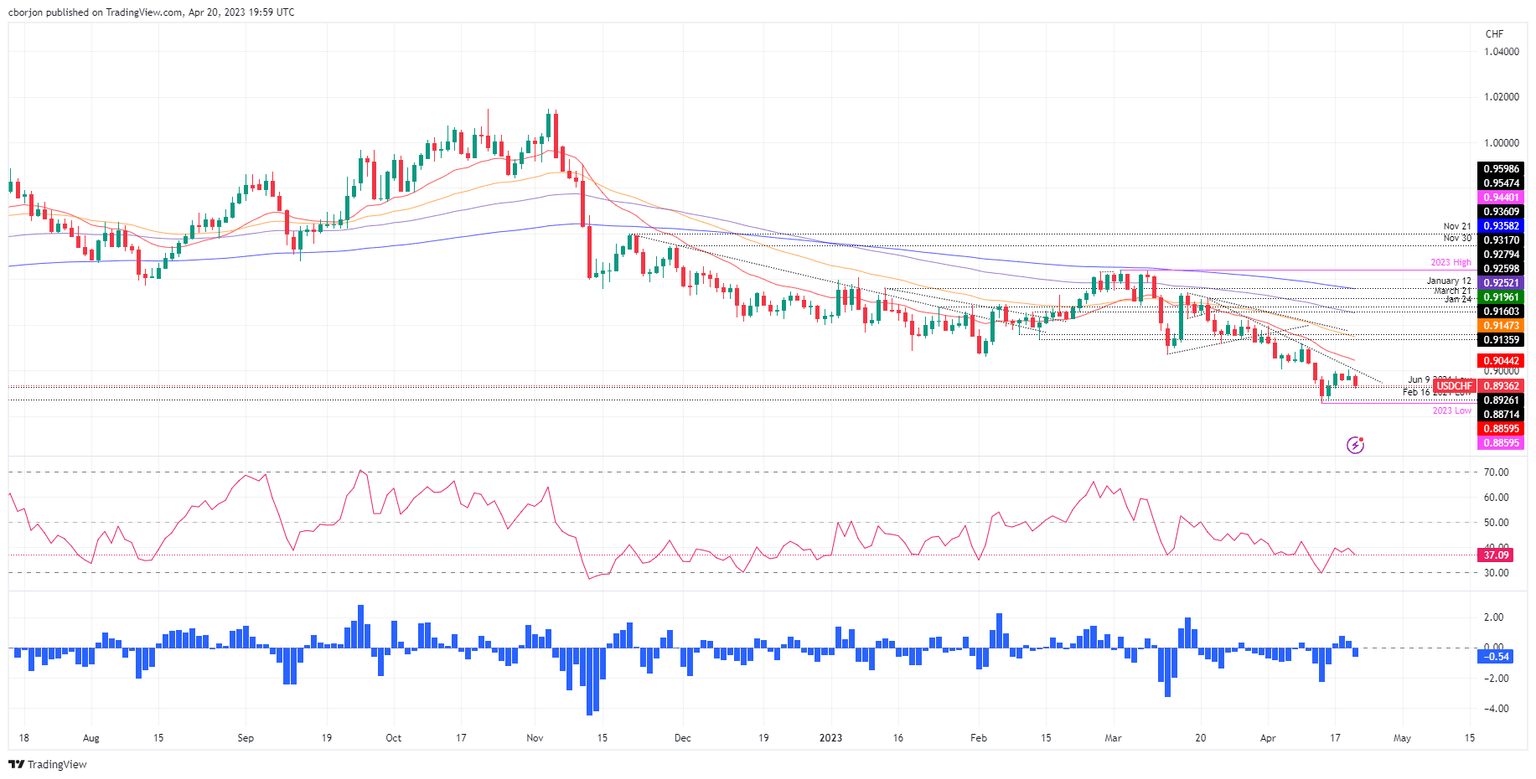

USD/CHF Price Analysis: Takes a bearish turn as sellers move in around 0.9000

- USD/CHF prepares to resume its bearish biased, confirmed by oscillators and sellers stepping in at around 0.9000.

- If USD/CHF sellers reclaim 0.8900, look for a test of the YTD low at 0.8859.

- Upside risks lie above 0.9000, with buyers eyeing the 20-day EMA.

USD/CHF reversed its course after hitting a weekly high of 0.9003 and fell, as the sellers remain committed to defending the 0.9000 figure. After consolidating for back-to-back days in the 0.8950-0.9000 range, the USD/CHF exchanges hands at 0.8933, down 0.45%.

USD/CHF Price Action

The USD/CHF posted two positive days and remained in the front foot during the week before turning negative. Sellers are gathering momentum, as shown by the Relative Strength Index (RSI), which is stills in bearish territory. In addition, the Rate of Change (RoC) also turned bearish, suggesting that the USD/CHF pair could resume its downward bias.

If USD/CHF continues lower, the next support would be the April 14 daily low at 0.8866. Once broken, up next would be the YTD low at 0.8859, followed by the 0.8800 figure.

On the other hand, the USD/CHF first resistance would be the confluence of a one-month-old downslope trendline around 0.8990, followed by the 0.9000 figure. A breach of the latter, the USD/CHF can rally towards the 20-day Exponential Moving Average (EMA) at 0.9044 before aiming towards April 10 daily high at 0.9120.

USD/CHF Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.