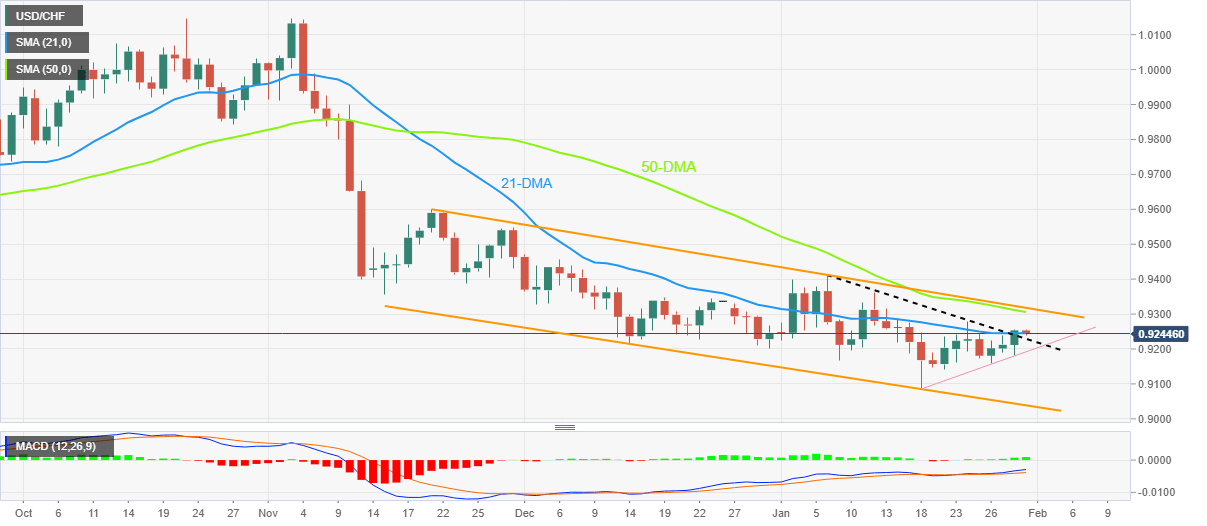

USD/CHF Price Analysis: Retreats towards resistance-turned-support above 0.9200

- USD/CHF takes offers to refresh intraday low, snaps three-day uptrend.

- Bullish MACD signals, key trend line breakout keeps buyers hopeful.

- Two-month-old bearish channel, 50-DMA challenges upside bias below 0.9320.

USD/CHF bulls struggle to keep the reins after a three-day uptrend as the Swiss currency pair drops to 0.9240 while flashing the first daily loss in four during early Tuesday. In doing so, the quote retreats toward the previous resistance line from January 06.

However, the bullish MACD signals and the pair’s trading beyond the resistance-turned-support, around 0.9225 by the press time, keeps the USD/CHF buyers hopeful.

Even if the pair drops back below the previous resistance line, a two-week-old ascending support line near 0.9190 could challenge the USD/CHF bears.

In a case where the quote remains bearish past 0.9190, the monthly low and lower line of the two-month-long bearish channel, respectively near 0.9085 and 0.9040, will be in focus.

On the contrary, a convergence of the 50-DMA and the stated bearish channel’s top line highlights the 0.9320 as a tough nut to crack for the USD/CHF bulls.

Following that, a run-up towards refreshing the monthly high, currently around 0.9410 becomes imminent before challenging the late November 2022 swing high close to the 0.9600 round figure.

It’s worth observing that the 0.9500 round figure may act as an intermediate halt during the quote’s rally between 0.9410 and 0.9600.

USD/CHF: Daily chart

Trend: Recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.