USD/CHF Price Analysis: Marches firmly towards the 0.9800 figure

- USD/CHF extends its rally to four straight days, refreshed seven-week highs.

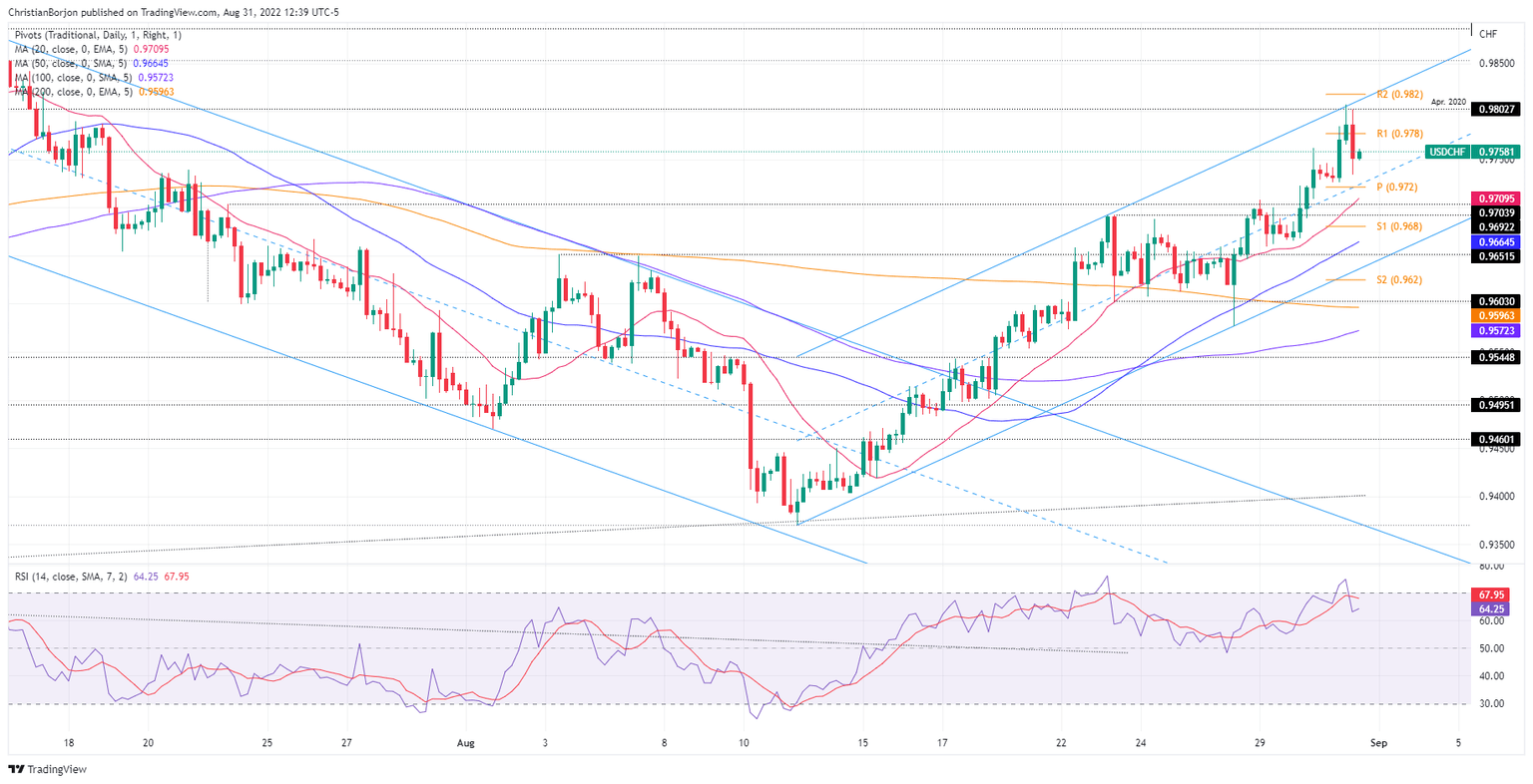

- Solid resistance lies around the confluence of a top-trendline of an ascending channel and a psychological price level of around 0.9800.

The USD/CHF advances sharply after hitting a daily low at 0.9726. in the North American session. The USD/CHF is trading at 0.9758 after hitting a seven-week high at 0.9807.

USD/CHF Price Analysis: Technical outlook

During the day, the USD/CHF printed a seven-week high, above the 0.9800 figure, though it was short-lived. The major retreated toward current exchange rates. Nevertheless, oscillators, particularly the Relative Strength Index (RSI), signal buyers still have some fuel left in the tank to re-test the abovementioned level, which, once cleared, could pave the way towards July 14 swings high at 0.9886.

Otherwise, the USD/CHF might consolidate around the 0.9700-0.9800 range ahead of the release of Swiss CPI figures on Thursday and Friday’s US Nonfarm Payrolls.

Short term, the USD/CHF 4-hour chart depicts the pair trending up in an ascending channel. The high of the day was the second test of the top-trendline of the channel, with sellers stepping in, dragging the major 50 pips lower. USD/CHF traders should note that the high of the day, was reached when the Relative Strength Index (RSI) peaked at overbought conditions. Therefore, once the RSI dipped, then a re-test of the 0.9800 figure is on the cards.

The USD/CHF first resistance would be the R1 pivot at 0.9777. Once cleared, the next supply zone would be the figure and top-trendline of the channel around 0.9800. On the flip side, the USD/CHF first support would be the daily pivot at 0.9722. A breach of the latter will send the major tumbling towards the 20 EMA at 0.9709, followed by the 0.9700 mark.

USD/CHF Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.