USD/CHF Price Analysis: Finally balanced if still marginally bullish

- USD/CHF has corrected back over recent days, raising the question of whether it might be reversing lower.

- It has still not fallen far enough to confidently indicate a reversal in the trend and a resumption of the uptrend is still possible.

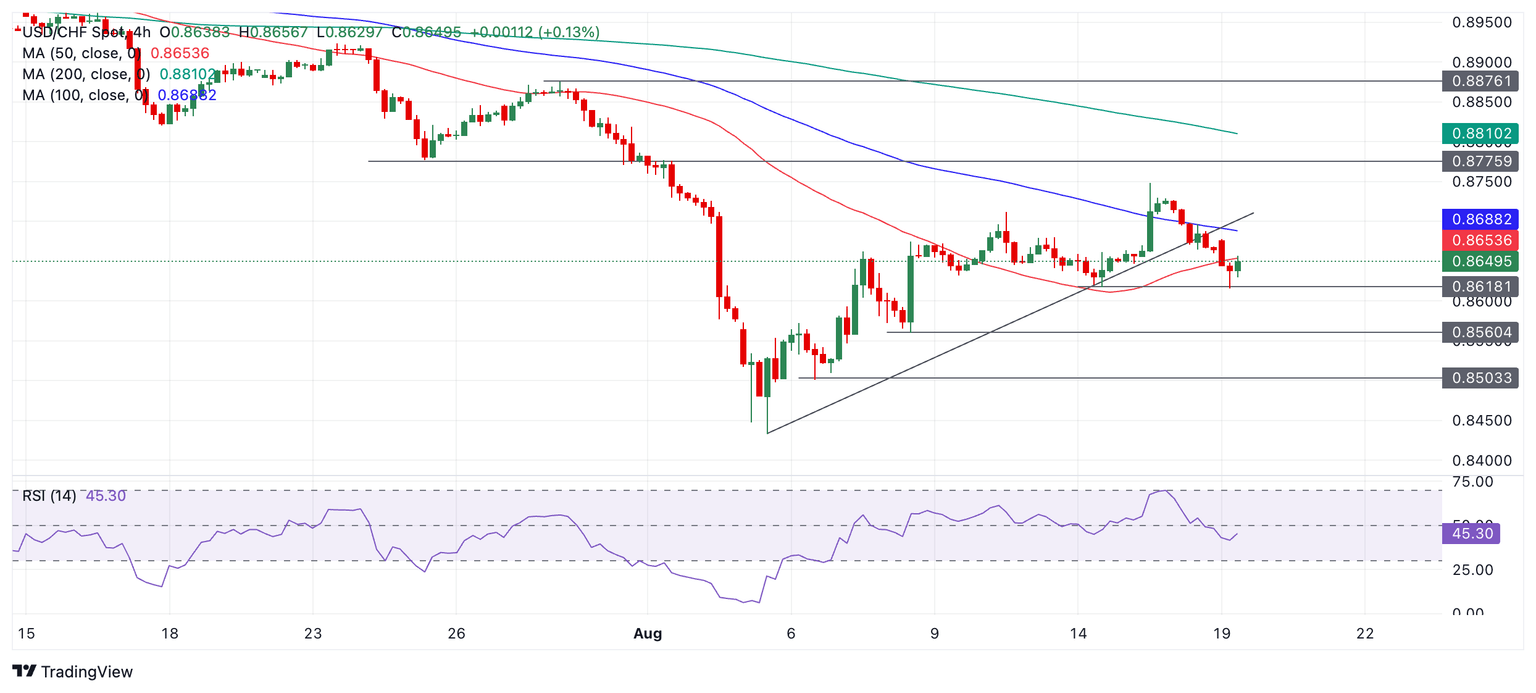

USD/CHF reversed course after posting a new low on August 5 and started trending higher. The pair began a sequence of higher highs and lows on the 4-hour chart suggesting it was in a short-term uptrend. It peaked at 0.8749 on August 15. Since then it has been correcting back. It reached a new low of 0.8616 on August 19.

USD/CHF 4-hour Chart

The question is whether the correction is merely a pull back within the dominant uptrend or the start of a deeper move lower?

Although USD/CHF is showing bearish signs it is still probably on balance slightly bullish, though not without risks. The pair has broken below a trendline for the rally up from the August 4 lows and below both the 100 and 50-period Simple Moving Averages – and it looks quite bearish on the daily chart (not shown). These are all negative signs, however, the short-term trend remains intact. More downside is still required to signal a reversal lower.

A close below the 0.8618 support level, for example, would provide confirmation of a reversal of the short-term trend and thestart of a new downtrend. Such a move might then be expected to continue falling to a downside target at 0.8560.

Alternatively the pair might still recover. The pull back from the August 15 high could be characterized as an ABC correction of the uptrend. If so, the uptrend is likely to resume.

The formation of a bullish reversal candlestick pattern at the current lows could provide evidence the pair was about to resume its uptrend. Or a close back above the 100 SMA at 0.8688 would help provide confirmation.

The pair would then be expected to climb back up to the August 15 high at 0.8749. A break above that would extend the trend probably to resistance at 0.8776.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.