USD/CHF Price Analysis: Snaps three days of losses but struggles around 0.9300

- The USD/CHF erases earlier losses but faces solid resistance, which could push the pair lower.

- The market sentiment shifted to a risk-off on an attack of a Saudi Aramco oil facility in Jeddah.

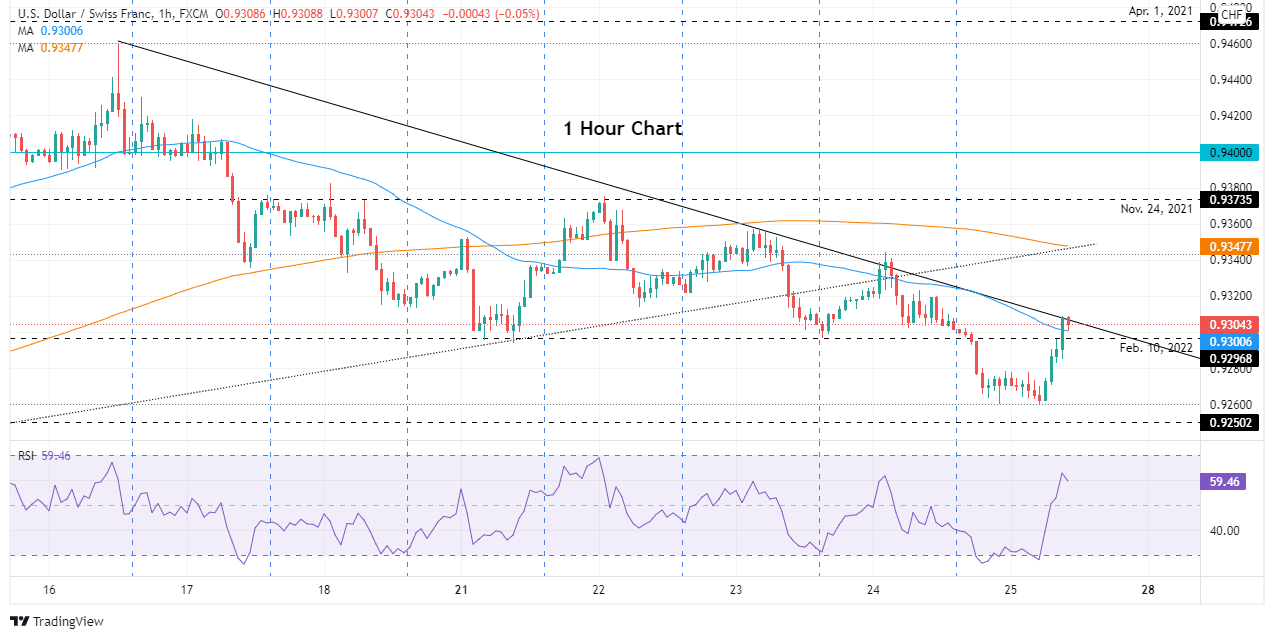

- USD/CHF Price Forecast: The USD/CHF is upward biased per the daily chart, but the pair is bearish in the near term, as shown by the 1-hour chart.

The USD/CHF snaps four days of losses and jumped off the day’s lows, around 0.9260, amid a mixed market mood and expectations of 50-bps increases by the US central bank on its May monetary policy meeting. At the time of writing, the USD/CHF is trading at 0.9304.

A risk-off market mood keeps US equity indices pressured while European bourses fluctuate. The greenback erases earlier losses, up 0.04%, sitting at 98.819, while US Treasury yields skyrocket, with the 10-year up 14 basis points at 2.489%, but short of daily highs around 2.503%.

The market mood dampened on reports that a Saudi Aramco oil facility located in Jeddah, Saudi Arabia, was hit by a missile launched by Yemen’s rebel Houthi militia on Friday, reports on social media suggested.

Read more: Saudi Aramco oil facility in Jeddah hit by Yemeni Houthi rebel missile

Overnight, the USD/CHF dropped from 0.9300ish towards 0.9260, the top of an eleven-month-old downslope trendline, previous resistance-turned-support, and jumped off as the North American session evolves, amid a softer demand for the greenback.

USD/CHF Price Forecast: Technical outlook

The USD/CHF daily chart depicts the pair as upward biased, despite breaking below the 0.9373 mark, though it would be resistance ahead of the YTD high around 0.9460.

However, the 1-hour chart depicts the USD/CHF as bearish biased in the near term. The USD/CHF is probing a downslope trendline drawn from March 16 highs, unsuccessfully tested two previous times. If the trendline holds, the USD/CHF first support level would be 0.9300. Breach of the latter would expose Friday’s daily low at 0.9260, followed by March 9 low at 0.9250.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.