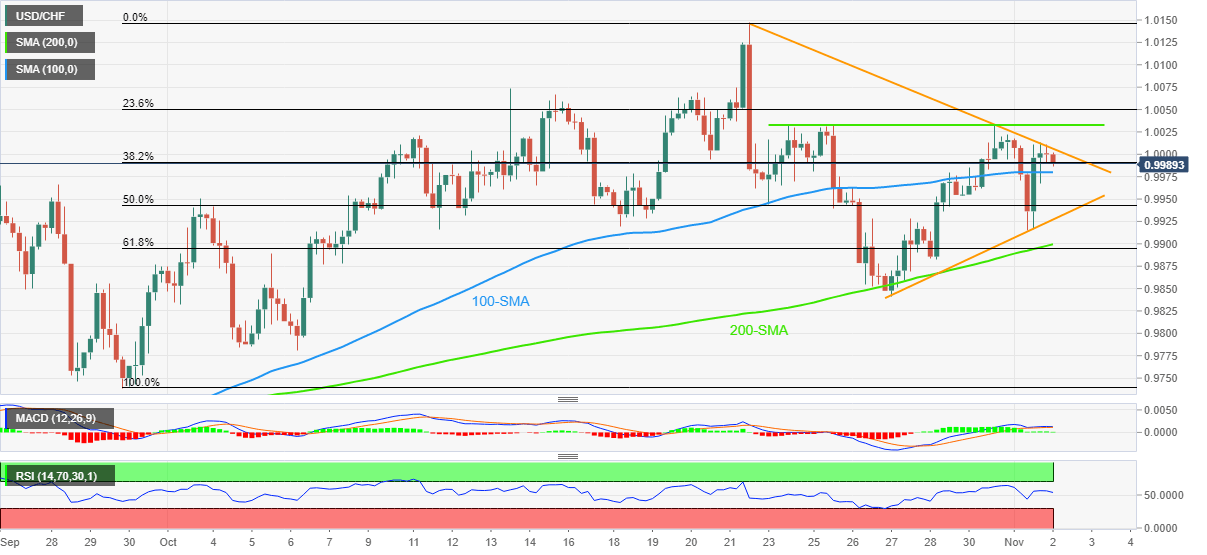

USD/CHF Price Analysis: Retreats towards 100-SMA near 0.9980

- USD/CHF takes offers to extend the previous day’s pullback from a one-week-old resistance line.

- Impending bear cross on MACD, sluggish RSI suggests further downside.

- 200-SMA appears a tough nut to crack for bears, upside moves need validation from 1.0035.

USD/CHF drops for the second consecutive day after reversing from an eight-day-old resistance line, refreshing intraday low near 0.9990 during Wednesday’s Asian session.

The Swiss currency (CHF) pair’s latest pullback, however, appears to have a limited downside room as it approaches the 100-SMA support near 0.9980.

Even so, the looming bearish cross on the MACD and the recent retreat of the RSI (14) seem to favor the USD/CHF sellers.

That said, an upwards-sloping support line from October 27, close to 0.9930 by the press time, could lure the bears to breaking the 0.9980 support.

It’s worth noting that the pair’s weakness past 0.9930 will make it vulnerable to challenge October’s low of 0.9780. However, the 200-SMA and the previous weekly bottom, respectively near 0.9900 and 0.9840, could test the USD/CHF bears.

Alternatively, the pair’s recovery beyond the 1.0005 immediate resistance needs validation from a one-week-old horizontal hurdle surrounding 1.0035.

Following that, a run-up toward the previous monthly peak of 1.0147 appears imminent. It should be observed that there are multiple levels near 1.0070 to challenge the USD/CHF bulls.

USD/CHF: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.