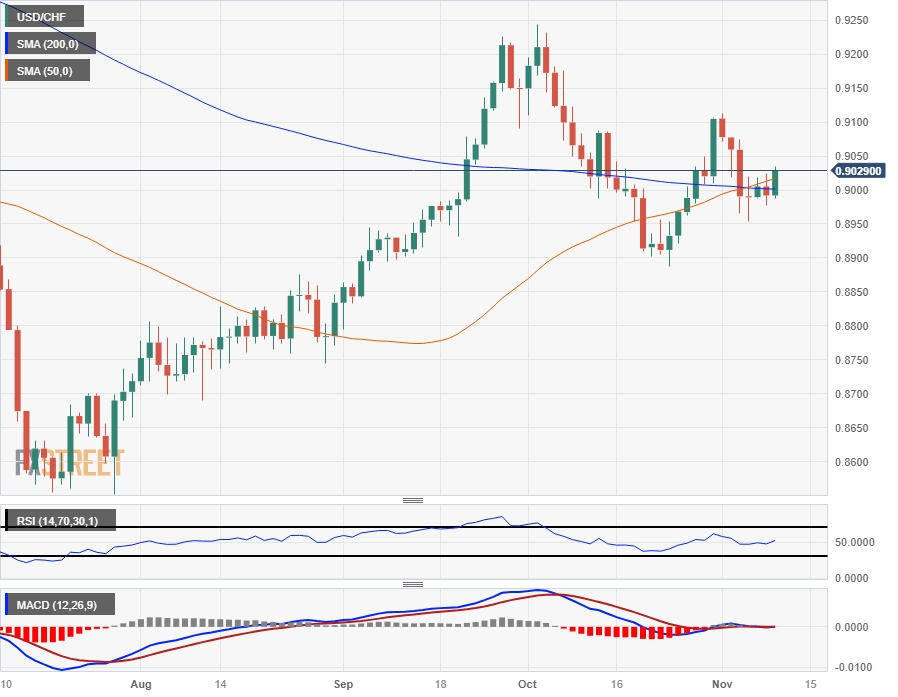

USD/CHF Technical Outlook

The US Dollar's intraday spike on Thursday has sent the USD/CHF back over the 200-hour Simple Moving Average (SMA) as the pair rotates out of a near-term bearish stance. The immediate target for bullish momentum will be the 0.9100 handle, a price level the pair lost after declining from November's early bids.

The USD/CHF has reached its highest bids on the week, stepping closer to 0.9050. The pair's recovery from October's swing low into 0.8900 is seeing momentum recover to the bullish side, and the 50-day SMA is confirming a bullish cross of the longer 200-day SMA.

Monday's sharp decline into the 0.8950 region could see the USD/CHF etch in a higher low is upside momentum maintains through the remainder of the trading week.

USD/CHF Daily Chart

USD/CHF Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.