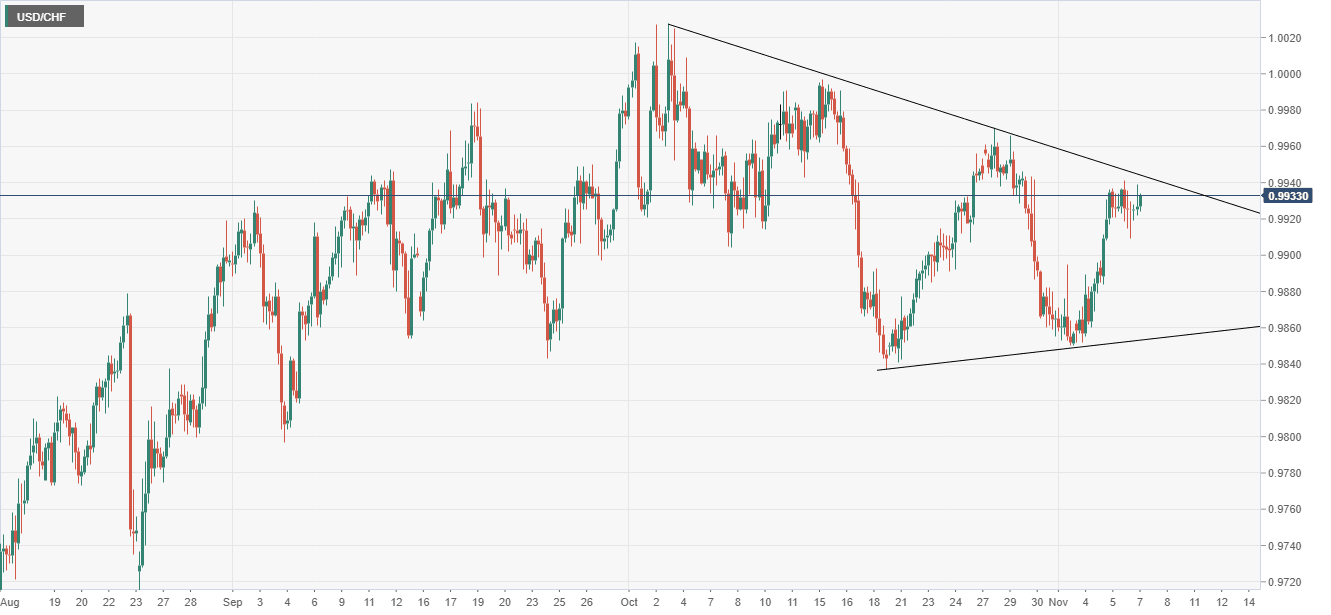

USD/CHF pushes higher and now the technical pattern top is in focus

- USD/CHF is trading higher this morning after a risk-on move.

- It has been reported that China and the US may remove tariffs.

On the 4-hour chart below USD/CHF looks like it may be set to test the top of the triangle pattern that has been forming since October,

The move today came after reports that China and US agree to phased rollback of extra trade war tariffs.

The indices are all trading higher after a move away from safe-haven assets was noted. Gold, JPY and CHF all suffered, while the DAX and the FTSE 100 rallied.

Any break of this pattern would be seen as risk positive but there are still a few things to contend with later in the session. We are due to hear from Fed's Bostic and Kaplan and we will also get the latest initial jobless claims data later in the session.

Author

Rajan Dhall, MSTA

FX Daily

Rajan Dhall is an experienced market analyst, who has been trading professionally since 2007 managing various funds producing exceptional returns.