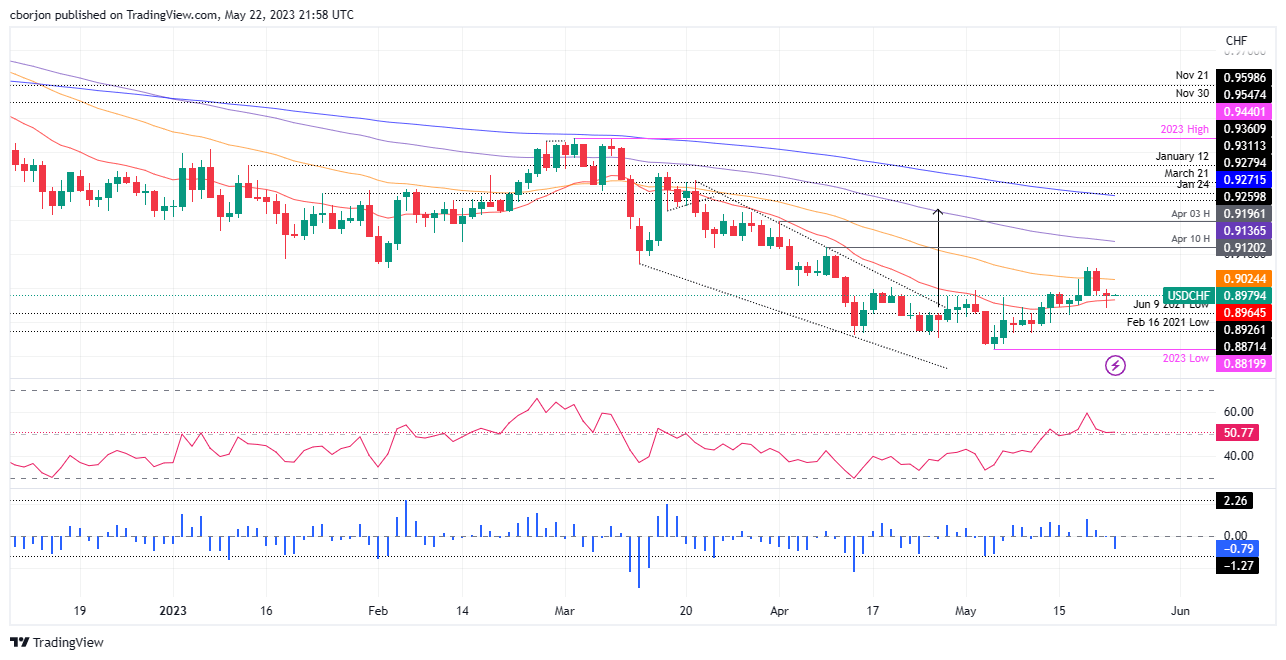

USD/CHF Price Analysis: Oscillates around the 20-day EMA as the pair tilts upward

- USD/CHF halts its downtrend and bounces off a daily low of 0.8940, charting its course near the crucial 20-day EMA at 0.8964.

- Market mood tilts as the pair’s technical outlook transitions from a neutral-to-downward bias to neutral, possibly tilting neutral-upward once it reclaims the April 10 daily high of 0.9120.

- For bearish persistence, USD/CHF must pierce the 20-day EMA, potentially exposing the May 22 low of 0.8940 and setting the stage for a potential plunge towards 0.8926.

USD/CHF stalled its downtrend after piercing the 20-day Exponential Moving Average (EMA) at 0.8964 and reached a daily low of 0.8940, but bounced off and closed Monday’s session nearby last Friday’s low at 0.8993. At the time of writing, USD/CHF is trading at 0.8980, almost flat, as Tuesday’s Asian session begins.

USD/CHF Price Analysis: Technical outlook

From a daily chart perspective, the USD/CHF shifted from neutral-to-downward biased to neutral. In early May, the USD/CHF pair reached a new year-to-date (YTD) low of 0.8820; since then, USD/CHF climbed 1.80%, registering on its way up, successive series of new highs-lows, but shy of turning the pair neutral-to-upward biased.

If USD/CHF reclaims the April 10 daily high of 0.9120, that could shift the bias to neutral-upwards, and it might open the door for a rally above the 100-day EMA At 0.9136 before reaching the April 3 high at 0.9196. Upside risks for the USD/CHF lie above 0.9200, with the 200-day EMA at 0.9271 as the only resistance to changing the pair’s bias upwards.

The USD/CHF must fall below the 20-day EMA at 0.8964 for a bearish continuation. A breach of the latter will expose the May 22 low of 0.8940 before clearing the path for the pair towards June 9, 2021, a low of 0.8926, ahead of the 0.8900 figure.

USD/CHF Price Action – Daily chart

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.