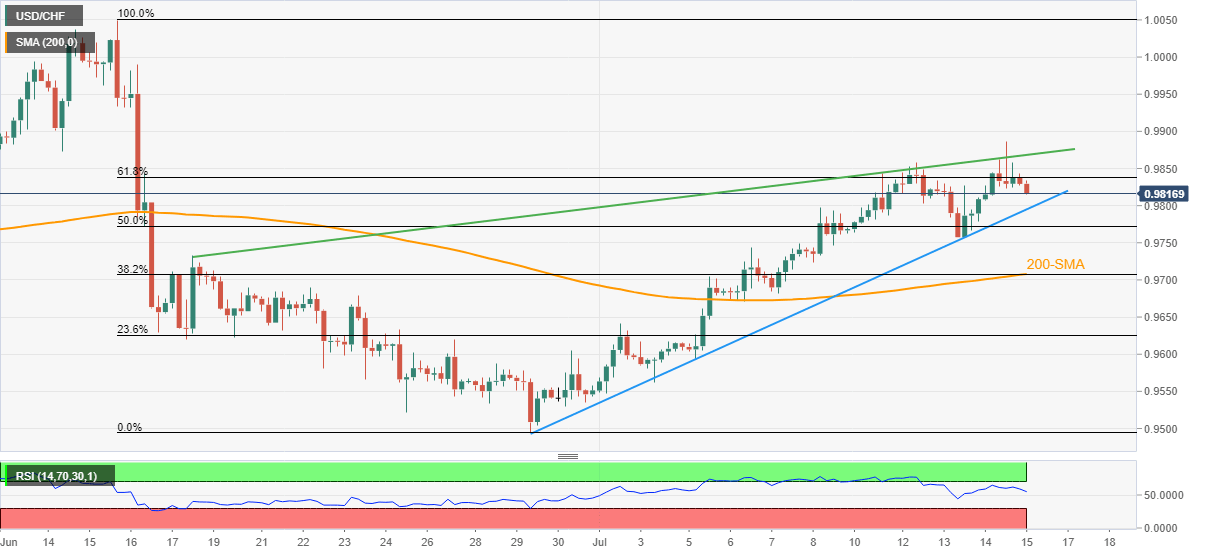

USD/CHF Price Analysis: Pullback eyes monthly support around 0.9800

- USD/CHF retreats from one-month high, takes offers to refresh intraday low.

- RSI weakness, not oversold, hints at the quote’s further declines towards short-term support line.

- Convergence of 200-SMA, 38.2% Fibonacci retracement appears key support, bulls need validation from 0.9870.

USD/CHF consolidates the biggest daily gains in three days while dropping back from a one-month high. That said, the Swiss currency pair (CHF) refreshes its intraday low to 0.9815 during Friday’s Asian session.

USD/CHF bears cheer the RSI retreat, as well as the pair’s inability to cross an upward sloping resistance line from June 17. Also keeping the sellers hopeful is the recent weakness below the 61.8% Fibonacci retracement (Fibo.) level of June 15-29 declines.

With this, the quote is likely to drop further towards a 12-day-old support line near 0.9800.

However, a confluence of the 200-SMA and 38.2% Fibo. near 0.9705 will be important for the USD/CHF bears to break to retake control.

On the flip side, the 61.8% Fibonacci retracement level and monthly resistance line, respectively around 0.9840 and 0.9870, could restrict short-term advances of the pair.

In a case where USD/CHF prices rally beyond 0.9870, the odds of witnessing a run-up towards the mid-June peak of 1.0050 can’t be ruled out.

USD/CHF: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.