USD/CHF Price Analysis: Hovers above 0.9150 ahead of US Jobless Claims

- USD/CHF recovered the intraday losses ahead of US jobs data.

- Economic indicators suggest bullish sentiment regarding the US Dollar.

- The 12-day EMA emerges as key support, followed by the 0.9100 psychological level.

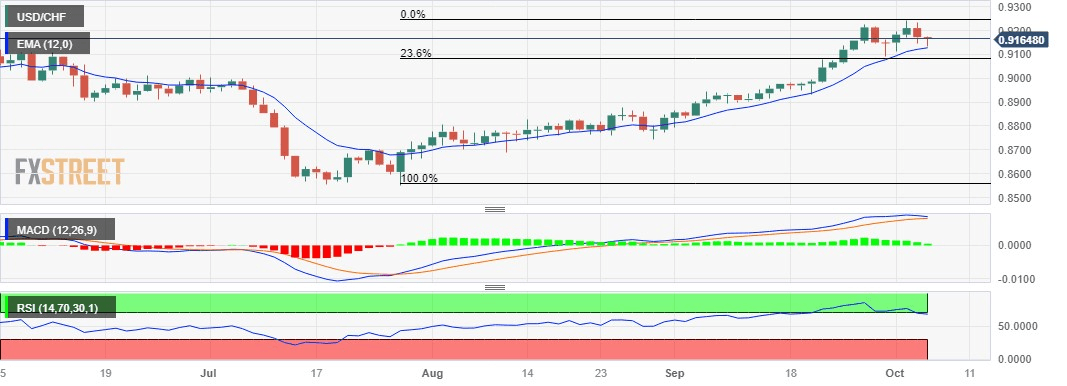

USD/CHF retraces the intraday losses, trading around 0.9170 lined up with the support level at 0.9150 psychological level during the early European session on Thursday, followed by the 12-day Exponential Moving Average (EMA) at 0.9127.

A firm break below the latter could influence the USD/CHF bears to navigate the region around the major level at 0.9100, followed by the 23.6% Fibonacci retracement at 0.9082 level.

The pair receives downward pressure following the extended losses in the US Dollar (USD), which could be attributed to the downbeat US employment data on Wednesday.

In September, the US ISM Services PMI decreased from 54.5 to 53.6, aligning with expectations. The ADP Employment Change for the same month increased by 89,000, falling below the market consensus of 153,000 and marking the lowest level since January 2021.

However, the prevailing upward momentum in the USD/CHF pair indicates a bullish bias, as the 14-day Relative Strength Index (RSI) remains above the 50 level.

On the upside, the immediate barrier is likely at the 0.9200 psychological level, followed by the weekly high at 0.9244 lined up with the 0.9250 major level.

The Moving Average Convergence Divergence (MACD) indicator is signaling strength for bulls of the USD/CHF pair, with the MACD line positioned above the centerline and the signal line. This setup indicates potentially strong momentum in the price movement.

USD/CHF: Daily Chart

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.