USD/CHF Price Analysis: Recoups from Thursday’s losses, edges toward 0.9870

- USD/CHF prepares to finish the week with decent gains of 0.65%.

- The weekly chart depicts the pair as neutral-to-upward biased, further extending the uptrend but unable to crack 0.9900.

- The USD/CHF daily chart portrays the major as upward biased, and once it clears the 0.9886 mares, the 0.9900 figure would be next.

The USD/CHF finished the week with substantial gains on Friday, up by 1.20% in the day, due to Federal Reserve officials crossing newswires, reiterating that the Fed would not pivot in the near term and will keep rates elevated to temper inflation. At the time of writing, the USD/CHF is trading at 0.9870.

USD/CHF Price Analysis: Technical outlook

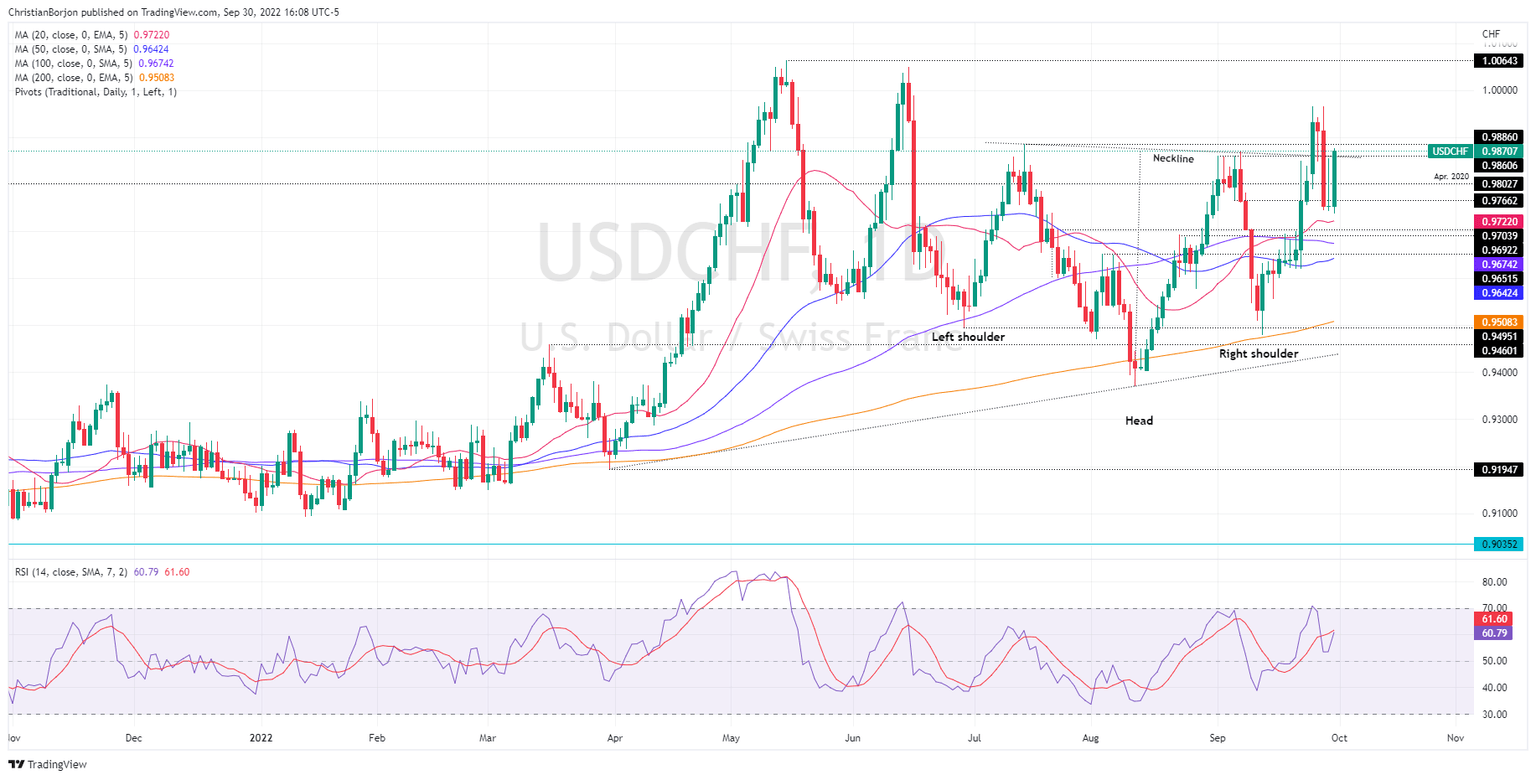

The USD/CHF weekly chart shows the majors closing just below the July 11 week high of 0.9886, keeping the neutral-to-upward bias unchanged. Traders should be aware that, albeit closing below the aforementioned July 11 high, the USD/CHF extended the successive series of higher highs/lows, opening the door for further gains. If the USD/CHF clears 0.9886, the 0.9900 figure is the next supply zone, followed by the parity.

When reviewing the USD/CHF daily chart, the bias is also upward biased, and price action escalating above the “neckline” of an inverted head-and-shoulders chart pattern could pave the way for further gains. Oscillators are in positive territory, with the RSi at 60.79 about to cross above its 7-day RSI SMA, which would mean that buyers are gathering momentum, opening the door for further gains.

Therefore, the USD/CHF first resistance would be the 0.9900 figure. Break above will expose the September 28 high at 0.9965, followed by parity, and then the YTD high at 1.0064.

USD/CHF Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.