USD/CHF Price Analysis: Extends break of fortnight-old support towards 0.9160

- USD/CHF takes offers to renew intraday low, stretching pullback from weekly top.

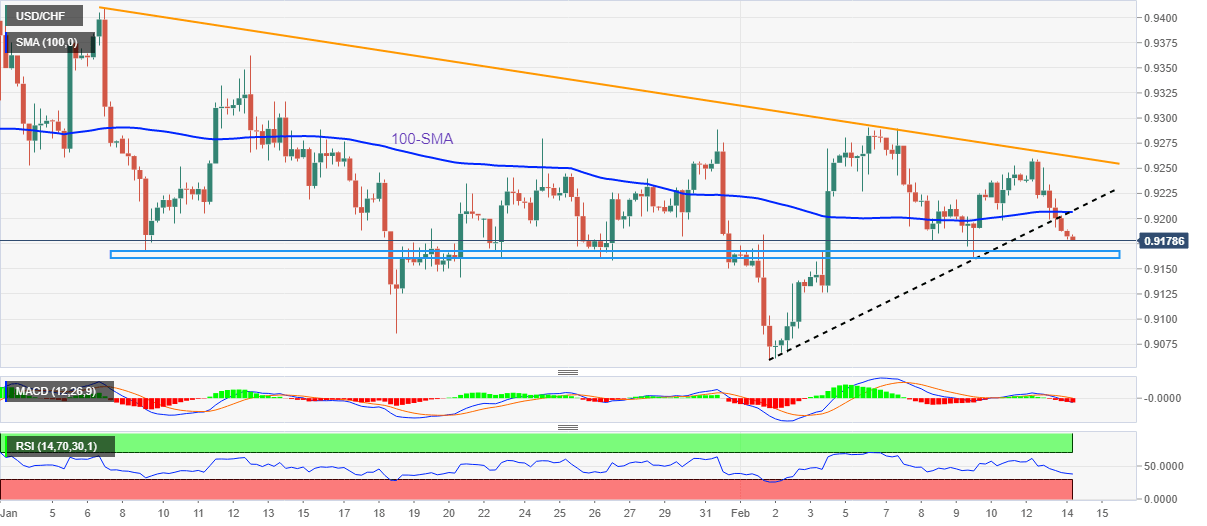

- Clear downside break of short-term key trend line, SMA joins downbeat oscillators to favor bearish bias.

- Recovery remains elusive unless crossing five-week-old resistance line.

USD/CHF prints mild losses around 0.9180 heading into Tuesday’s European session, stretching the previous day’s downside break of the key support ahead of the all-important US inflation data.

Not only the downside break of the 100-SMA and a two-week-old ascending trend line but bearish MACD signals and downbeat RSI (14), not oversold, also favor the USD/CHF bears.

That said, a horizontal area comprising multiple levels marked since January 09, close to 0.9165-60, appears imminent support for the Swiss currency pair to test.

Following that, the 0.9100 round figure and the previous monthly low near 0.9085 could act as intermediate halts before directing the USD/CHF bears toward the monthly bottom surrounding 0.9060.

Meanwhile, recovery moves appear elusive unless crossing the convergence of the 100-SMA and the aforementioned support line, close to 0.9210.

Even if the USD/CHF manages to stay firmer past 0.9210, a downward-sloping resistance line from January 06, near 0.9260, could act as the last defense of the pair bears.

Overall, USD/CHF remains bearish as traders brace for the key US inflation data. However, the downside room appears limited.

USD/CHF: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.