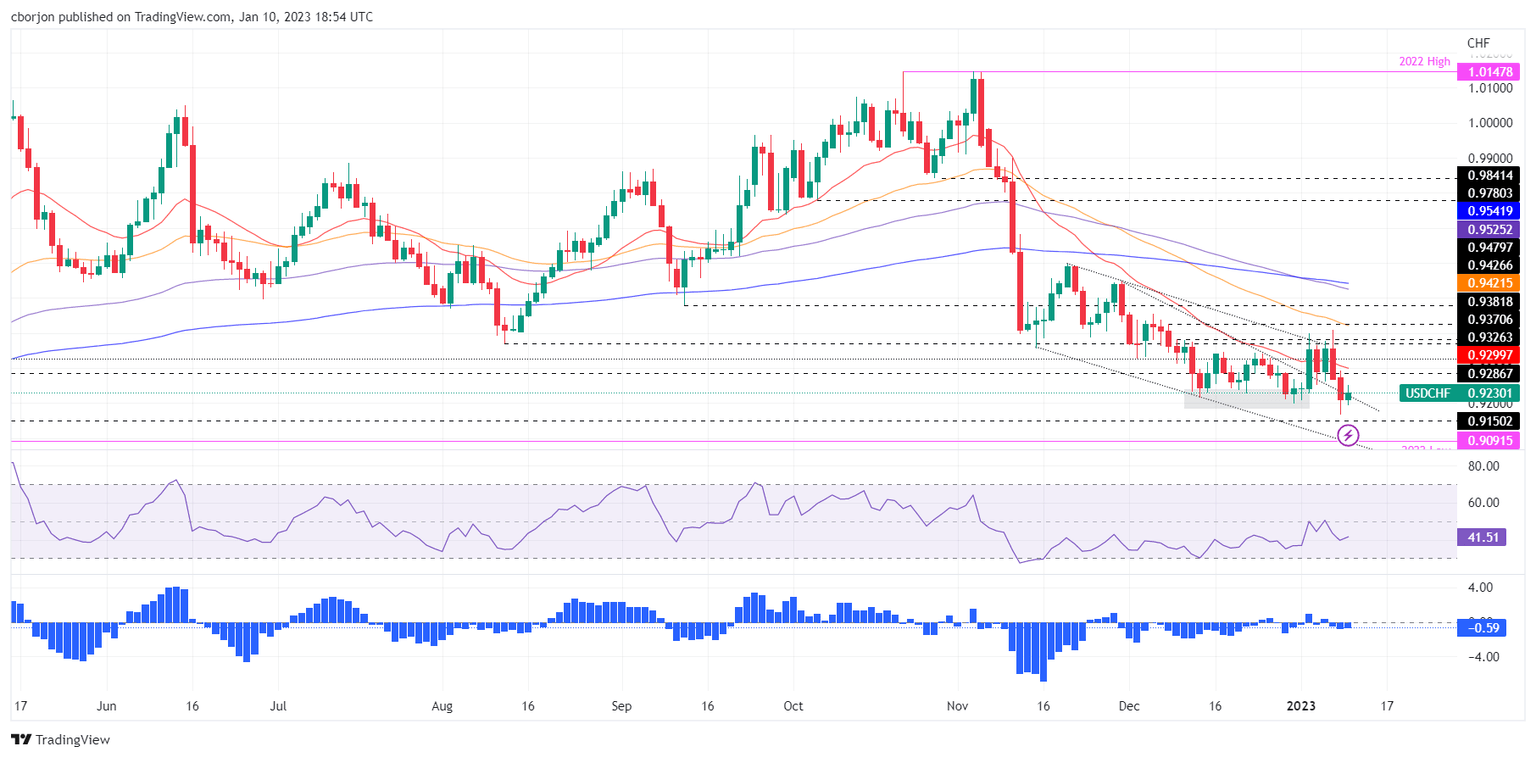

USD/CHF Price Analysis: Rises back above 0.9200 as bullish harami emerges

- USD/CHF rebounds around 0.9170s as buyers stepped in, lifting the pair nearby 0.9200.

- For the USD/CHF to extend its losses, it needs a daily close below 0.9200.

- Otherwise, a bullish harami candlestick pattern could exacerbate a USD/CHF rally toward 0.9300.

USD/CHF is trimming Monday’s losses and bounces from daily lows, as sellers failed to gain traction beneath the 0.9200 figure, achieving a daily low of 0.9194 before giving way to buyers. Therefore, the USD/CHF is forming a bullish harami candlestick pattern, pending confirmation. Therefore, the USD/CHF is trading at 0.9234, gaining 0.25%.

USD/CHF Price Analysis: Technical outlook

After failing to extend its losses below 0.9167, the USD/CHF stages a comeback. Formation of a bullish harami could open the door for further upside, though it needs to be confirmed once the USD/CHF reclaims 0.9292. If that scenario is achieved, then the USD/CHF next resistance would be the 20-day Exponential Moving Average (EMA), which tracks bullish/bearishness price action in the pair, at 0.9299. followed by the last week’s high of 0.9409.

However, the Relative Strength Index (RSI) remains at bearish territory, though aiming up, keeping buyer hopeful of higher prices.

As an alternate scenario, the USD/CHF key support levels would be the 0.9200 figure, followed by the January 9 daily low of 0.9167, ahead of the 0.9100 mark.

USD/CHF Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.