USD/CHF Price Analysis: Rising in a channel

- USD/CHF is trending higher within a rising channel.

- The trend is expected to continue to the next set of targets.

- A break below the lower channel line would be required to signal a reversal.

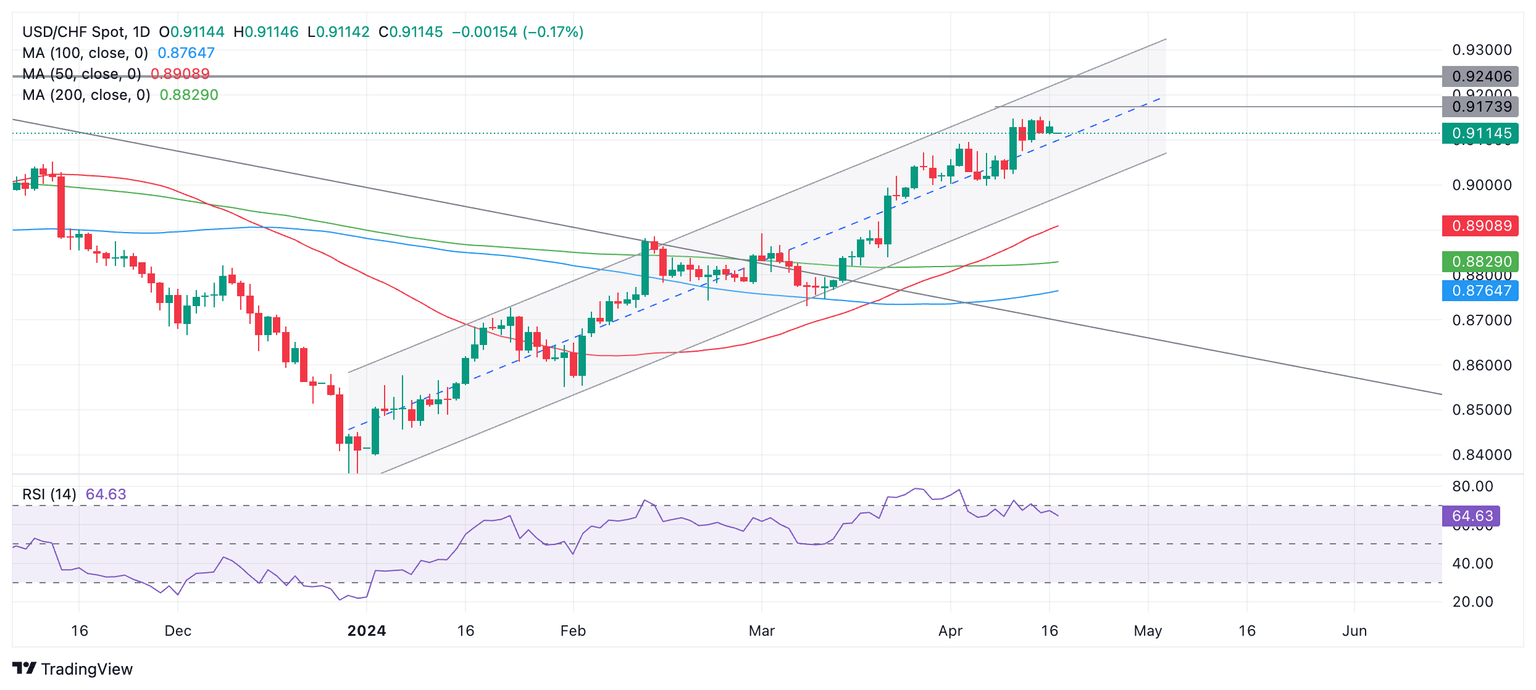

USD/CHF is rallying in an ascending channel on the daily chart. It is in a short and medium-term uptrend which is expected to continue higher given the old adage that the “trend is your friend.”

USD/CHF Daily Chart

USD/CHF has been consolidating over the past few days in the lower 0.9100s but it will probably eventually break higher in accordance with the dominant uptrend. A break above the 0.9152 April highs would confirm more upside.

The next target to the upside comes in at around 0.9173 where some major moving averages converge on higher time-frame charts.

Following that, the next upside target would be located at 0.9240 the level of previous major swing highs made in October 2023.

The Relative Strength Index (RSI) is not overbought any longer, suggesting scope for further upside.

A decisive break below the lower boundary of the channel, currently at roughly 0.9020, would reverse the outlook and bring into question the direction of the intermediate trend.

A decisive break would be one characterized by a breach with a longer-than-average red candlestick or three consecutive red candlesticks.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.