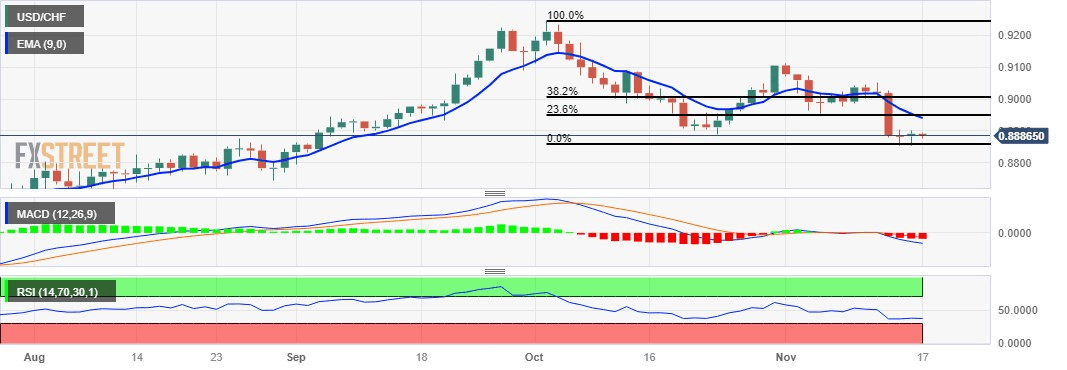

USD/CHF Price Analysis: Looks to approach 0.8850 near monthly lows

- USD/CHF remains below the psychological barrier at 0.8900.

- Technical indicators suggest a weaker momentum for the pair.

- A firm break above the nine-day EMA could help the pair to reach the 38.2% Fibonacci retracement.

USD/CHF seems to retrace the recent gains, trading around 0.8880 during the European session on Friday. The pair could find immediate support around the major level at 0.8850 lined up with the monthly low at 0.8854.

A decisive break below the level could push the USD/CHF pair toward the psychological level at 0.8800 with the conjunction at September’s low at 0.8795.

The ongoing downward trend is backed by the technical indicators for the USD/CHF pair. The 14-day Relative Strength Index (RSI) below the 50 level signals downward pressure, indicating a weaker momentum for the pair.

Furthermore, the Moving Average Convergence Divergence (MACD) line below the centerline, with divergence below the signal line, suggests a bearish momentum in the USD/CHF pair.

On the upside, the psychological level of 0.8900 emerges as the immediate resistance followed by the nine-day Exponential Moving Average (EMA) at 0.8939 aligned with the 23.6% Fibonacci retracement at 0.8947.

A firm breakthrough above the latter could support the bulls of the USD/CHF pair to approach the region around the 38.2% Fibonacci retracement at 0.9004.

USD/CHF: Daily Chart

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.