USD/CHF Price Prediction: Extends uptrend towards 100-day SMA

- USD/CHF is closing in on the key 100-day SMA, where it will probably encounter resistance.

- The pair is in an established short and medium-term uptrend and the odds favor more upside to come.

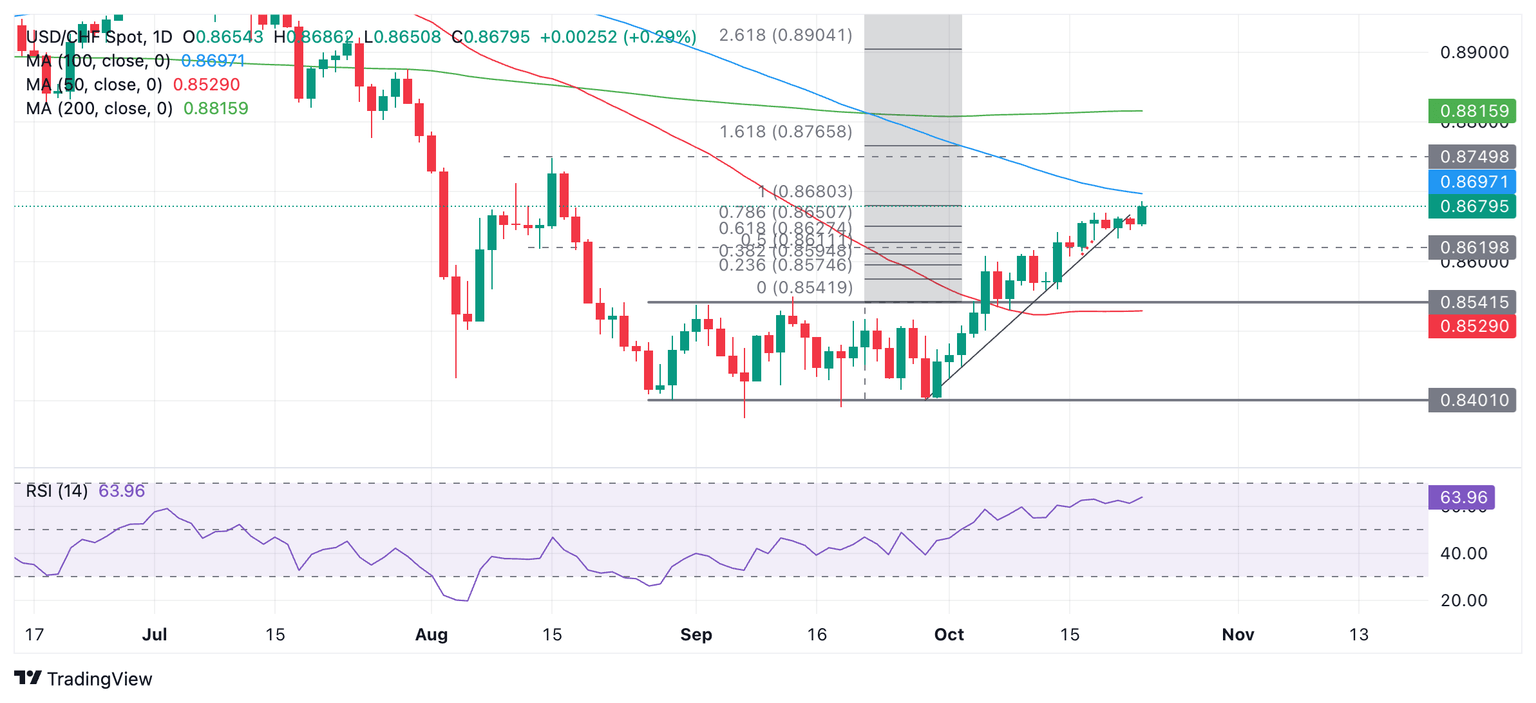

USD/CHF extends its uptrend from the late September lows and approaches resistance at the 100-day Simple Moving Average (SMA), currently situated at 0.8697.

USD/CHF Daily Chart

USD/CHF has now reached the target generated after it broke out of its September range, at 0.8680 – the 100% Fibonacci (Fib) extrapolation of the height of the range higher. This could signify that bullish pressure will lessen.

A break above the 100-day SMA and the 0.8700 level could lead to a further extension to the 0.8750 resistance level (August 15 high).

USD/CHF’s short and medium-term trends are bullish but its longer-term trend is probably still bearish despite the recent strong recovery.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.