USD/CHF Price Analysis: Eyes further downside as Swiss Franc buyers approach 0.8900

- USD/CHF fades bounce off intraday low, extends previous day’s pullback from two-week high.

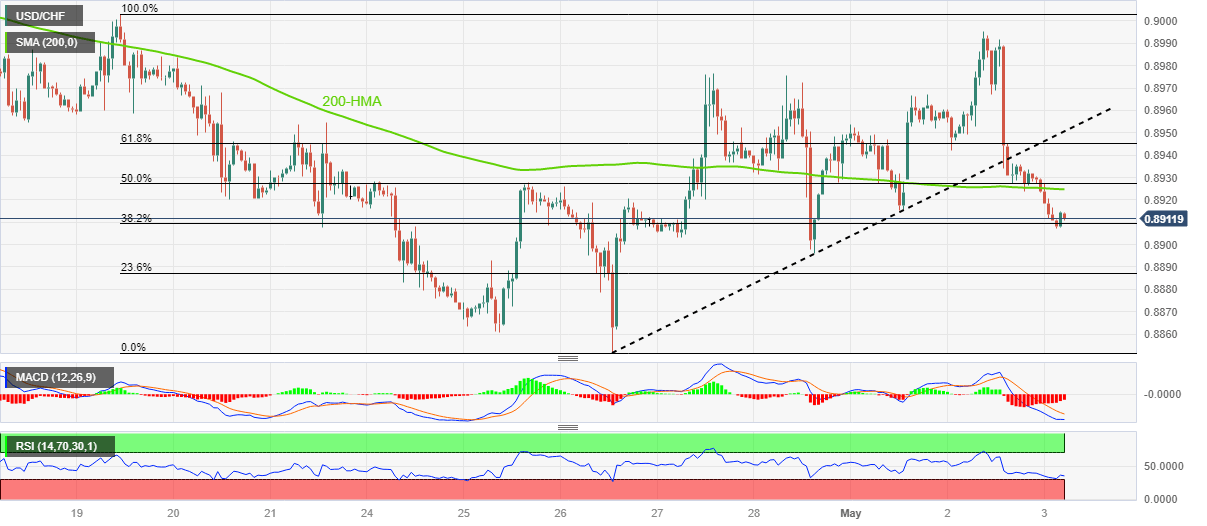

- Oversold RSI, 38.2% Fibonacci retracement prod Swiss Franc buyers.

- Clear downside break of one-week-old ascending trend line, 200-HMA suggest pair’s further fall amid bearish MACD signals.

USD/CHF holds lower grounds near the intraday bottom of 0.8907, retreating of late, as bears keep the reins for the second consecutive day heading into Wednesday’s European session.

In doing so, the Swiss Franc (CHF) pair extends the previous day’s U-turn from the highest level in a week.

That said, the bearish bias takes clues from the downbeat MACD conditions and a clear break of the previous support line stretched from April 26, as well as sustained trading below the 200-Hour Moving Average (HMA).

However, the 38.2% Fibonacci retracement level of April 19-26 fall, near 0.8910, joins the nearly oversold RSI (14) line to challenge the USD/CHF bears.

Hence, the USD/CHF pair is likely to decline further but the fresh selling may wait for a successful trading below 0.8910.

Following that, the 0.8900 round figure may act as an extra filter toward the south before directing the bears toward the previous monthly low of around 0.8850, also the lowest level since January 2021.

Should the Swiss Franc pair remains bearish past 0.8850, the 0.8800 round figure and the year 2021 low of near 0.8755 can lure the sellers.

On the flip side, USD/CHF recovery needs validation from the 200-HMA and the support-turned-resistance line, respectively near 0.8925 and 0.8950.

Even so, multiple hurdles near 0.8970 and the 0.9000 psychological magnet can prod the pair buyers before giving them control.

USD/CHF: Hourly chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.